Chicago Board of Trade Market News

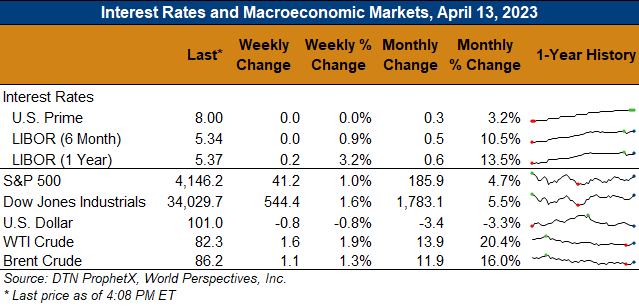

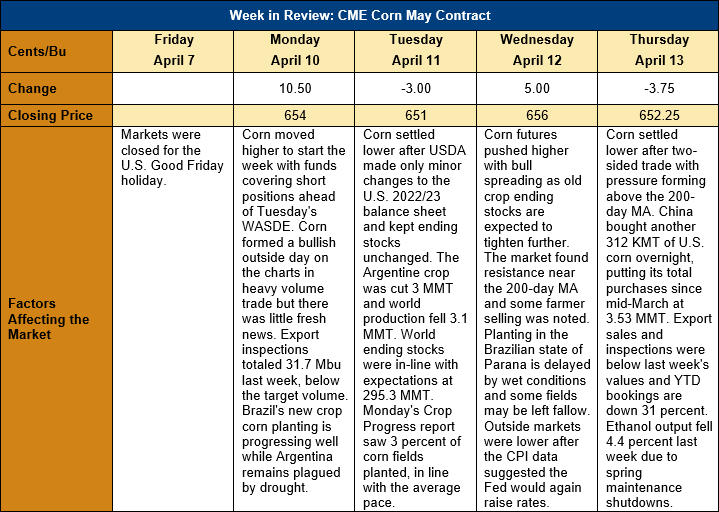

Outlook: May corn futures are 8 ¾ cents (1.4 percent) higher this week after a sharp rally on Monday and modest strength following a neutral/bullish WASDE. Fund short-covering was the primary driver of Monday’s rally as managed money traders pared bearish bets heading into the April WASDE. The USDA’s report, issued on Tuesday, did not feature any major surprises but still pointed to a tightening of world corn supplies.

The April WASDE typically does not feature major adjustments to the U.S. corn balance sheet, and that was true again this year. Analysts were expecting smaller 2022/23 ending stocks based on the Grain Stocks report, but USDA left its carry-out estimate unchanged from March at 34.09 MMT (1.342 Bbu). USDA lowered its estimate of U.S. 2022/23 corn imports by 0.25 MMT (10 Mbu) and cut Food, Seed and Industrial (FSI) use by an equal amount. USDA said the cuts to FSI consumption were motivated by expectations of smaller glucose, dextrose, and starch production. The USDA left its season-average farm price forecast unchanged at $259.93/MT ($6.60/bushel).

The biggest changes in the April WASDE were from the South American balance sheets, most notably the 3-MMT (8 percent) cut to Argentina’s corn production. USDA lowered its forecast to 37 MMT, which is still 5 MMT above the Buenos Aires Grain Exchange’s latest forecast. USDA also cut Argentina’s export forecast by 3 MMT to 25 MMT, which would be the country’s smallest export program since the 2017/18 crop, which was also hurt by drought. USDA did not make any changes to the Brazilian corn production estimate but increased 2022/23 beginning stocks fractionally.

The world corn balance sheet saw production estimates for 2022/23 fall by just over 3 MMT, due to smaller production in Argentina, Uruguay, the EU, and Serbia that outweighed an increase in Russian production. Global ending stocks were cut 1.1 MMT to 295.3, which was in-line with pre-report estimates.

U.S. corn exports are maintaining their steady pace and the latest Export Sales report featured 0.827 MMT of gross sales and 0.917 MMT of exports. The sales volume was down 58 percent from the prior week while the export figure fell 19 percent week-over-week. YTD exports now total 21.2 MMT (down 40 percent) while YTD bookings (exports plus unshipped sales) are down 31 percent.

After a brief hiatus, China has returned to buying U.S. corn and USDA announced on Thursday that the Middle Kingdom secured another 327 KMT. Of that, 191 KMT was for 2022/23 delivery and the balance (136 KMT) is for 2023/24. That puts China’s total corn purchases from the U.S. since mid-March at 3.53 MMT (139 Mbu).

From a technical perspective, May corn is finding increasing resistance at the 200-day MA ($6.57 ¾) and has struggled in the past two weeks to maintain any gains above that point. Bull spreading was active earlier this week as old crop stocks remain tight and the outlook for the U.S. 2023 crop is favorable. Funds are thought to be net long corn futures by an approximate 24,500 contracts, but tomorrow’s CFTC report will confirm their position. May corn has recently turned lower and consolidated within an uptrend in place since mid-March, but fresh export sales to China could keep the momentum moving higher.