Ethanol, Fuels and Co-Product Pricing

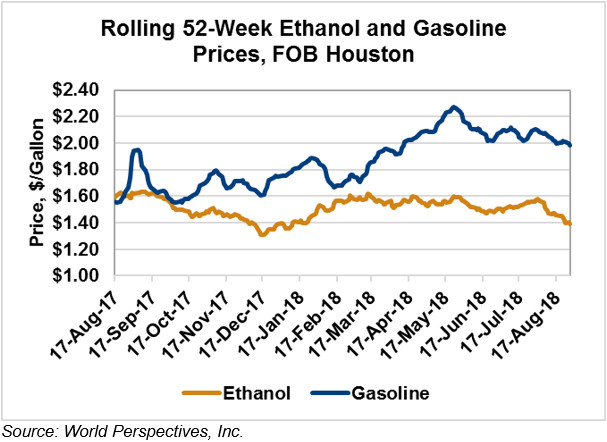

Market Outlook: U.S. ethanol prices were down to end last week. This week, nearby CBOT ethanol futures are down from Friday’s close, with continued pressure from falling corn prices as the trade focuses on weather and crop quality reports. Midwest wholesale rack ethanol prices were down to end last week and are down from Friday’s close at 38.71 cents/liter (146.53 cents/gallon).

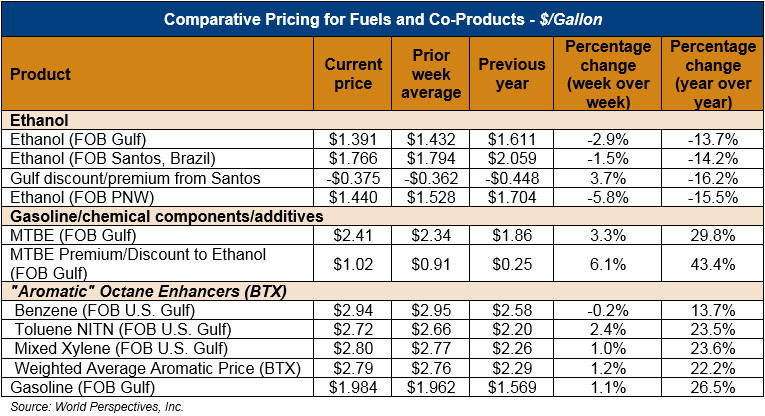

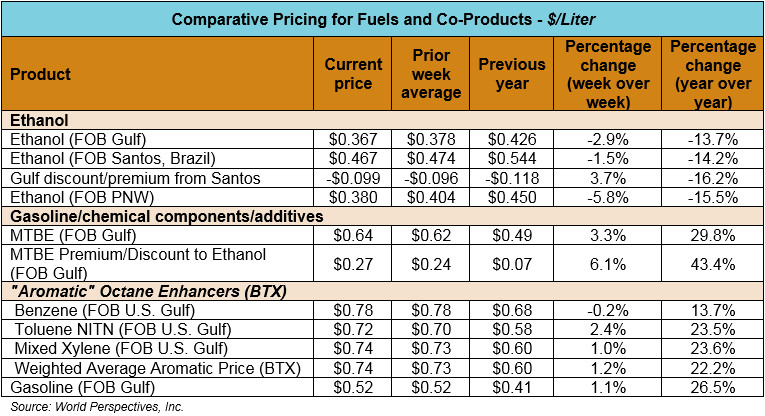

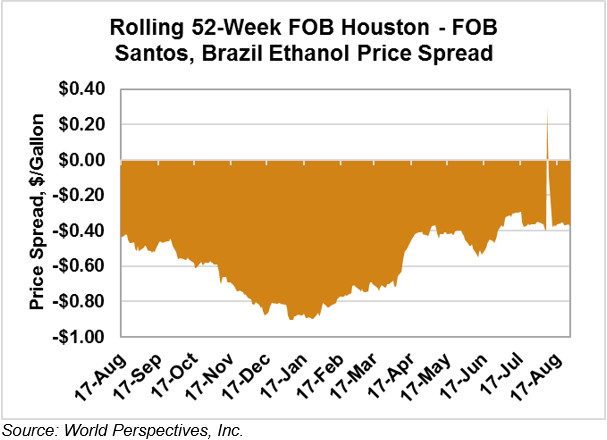

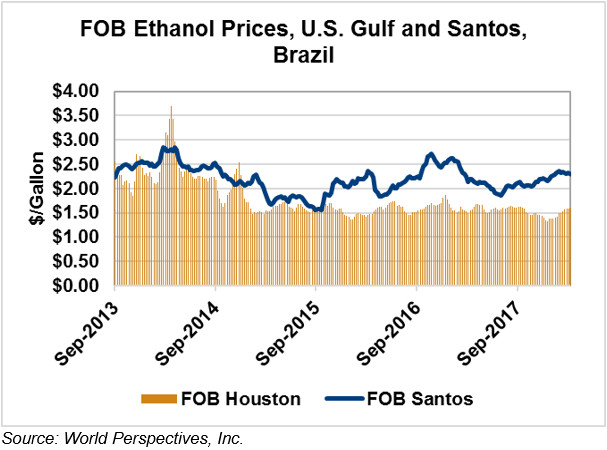

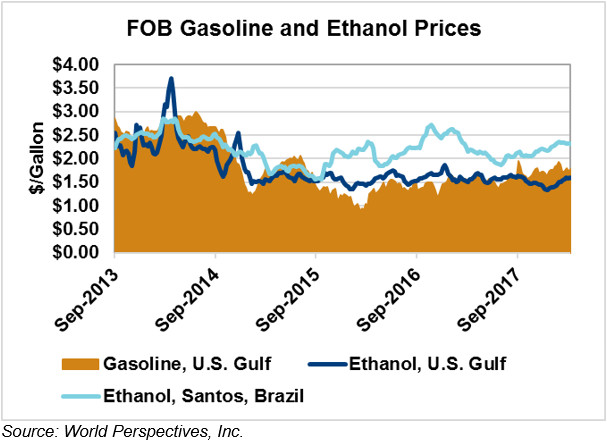

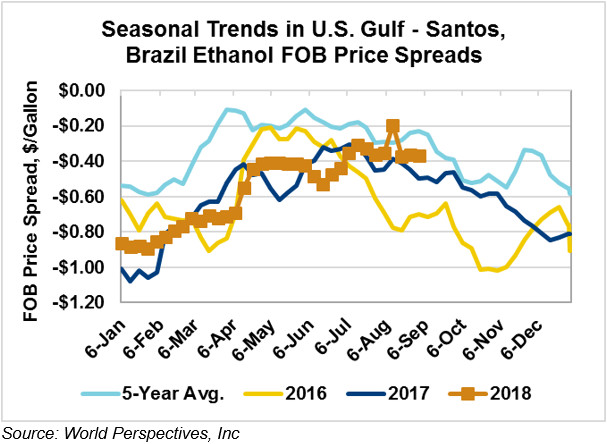

FOB Houston ethanol prices finished last week down over 2 percent and are down nearly 3 percent through Tuesday’s trading. FOB Houston prices are quoted at 36.740 cents/liter (139.075 cents/gallon). FOB Santos, Brazil ethanol prices ended last week down. This week the downward trend continues, with FOB Santos, Brazil prices at 46.651 cents/liter (176.595 cents/gallon) through Tuesday’s trading.

The FOB Gulf-Santos, Brazil spread has widened from last week’s close through Tuesday’s trading and is currently at -9.912 cents/liter (-37.52 cents/gallon).

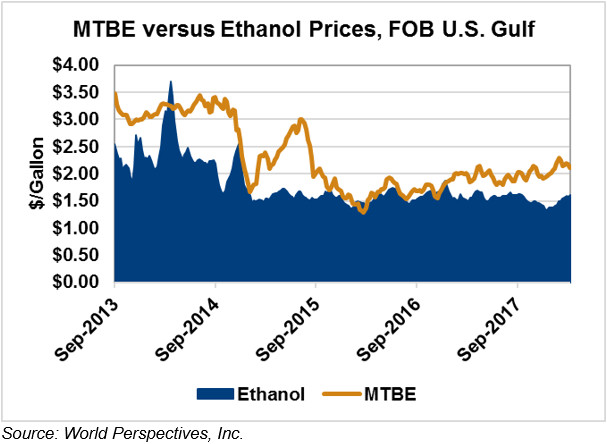

MTBE prices were up slightly to end last week and continue to show upward momentum through early week trading. MTBE now holds a 27.057 cents/liter (102.42 cents/gallon) premium to FOB Houston ethanol, with the spread widening substantially from last week.

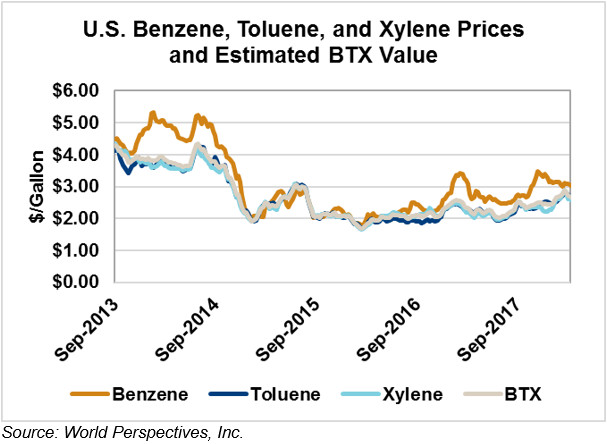

BTX component prices were mixed to end last week, and through Tuesday’s trading they are mixed to unchanged. Benzene prices are mostly unchanged, Toluene prices are up over 2 percent and Xylene prices are up 1 percent. The estimated weighted average aromatic price is currently 73.76 cents/liter (279.22 cents/gallon), up slightly from Friday’s close. The BTX-Houston ethanol spread widened, with the weighted average BTX price now 37.022 cents/liter (140.14 cents/gallon) higher than FOB Houston ethanol prices in a continuation of past weeks’ spread widening.

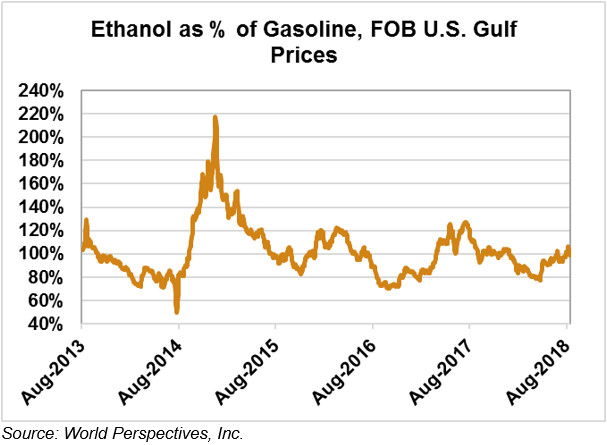

Gasoline and petroleum products are mostly unchanged in early week trading. RBOB futures are up fractionally from Friday’s close; FOB Gulf/Houston prices for 84 octane RBOB and 87 octane CBOB are mostly unchanged. WTI and Brent crude oil futures ended last week up and are up slightly through Tuesday’s trading.

Price Database: If you are interested in historical price data, please click here.