Ethanol, Fuels and Co-Product Pricing

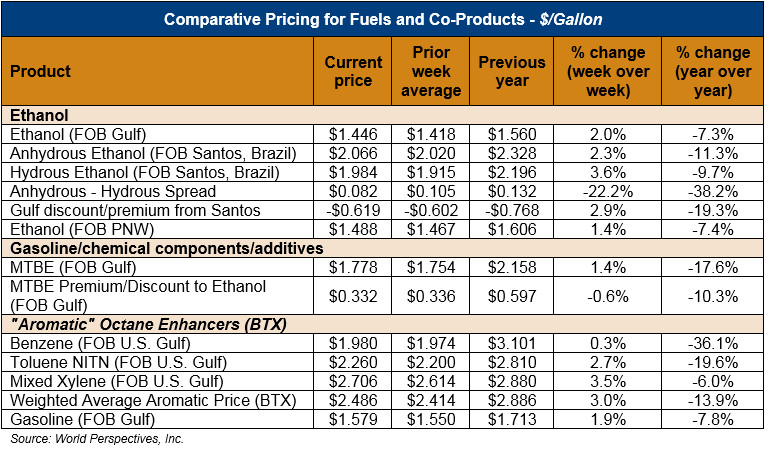

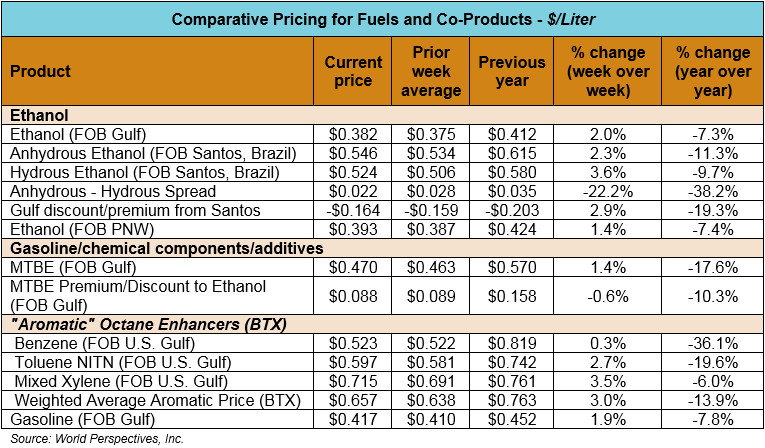

Market Outlook: U.S. ethanol prices ended last week up 1.3 percent and are up nearly 1 percent in early week trading. Midwest wholesale rack ethanol prices were up slightly to end last week; they are mostly unchanged to start this week at 38.41 cents/liter (145.39 cents/gallon) through Tuesday’s trading.

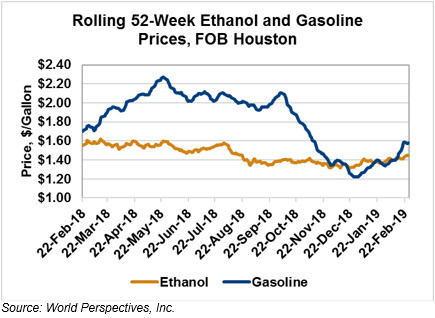

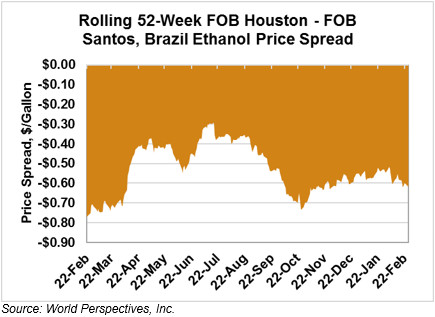

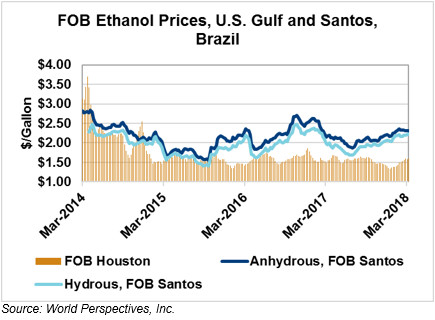

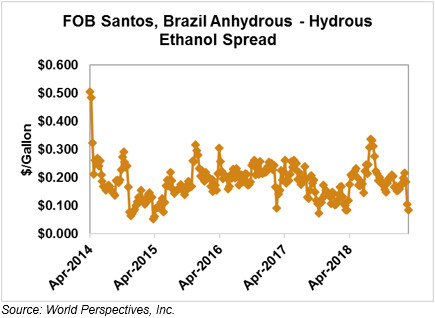

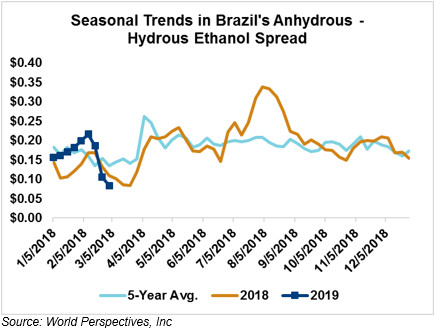

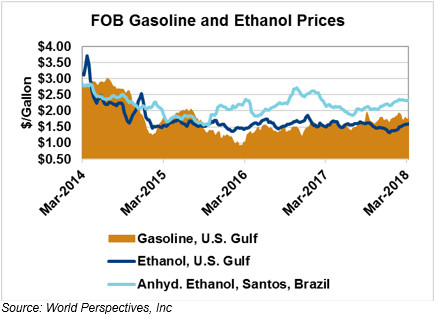

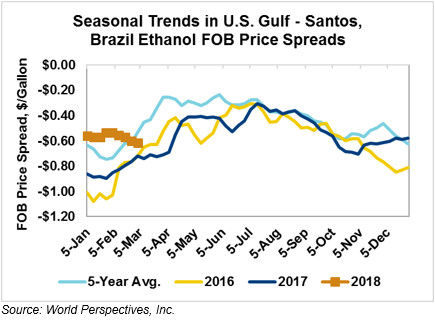

FOB Houston ethanol prices finished last week mostly unchanged; prices are up 2 percent through Tuesday’s trading from Friday’s close. FOB Houston ethanol prices are quoted at 38.20 cents/liter (144.63 cents/gallon). FOB Santos, Brazil ethanol prices ended last week up 1.4 percent; prices continue up (+2.3 percent) from Friday’s close and stand at 54.56 cents/liter (206.56 cents/gallon) through Tuesday’s trading.

The FOB Gulf-Santos, Brazil spread widened from last week’s close through Tuesday’s trading and is currently at -16.35 cents/liter (-61.92 cents/gallon).

MTBE prices were up a significant 8.3 percent to end last week; they are up nearly 2 percent to start this week. MTBE’s premium to FOB Houston ethanol widened again from last week and now stands at 8.94 cents/liter (33.85 cents/gallon).

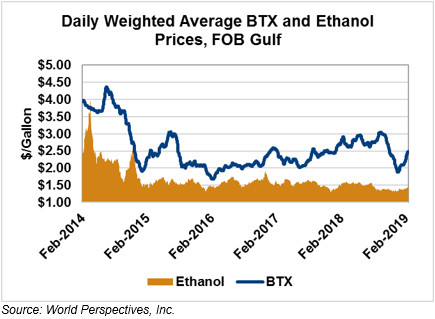

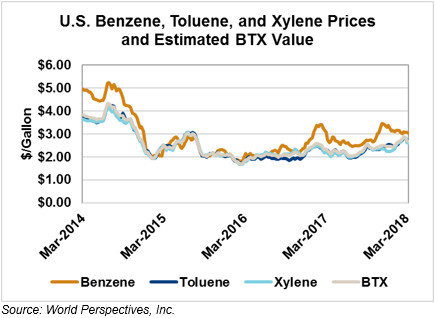

BTX component prices were up across the board to end last week and continue mostly up through Tuesday’s trading: while Benzene is unchanged, Toluene is up 2.3 percent and Xylene is up 3.4 percent. The estimated weighted average aromatic price is currently 65.51 cents/liter (247.99 cents/gallon), up from last Friday’s close. The BTX-Houston ethanol spread widened again from last week; the weighted average BTX price is 27.30 cents/liter (103.35 cents/gallon) higher than the FOB Houston ethanol price.

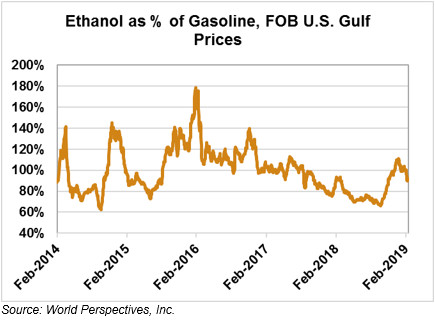

Gasoline and petroleum products were up to end last week on positive macroeconomic/policy signals but are mostly down through early-week trading. This week, RBOB futures are down slightly: 84 (Houston) and 87 (U.S. Gulf) octane gasoline prices are down 0.3 percent and 0.4 percent, respectively. WTI futures are down 1.1 percent to $56.64/barrel and Brent futures are down 1.5 percent to $66.08/barrel, from Friday’s close through Tuesday’s trading.

Price Database: If you are interested in historical price data, please click here.