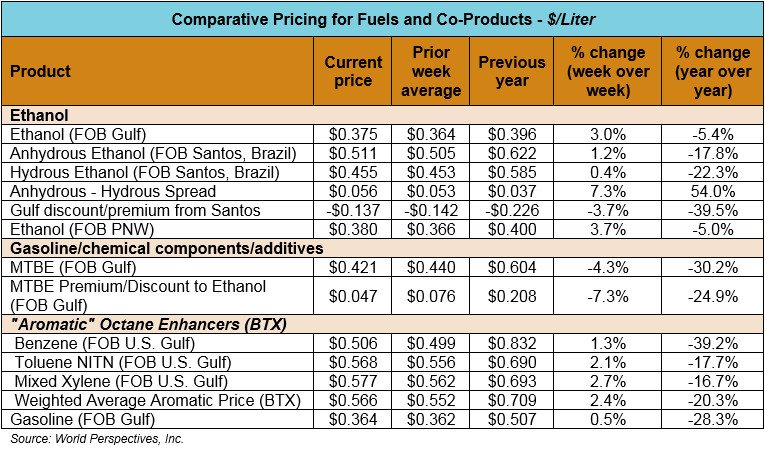

Ethanol, Fuels and Co-Product Pricing

Market Outlook: U.S. ethanol prices ended last week up 2.5 percent but are do wn fractionally in early week trading. Midwest wholesale rack ethanol prices were mostly unchanged to end last week; they are up 1.3 percent to start this week with prices at 37.34 cents/liter (141.36 cents/gallon) through Tuesday’s trading.

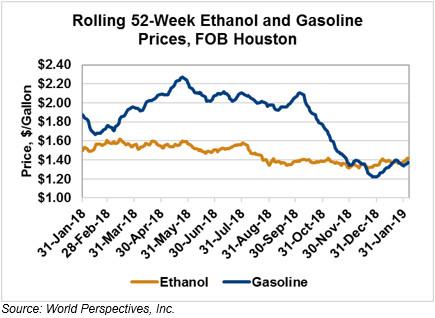

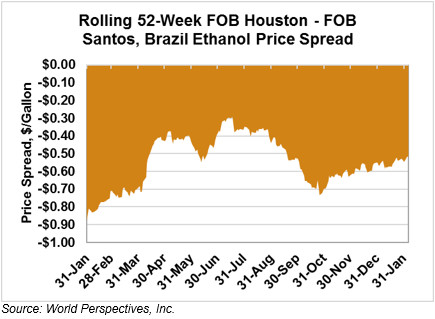

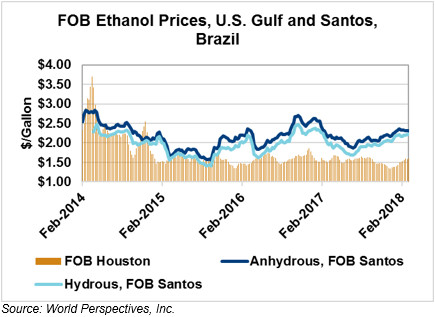

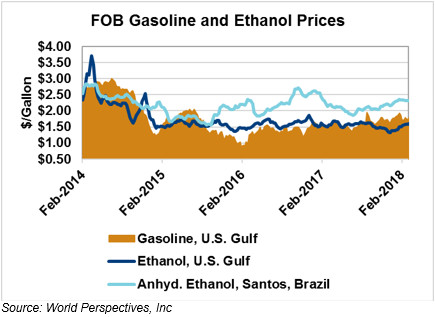

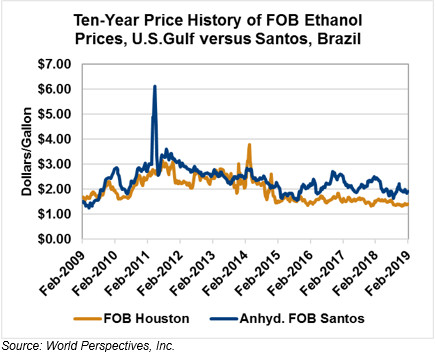

FOB Houston ethanol prices finished last week unchanged; prices are up 3.0 percent through Tuesday’s trading from Friday’s close. FOB Houston ethanol prices are quoted at 37.46 cents/liter (141.80 cents/gallon). FOB Santos, Brazil ethanol prices ended last week up fractionally; prices continue up from Friday’s close and stand at 51.12 cents/liter (193.50 cents/gallon) through Tuesday’s trading.

The FOB Gulf-Santos, Brazil spread narrowed from last week’s close through Tuesday’s trading and is currently at -13.66 cents/liter (-51.70 cents/gallon).

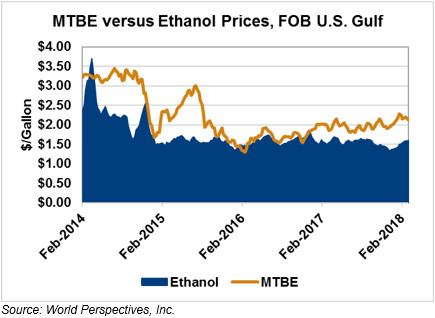

MTBE prices were down 2.3 percent to end last week; they are down 3.6 percent to start this week. MTBE’s premium to FOB Houston ethanol narrowed from last week and now stands at 4.96 cents/liter (18.79 cents/gallon).

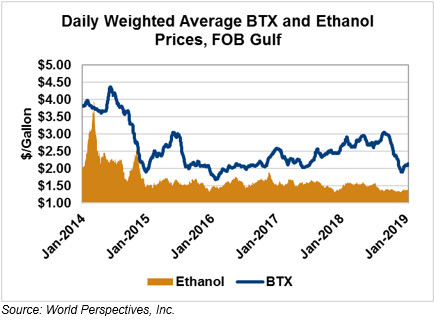

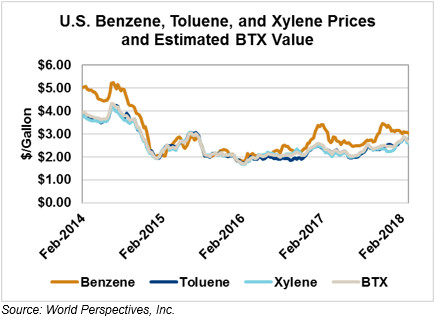

BTX component prices were down across the board to end last week but have rebounded and are up through Tuesday’s trading: Benzene is up 1.1 percent, Toluene is up 1.8 percent and Xylene is up 2.2 percent. The estimated weighted average aromatic price is currently 56.33 cents/liter (213.24 cents/gallon), up from last Friday’s close. The BTX-Houston ethanol spread narrowed slightly from last week; the weighted average BTX price is 18.87 cents/liter (71.44 cents/gallon) higher than the FOB Houston ethanol price.

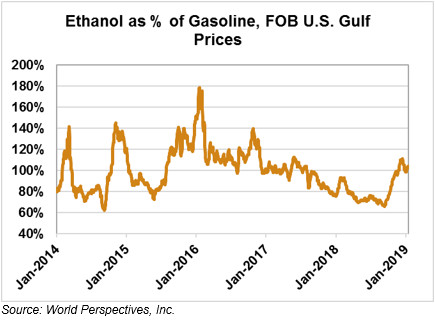

Gasoline and petroleum products were up across the board to end last week but have turned down through early-week trading. This week, RBOB futures are down: 84 (Houston) and 87 (U.S. Gulf) octane gasoline prices are both down 1.3 percent. WTI futures are down 2.8 percent to $53.72/barrel, and Brent futures are down 1.2 percent to $61.98/barrel, from Friday’s close through Tuesday’s trading.

Price Database: If you are interested in historical price data, please click here.