Chicago Board of Trade Market News

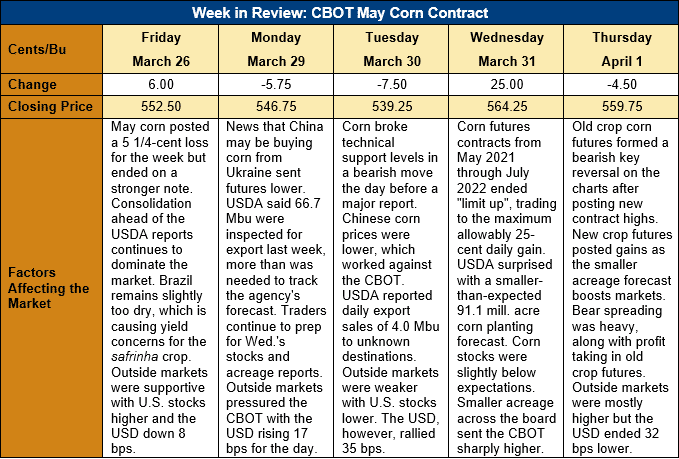

Outlook: May corn futures are 7 ¼ cents (1.3 percent) higher after a week of volatile trading. Heading into Wednesday’s Prospective Plantings and Grain Stocks reports from USDA, funds were becoming increasingly bearish, expecting large planted acreage estimates. That pressured futures and the May contract broke major technical support levels on Tuesday. The USDA’s reports, however, were bullish and the market posted the permissible 25-cent daily gain shortly after USDA released its numbers. Thursday’s trade saw old crop futures moderate somewhat after charging to new contract highs overnight.

USDA surprised the market with a forecast for 2021 U.S. corn planted area of 36.867 million hectares (91.1 million acres). The agency’s estimate was well below the low end of pre-report estimates, which, on average, expected 37.721 million hectares (93.21 million acres). USDA also projected soybean acreage well below pre-report estimates and pegged 2021 U.S. sorghum planted area at 2.81 million hectares (6.94 million acres), down from the February Ag Outlook Forum projections and below most analysts’ expectations. The fact acreage was sharply lower for corn and soybeans sparked a massive, bullish reaction at the CBOT that sent corn futures contracts from May 2021 through July 2022 to limit gains on Wednesday.

USDA’s quarterly Grain Stocks report featured less bullish statistics for the grain markets. USDA said corn stocks as of 1 March 2021 totaled 195.616 MMT (7.701 billion bushels), down 3 percent from 2020. The March stocks estimate was slightly below the average pre-report estimate but within the overall range, giving the report a neutral interpretation. Notably, on-farm stocks were down 9 percent from the prior year and December-February indicated disappearance was up 6 percent year-over-year at 91.19 MMT (3.59 billion bushels).

The strength of the 2020/21 sorghum export program was also evident in the Grain Stocks report. Total sorghum stocks totaled 3.47 MMT (136.6 million bushels) as of 1 March, down 17 percent from 2020. On-farm sorghum stocks were down 70 percent from the prior year, highlight how aggressive commercials and exporters have been in originating grain.

The weekly Export Sales report saw international buyers book 0.797 MMT of net export sales, down from the prior week. Exports totaled 1.977 MMT, down 3 percent from the prior week. YTD exports total 33.917 MT (up 85 percent) while YTD bookings (exports plus unshipped sales) total 65.726 MMT (up 106 percent).

Despite the CBOT volatility, U.S. cash prices higher this week with basis levels firming and continuing to post five-year highs. The average U.S. basis bid was -10K (10 cents under May futures) this week, putting the average U.S. corn price at $218.08/MT ($5.54/bushel). Barge CIF NOLA offers are up 5 percent this week at $246.86/MT while FOB NOLA offers are up 4 percent. May and June FOB Gulf positions are offered at $251.86/MT as of Thursday afternoon.

From a technical standpoint, May corn futures posted two bearish signals this week. The first came Tuesday afternoon with a breach of and settlement below trendline support at $5.44. The second is the key reversal posted on Thursday after the market posted a new contract high at $5.85 and settled 4 ½ cents lower. Thursday’s trade was primarily driven by profit-taking and some position liquidation ahead of the long holiday weekend (the CBOT is closed Friday, 2 April for the U.S. Good Friday holiday). The key reversal in May futures was surprising given the fact December-February corn use was at a three-year high and 2020/21 ending stocks remain moderately tight.

In contrast to the turnaround in old crop futures, December corn futures posted staunchly bullish days on charts at this week’s end. After breaking trading range support on Monday, Wednesday’s post-report trade quickly erased those losses, and the market settled the permissible 25 cents higher. Under expanded trading limits on Thursday, the market traded to gains of 15 ½ cents before settling 7 cents higher. December futures left a bullish chart gap at Thursday’s open and posted new contract highs at $4.93. Notably, trading volume and open interest grew substantially on Wednesday and Thursday’s trade. The open chart gap now serves as the first support level for December corn while the market looks towards resistance at the contract highs and $5.00 above that.