Chicago Board of Trade Market News

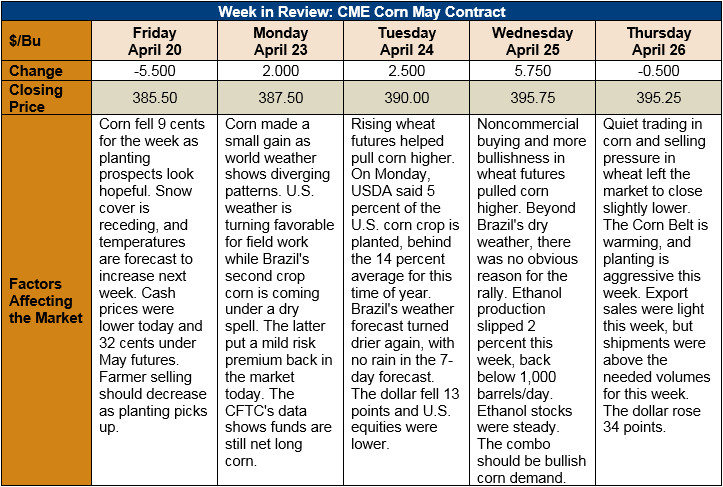

Outlook: The corn market is focused on U.S. planting progress and likely will be for the next several weeks. After cool, wet weather threatened severe planting delays, recent improvements in the forecast allowed farmers to enter fields last week. USDA reported 5 percent of the U.S. corn crop was planted last week (behind the 5-year average of 14 percent). Reports are that farmers are aggressively planting this week, especially south of Interstate 80, and the next Crop Progress report should feature a solid advance in completion rates.

Outside the U.S., Brazil’s second-crop corn is heading into pollination under conditions that are “too dry.” Once the minor player in Brazil’s corn production cycle, the safrinha (which means “little harvest” in Portuguese) now accounts for as much as 71 percent of Brazil’s total crop, according to private estimates. Brazil’s first crop is traditionally used to fill the country’s domestic needs while the second crop drives the export program.

Today’s Export Sales report from USDA showed 0.697 MMT of net corn sales and 1.7 MMT of exports. YTD bookings are down just 2 percent from last year while exports remain below last year’s pace. No barley sales or exports were reported this week, but YTD exports are up 67 percent from last year. Additionally, 31.5 KMT of sorghum net sales were reported this week with 125.4 KMT exported.

In other markets, merchandisers report that the white corn market is undefined this week as it has become more challenging to source product.

Technically, the trend in old-crop corn futures is sideways with major support at $3.80 (the 100-day moving average) and major resistance at $4.03. In new-crop futures, the trend is slightly higher with support at $3.95 and resistance at $4.17. The dry weather in Brazil presently threatening the second-crop corn could prove sufficient motivation for December futures to trade to new highs. Similarly, any summer weather concern in the U.S. would likely cause a notable rally. With political and weather developments driving market volatility, farmers and end-users should watch for opportunities to lock-in profits and mitigate price risk.