Ethanol, Fuels and Co-Product Pricing

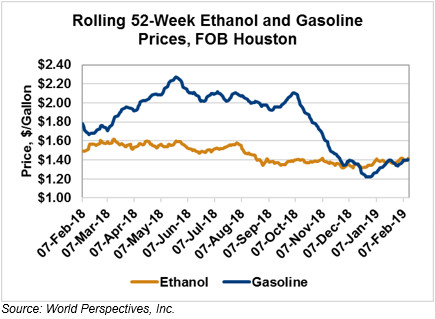

Market Outlook: U.S. ethanol prices ended last week down 1.1 percent but are up 3 percent in early week trading. Midwest wholesale rack ethanol prices were slightly up to end last week; they are up 1.4 percent to start this week at 37.84 cents/liter (143.24 cents/gallon) through Tuesday’s trading.

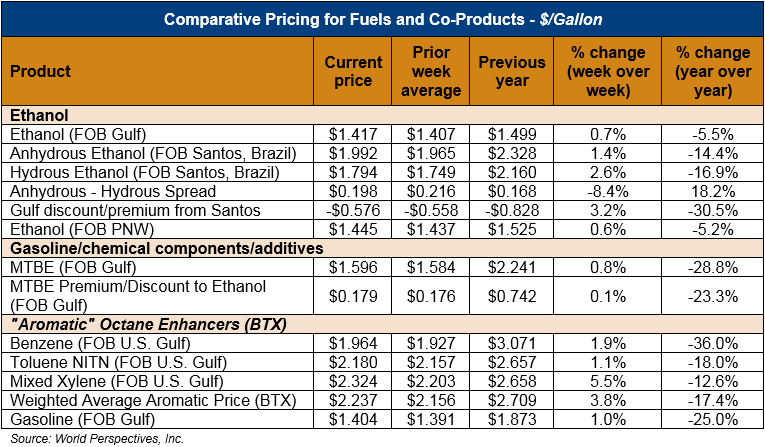

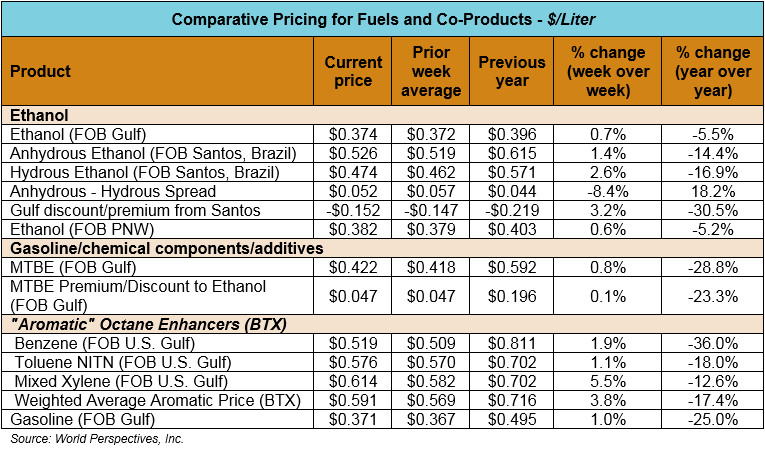

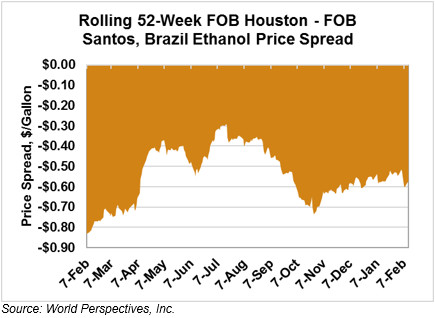

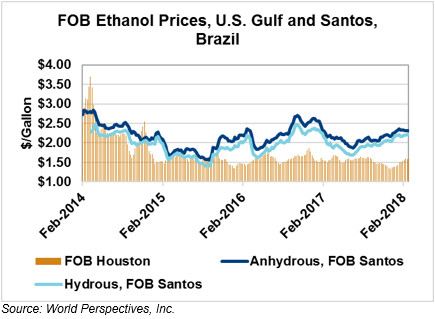

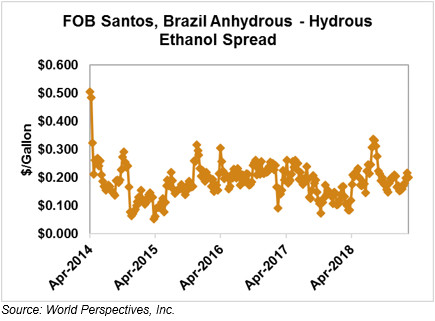

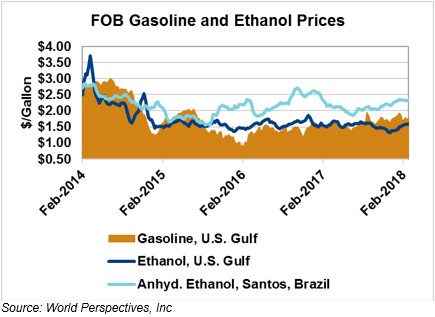

FOB Houston ethanol prices finished last week up 2.2 percent; prices are up 0.7 percent through Tuesday’s trading from Friday’s close. FOB Houston ethanol prices are quoted at 37.42 cents/liter (141.65 cents/gallon). FOB Santos, Brazil ethanol prices ended last week up 2.7 percent; prices continue up from Friday’s close and stand at 52.62 cents/liter (199.22 cents/gallon) through Tuesday’s trading.

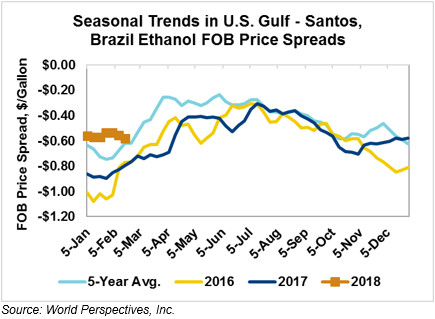

The FOB Gulf-Santos, Brazil spread widened from last week’s close through Tuesday’s trading and is currently at -15.20 cents/liter (-57.56 cents/gallon).

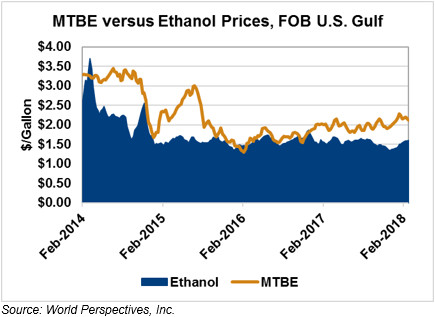

MTBE prices were down 4.9 percent to end last week; they are up fractionally to start this week. MTBE’s premium to FOB Houston ethanol narrowed slightly from last week and now stands at 4.58 cents/liter (17.35 cents/gallon).

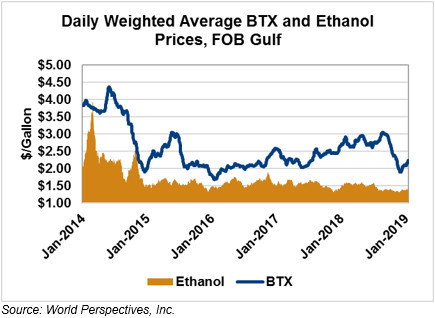

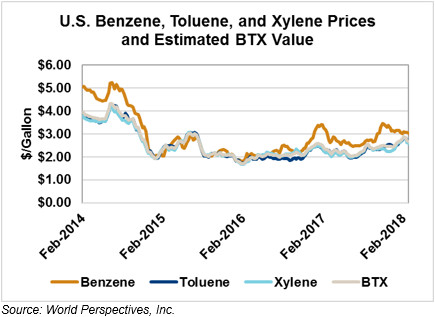

BTX component prices were up across the board to end last week and continue up through Tuesday’s trading: Benzene is up 1.7 percent, Toluene is up 0.9 percent and Xylene is up 4.2 percent. The estimated weighted average aromatic price is currently 58.64 cents/liter (221.97 cents/gallon), up from last Friday’s close. The BTX-Houston ethanol spread widened from last week; the weighted average BTX price is 21.21 cents/liter (80.31 cents/gallon) higher than the FOB Houston ethanol price.

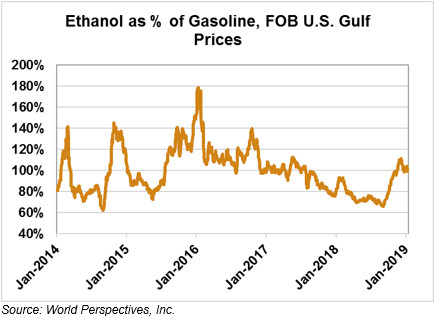

Gasoline and petroleum products were mixed to end last week and continue mixed through early-week trading. This week, RBOB futures are down fractionally: 84 (Houston) and 87 (U.S. Gulf) octane gasoline prices are down 0.4 percent and 0.5 percent, respectively. WTI futures are up 1.6 percent to $53.55/barrel, and Brent futures are up 1.2 percent to $62.87/barrel, from Friday’s close through Tuesday’s trading.

Price Database: If you are interested in historical price data, please click here.