Chicago Board of Trade Market News

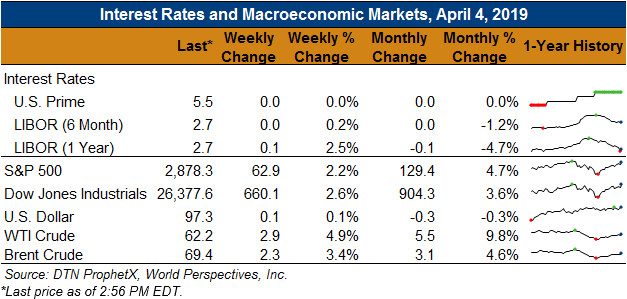

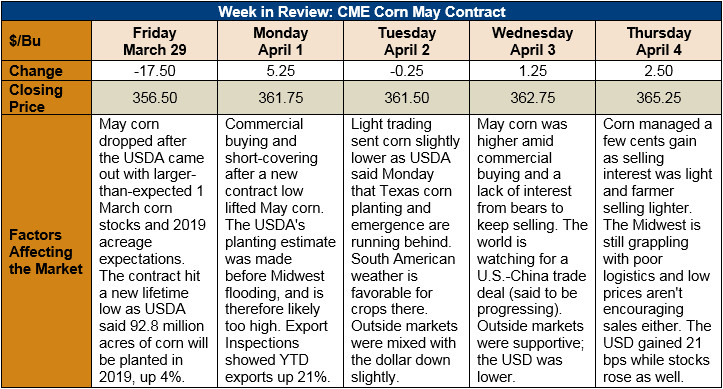

Outlook: May corn futures are 8.75 cents (2.5 percent) higher this week; Friday’s new contract low led the way for a round of fund short-covering. Corn futures fell last week after USDA reported larger-than-expected grain stocks/planted acreage estimates. The reports were bearish but bullish opportunities remain for the market.

USDA’s March 1 Grain Stocks report said 0.218 MMT (8.60 bln. bu) of corn were in bins across the U.S., down 3 percent from March 2018 but above analysts’ expectations of 0.212 MMT (8.336 bln. bu). The stocks figure implies a quarterly (Dec. 2018-Feb. 2019) usage of 0.085 MMT (3.33 bln. bu), down 11 percent from the same period in 2018. Interestingly, on-farm corn storage amounted to 0.130 MMT (5.13 bln. bu) (up 3 percent from 2018) amid slow farmer sales. Barley disappearance was 9 percent higher than in 2018 with stocks down 7 percent year-over-year. Sorghum stocks grew 37 percent year-over-year; disappearance slipped 24 percent.

The biggest surprise from USDA was the Prospective Plantings (PP) forecast of 92.8 mln. acres being planted to corn in 2019. The estimate is up 4 percent from 2018 and beat analysts’ expectations of 91.19 mln. acres. The forecast came in conjunction with lower-than-expected soybean acres as USDA anticipated some soybean acres switching to corn given the 2019 price outlook. The risk to USDA’s forecast is that the PP report is based on surveys collected before recent flooding hit the Midwest. With flood waters still receding and a cold/wet start to spring across the Midwest, there are good odds that final core acreage statistics will be smaller than expected; cold/wet starts to spring historically prompt some farmers to switch acreage to beans.

The USDA’s weekly Export Sales report featured 0.811 MMT of sales this week and 0.537 MMT of net sales. Exports last week reached 1.262 MMT, up 32 percent from the prior week. YTD exports stand at 30.04 MMT, up 24 percent. YTD bookings (exports plus unshipped sales) are down 9 percent, slightly below USDA’s forecast of a 3 percent year-over-year reduction in exports. The report also featured 55 KMT of sorghum exports and 1.3 KMT of barley exports. Barley bookings are up 50 percent YTD.

Cash corn prices are higher this week, averaging $132.93/MT ($3.38/bushel), up 2 percent from last week but down 5 percent from 2018. Slow farmer sales, hampered by logistics, are prompting elevators to increase bids. Rates for corn barges CIF NOLA have firmed again this week as river travel remains challenging. FOB NOLA values are steady as exporters fight to maintain U.S. corn’s competitiveness on the export market.

From a technical standpoint, May corn futures are in a downtrend but found support at a new contract low and are moving higher. Seasonally, corn tends to move higher into the summer as traders add a “weather premium” to prices. This year should be no exception given the recent selloff and the odds that 2019 corn acres will likely be smaller than USDA’s latest 92.8 million acres. With funds heavily short, any bullish fundamental could spark a quick pop higher at the CBOT with funds covering their position. The outlook is mostly neutral for now, but bullish potential is far from gone.