Ethanol, Fuels and Co-Product Pricing

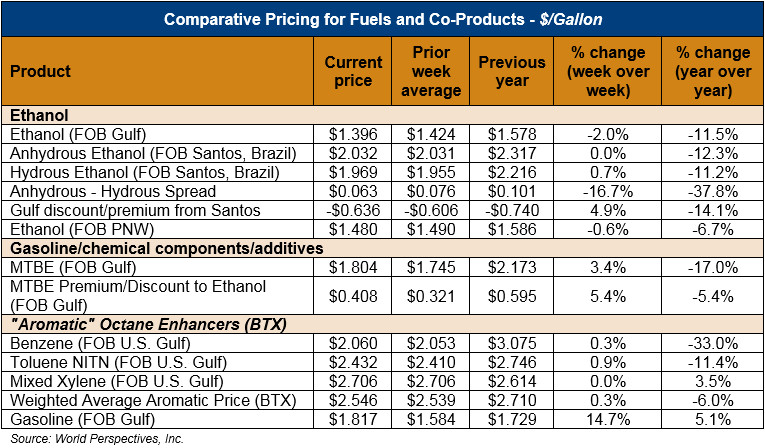

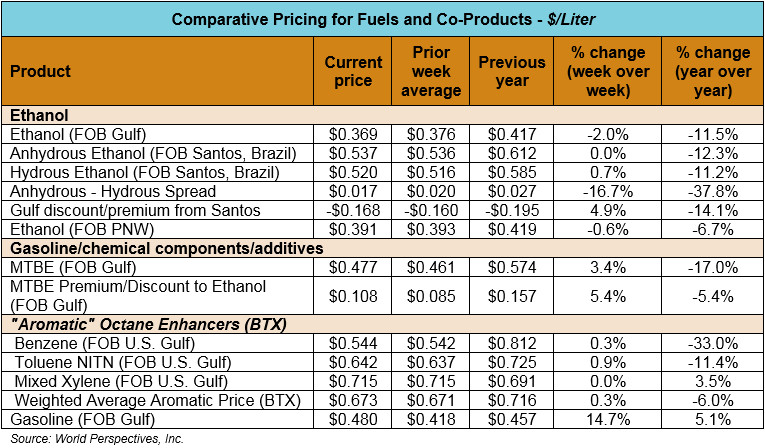

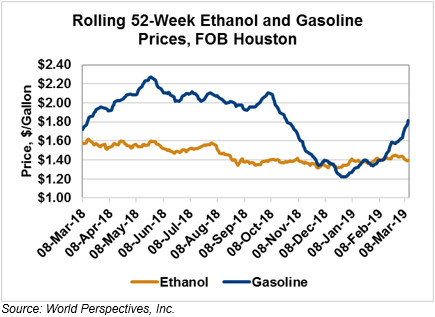

Market Outlook: U.S. ethanol prices ended last week down nearly 4 percent but are up 1 percent in early week trading. Midwest wholesale rack ethanol prices were down to end last week; they continue down to start this week at 37.62 cents/liter (142.40 cents/gallon) through Tuesday’s trading.

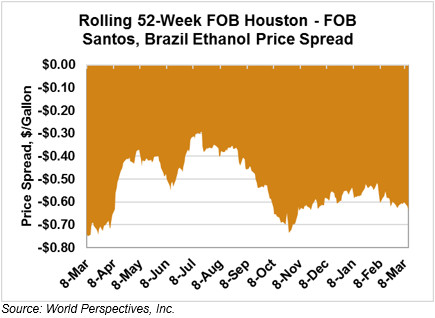

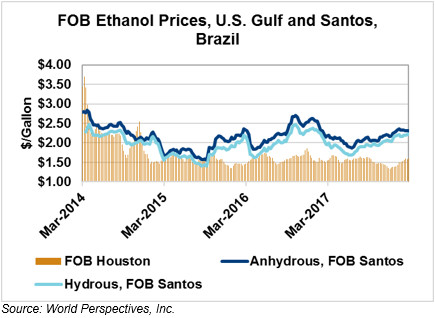

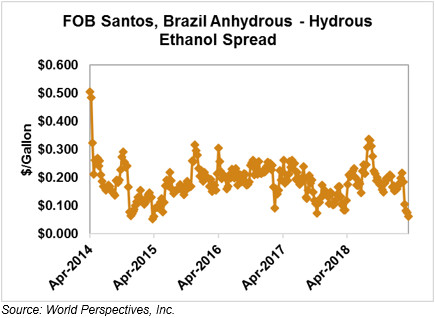

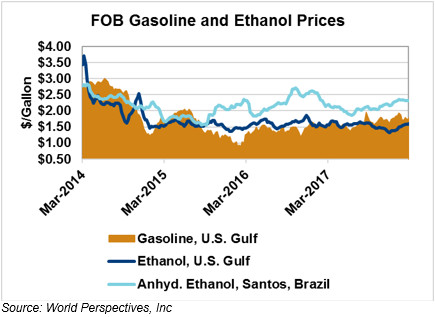

FOB Houston ethanol prices finished last week down 1.2 percent; prices are down 2 percent through Tuesday’s trading from Friday’s close. FOB Houston ethanol prices are quoted at 36.87 cents/liter (139.58 cents/gallon). FOB Santos, Brazil ethanol prices ended last week down 1.4 percent; they are unchanged from Friday’s close and stand at 53.67 cents/liter (203.16 cents/gallon) through Tuesday’s trading.

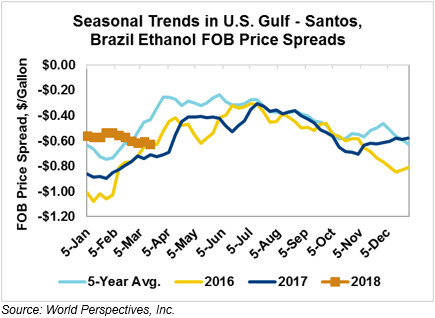

The FOB Gulf-Santos, Brazil spread widened slightly from last week’s close through Tuesday’s trading and is currently at -16.79 cents/liter (-63.57 cents/gallon).

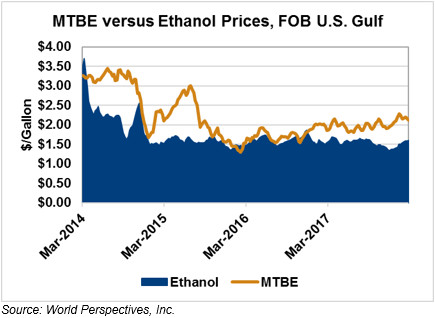

MTBE prices were down 0.7 percent to end last week; they are back up 2.5 percent to start this week. MTBE’s premium to FOB Houston ethanol widened from last week and now stands at 10.36 cents/liter (39.22 cents/gallon).

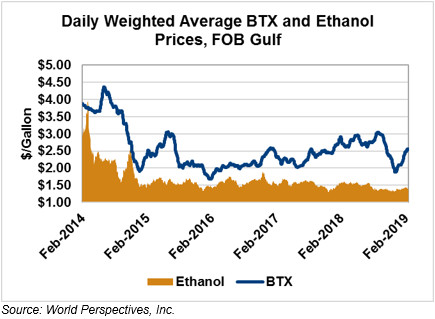

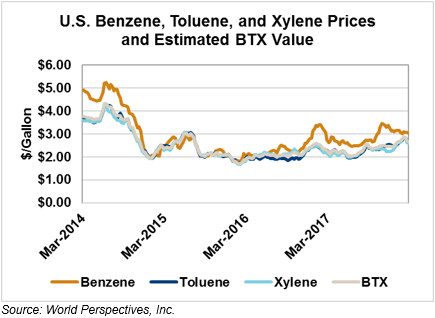

BTX component prices were up across the board to end last week and continue up through Tuesday’s trading: Benzene is up 0.3 percent, Toluene is up 1.1 percent and Xylene is up fractionally. The estimated weighted average aromatic price is currently 67.37 cents/liter (255.02 cents/gallon), up from last Friday’s close. The BTX-Houston ethanol spread widened again from last week; the weighted average BTX price is 30.49 cents/liter (115.43 cents/gallon) higher than the FOB Houston ethanol price.

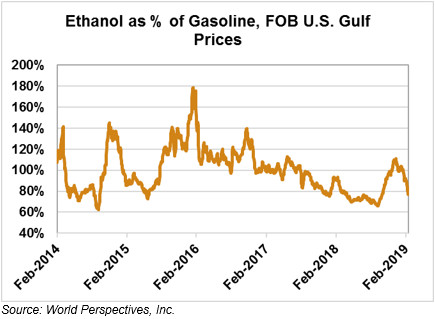

Gasoline and petroleum products were up to end last week and continue up across the board through early-week trading. This week, RBOB futures are up: 84 (Houston) and 87 (U.S. Gulf) octane gasoline prices are up 1.2 percent and 0.5 percent, respectively. WTI futures are up 1.9 percent to $57.16/barrel and Brent futures are up 1.4 percent to $66.67/barrel, from Friday’s close through Tuesday’s trading.

Price Database: If you are interested in historical price data, please click here.