Chicago Board of Trade Market News

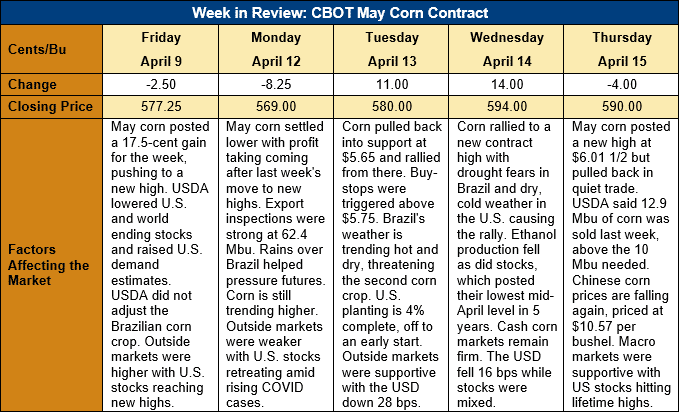

Outlook: May corn futures are 12 ¾ cents (2.2 percent) higher this week as the market rallies following the April WASDE. USDA made comparatively few adjustments in the report, but U.S. and world ending stocks continue to shrink, thereby supporting futures. Since the WASDE’s release, hot, dry weather in Brazil and cool, dry weather in the U.S. have further supported futures.

USDA made mostly minor changes to the U.S. corn balance sheet in the April WASDE. U.S. corn ending stocks were cut 3.8 MMT (150 million bushels or “Mbu”) with demand increased for three consumption areas. U.S. ethanol consumption was increased 0.635 MMT (25 Mbu) due to an improved gasoline/ethanol use outlook while feed use was increased 1.9 MMT (75 Mbu) based on data from the March Grain Stocks report. USDA also increased the 2020/21 U.S. corn export forecast by 1.9 MMT (75 Mbu) to a record high 67.95 MMT (2.675 billion bushels). These changes created the 3.8-MMT reduction in U.S. 2020/21 ending stocks and pulled the ending stocks-to-use down to 9.2 percent, the lowest since 2013/14.

Due largely to reduction in the U.S. carry out, world 2020/21 ending stocks were reduced by 3.8 MMT in the April WASDE. Somewhat surprisingly, USDA did not adjust its forecast of the Brazilian 2021 corn crop, leaving its production estimate at 109 MMT. Many analysts projected a reduction in Brazilian production due to increasing drought issues for the safrinha crop. USDA did, however, lower its estimate of the Argentine corn crop by 0.5 MMT to 47 MMT. The agency lowered 2020/21 corn ending stocks for Brazil and Argentina to 6.2 and 2.1 MMT, respectively. Notably, USDA forecast the combined 2020/21 corn ending stocks forecast for the U.S., Brazil, and Argentina at 42.7 MMT, the smallest figure since the drought year of 2012/13.

Analysts and traders are closely watching the weather patterns for the U.S. and Brazil for the coming weeks. In the U.S., planting got off to a strong, early start but new forecasts for cold, dry weather are threatening to delay additional progress. Drought conditions are expanding across the U.S. West and Upper Midwest, but no major planting disruptions are presently expected. In Brazil, the weather remains similarly dry for the southern part of the country and parts of central Brazil, but with above normal temperatures. Some are calling the weather in southern Brazil a “flash” drought and conditions are threatening safrinha crop yields. Conditions in central Brazil (notably, the major producing state of Mato Grosso) are mostly normal but the market remains concerned about a possible for a shift towards drier weather.

The weekly Export Sales report featured 327,700 MT of corn net export sales, down 57 percent from the prior week. Corn exports totaled 1.816 MMT, down 12 percent from the prior week. YTD exports total 37.787 MMT (up 82 percent) while YTD bookings (exports plus unshipped sales) total 66.810 MMT (up 93 percent). Exporters recorded sorghum net sales of 656,700 MT last week – a marketing year high – and shipped 860,400 MT, bringing YTD exports to 4.85 MMT (up 208 percent). YTD sorghum bookings total 7.043 MMT, up 126 percent.

U.S. cash prices continue to rally with old crop supplies tightening. Basis remains firm and at five-year highs of -8K (8 cents under May futures), up from -9K last week and -66K this time last year. FOB Gulf corn offers are 2 percent higher this week at $263.37/MT for May shipment.

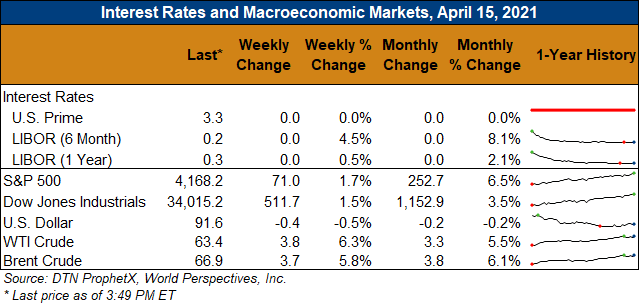

May corn futures rallied sharply heading into the WASDE but settled 2 ½ cents lower after the report’s release. The market continued to break lower over the next two days but found support at $5.65 on Tuesday. Since then, weather concerns in Brazil and the U.S. have helped corn rally, with strong cash prices/basis underpinning the move higher. Both old crop and new crop futures posted new contract highs on Thursday, but May and July contracts settled slightly lower. The lower close in old crop futures formed a mildly bearish hook reversal, which could spark some profit taking. Overall, however, corn charts remain extremely supportive and a strong cash market suggests any breaks will be short lived.