Ocean Freight Comments

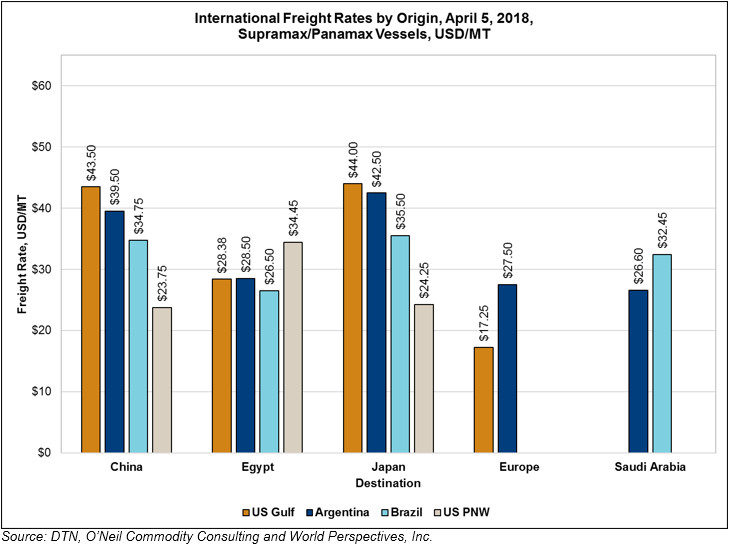

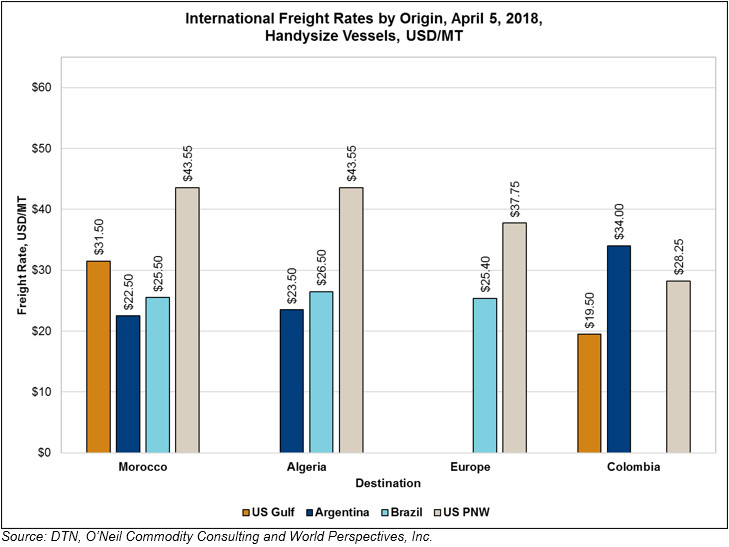

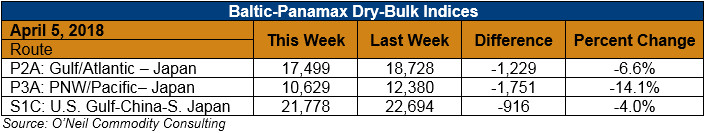

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: It was a difficult week for vessel owners. Dry-bulk cargo demand remains softer than expected and rates are suffering. Daily hire rates for Q2 2018 Panamax vessels has dropped to $10,500/day and bids for CAL 2019 are no better than $10,785/day. So, a lot of the recent market optimism is fading – at least for the moment.

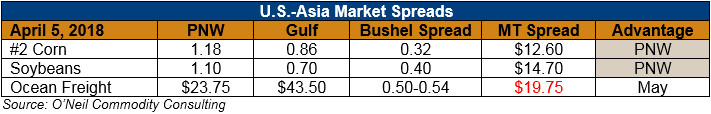

There is, of course, a lot of conversation regarding the Chinese trade tariffs and their impact on U.S. and South American grain and meal exports. The exact impact greatly depends on the commodity. For soybeans I do not see a big negative for U.S. exports as the world’s soy S&D picture is not changed by this action. Globally, we will still export/trade the same volumes of soybeans and meal. China imports 97-100 MMT of soybeans per year. South America exports just 77-78 MMT. Thus, it will be impossible for China to get all their beans from South America, and for Brazil to export 65-70 MMT-plus of soybeans to one country smoothly will be a logistical and trade nightmare. Do be careful about the soybean export basis; it is moving up as we are seeing a rush to buy beans and attempt to get them in quickly before the potential tariffs take effect. As for container freight, the biggest factor in these rates today is the rising cost of U.S. truck freight.

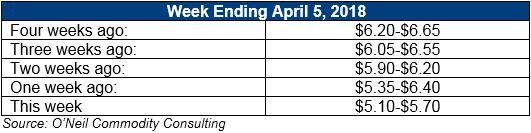

Below is a recent history of freight values for Capesize vessels of iron ore from Western Australia to South China:

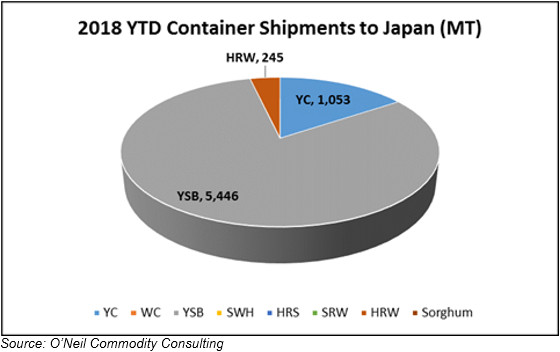

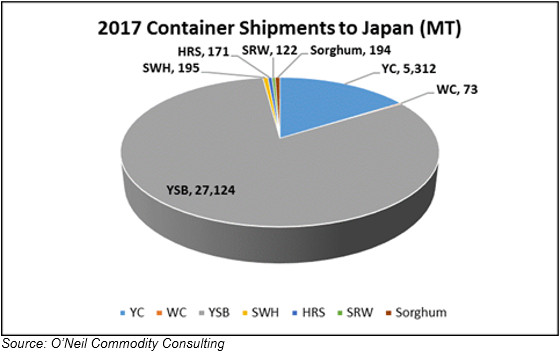

The charts below represent 2017 annual totals versus 2016 annual totals for container shipments to Japan.