Ocean Freight Comments

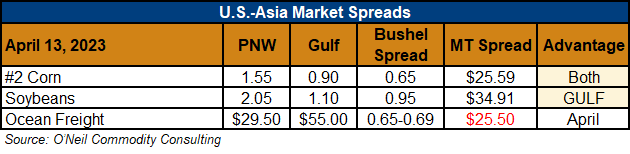

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: There are plausible reasons to expect higher ocean freight rates in 2023-24; the low level of new vessel orders, high compliant fuel cost, higher labor costs, and stiff CII emissions regulations. The driving force behind rate movement, however, is cargo demand and this is the one needed item that is not yet supporting higher rates. Though vessel owners anticipate increased cargo demand from China, economics there have yet to motivate import demand levels that would support a substantial rally in ocean freight markets.

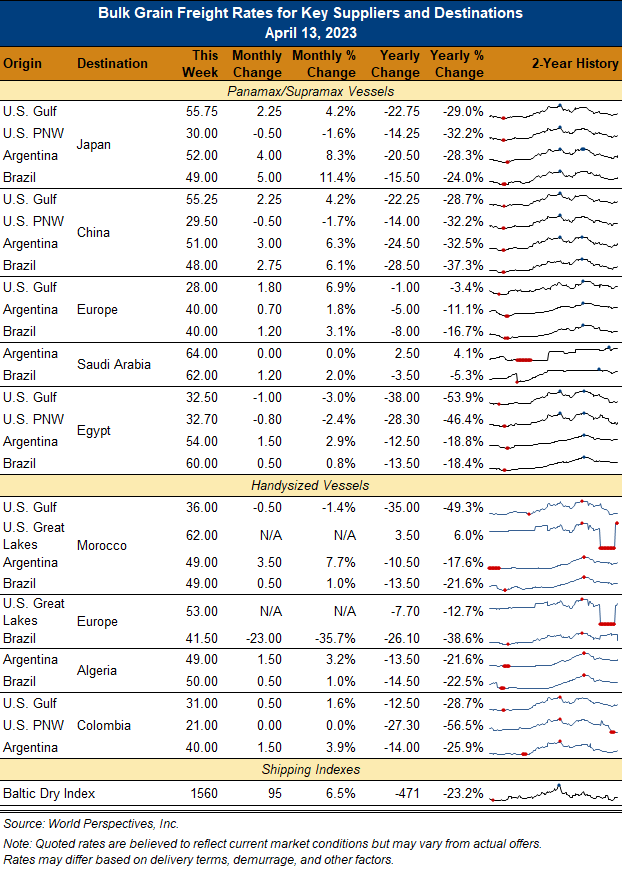

Panamax FFA paper for Q2 was flat at $1,550/day, with Q3 trading down to $16,500/day and Q4 at $15,750/day. U.S. container markets are trying to manage current and anticipated labor slowdowns in the port of Loa Angeles/Long Beach. The U.S. West Coast port contract negotiations seem to be going nowhere and both parties are getting frustrated.