Ocean Freight Comments

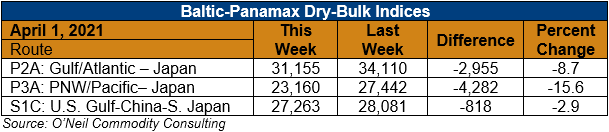

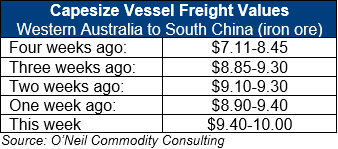

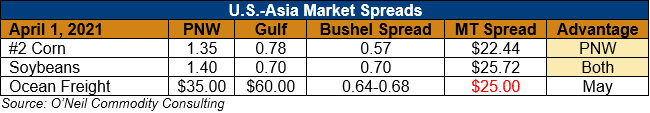

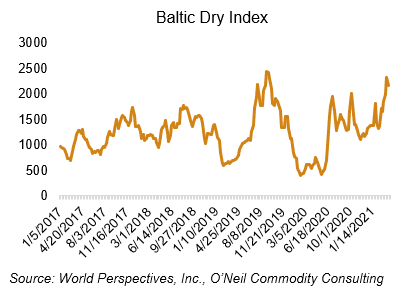

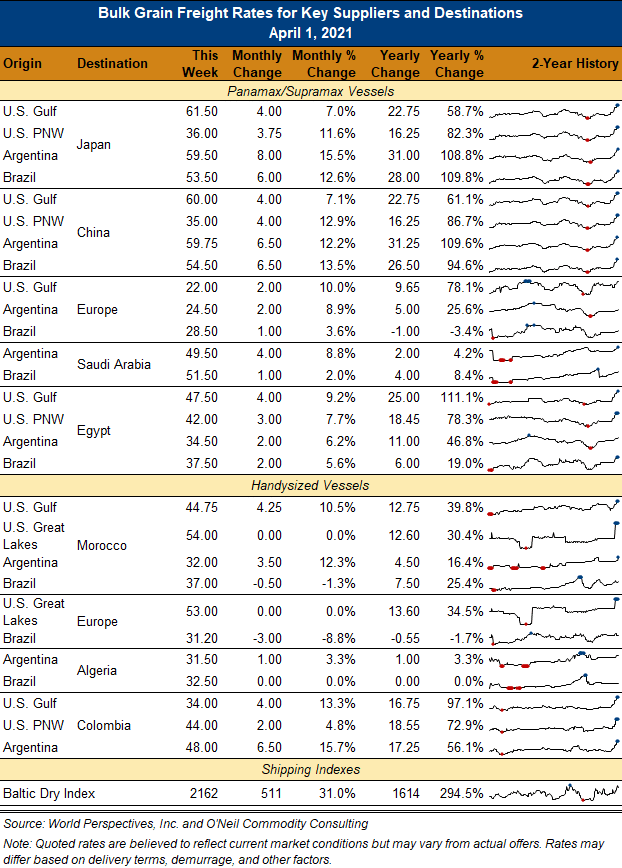

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: This was a week of adjustment in Dry-bulk markets. Capesize values moved higher as they rebalanced spreads with the smaller size vessel markets. Panamax vessel rates were unchanged to slightly lower this week after experiencing a dramatic rise over the past few weeks. As we move through the Easter holiday week, traders are looking to see if the recent bullish sentiment can be maintained. Vessel owners are still looking for 2021 to be the year that reverses the past low market cycles and catapults them into a period of prosperity. They are hoping the projected global economic super cycle is a reality.

Panamax indexed rates for April are now at $21,000 with Q2 at $20,250. Further out, Cal22 is range-bound at $13,450. Consultancy IHS Markit recently said “The more than two dozen container ships currently at anchor awaiting berths at Los Angeles and Long Beach are experiencing delays greater than what occurred at the Suez and have been for weeks.” Container shippers must continue to expect delays and difficult logistics.