Chicago Board of Trade Market News

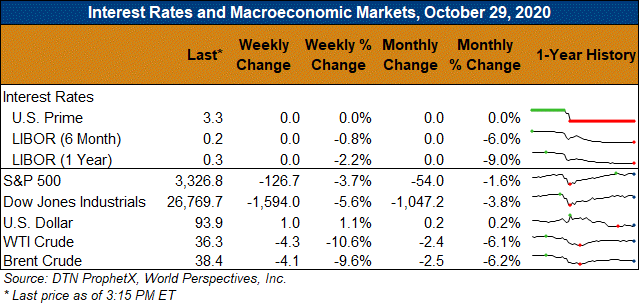

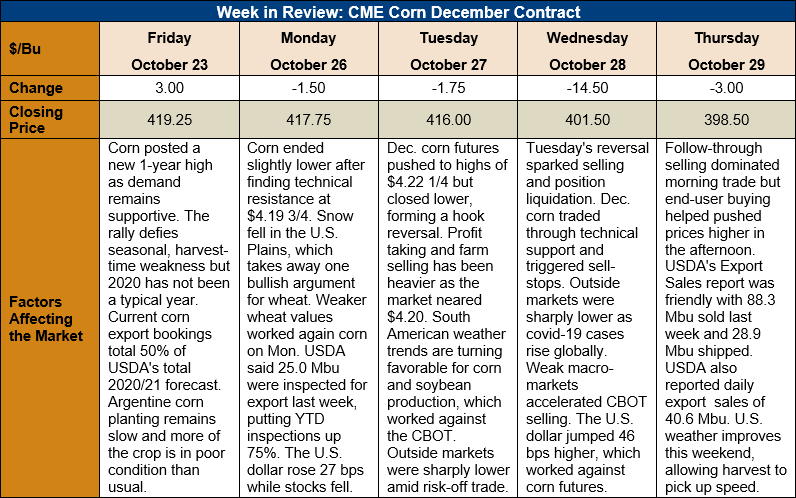

Outlook: December corn futures are 20 ¾ cents (4.9 percent) lower this week after a new rally high gave way to profit taking and technical selling. December futures pushed to fresh highs at $4.22 ¼ on Tuesday but closed lower, which set the stage for technically-based selling on Wednesday and Thursday. Commercial buyers have been aggressive on the break and that lifted prices off their daily low on Thursday. Strong export interest remains supportive as U.S. corn is among the lowest priced origins on the world market.

Thursday’s Export Sales report from USDA showed 2.243 MMT of net export sales last week, up 22 percent from the prior week. The gain in net sales came despite continued strength in corn futures and cash markets. Weekly corn exports totaled 734,200 MT, down 18 percent from the prior week but enough to put YTD shipments at 6.125 MMT. YTD exports are up 69 percent. Total export bookings (exports plus unshipped sales) stand at 30.578 MMT, up 168 percent.

Sorghum exports totaled 56,400 MT last week, down from the prior week but enough to keep YTD shipments at 520,000 MT. YTD sorghum exports are up 1,030 percent while YTD bookings total 3.2 MMT, up 917 percent.

The 2020 U.S. corn harvest made strong progress last week but has been stalled by poor weather this week. Monday’s USDA report showed 72 percent of the U.S. corn crop harvested, up from 56 percent in the prior week’s report. Progress this week has been limited with rain and snow across parts of the Midwest, coupled with cooler weather. The coming 7-day forecast offers better weather for field work, and U.S. farmers should again make strong progress this weekend.

U.S. cash corn prices are lower this week in conjunction with the weaker CBOT. Basis, however, continues to strengthen and approach five-year highs for much of the U.S. Commercial demand for physical corn remains strong as exporters work to meet their large shipment commitments. U.S. basis levels are averaging 20 cents under December futures (-20Z) this week, up from -22Z last week and -32Z this time last year.

From a technical standpoint, December corn futures posted a hook reversal on Tuesday, which appears to have triggered long position liquidation heading into the weekend. Macroeconomic markets (equities, crude oil, etc.) have been nervous this week amid rising coronavirus cases around the world, and a “risk-off” trading mentality has affected the CBOT as well. December futures found support at $3.93 Thursday afternoon and moved higher from that level, though they could not close above the $4.00 mark. The contract has trendline support at $3.89 ¾ and short covering/end-user buying should be aggressive if breaks are allowed to progress that far.

Fundamentally, however, commercials have been aggressive buyers on the two-day break in corn prices, which signals that physical supply/demand dynamics remain supportive. Corn demand has been robust so far in the 2020/21 marketing year and that shows little sign of changing. The near-term outlook for the CBOT is dominated by whether or not funds will exit their large long position and keep prices on the defensive. In the longer run, however, corn market fundamentals remain supportive and price breaks should create strong buying interest.