Germans toast with their beer steins, the Irish with their whiskey, but in China, baijiu reigns supreme. The U.S. Grains Council (USGC), with support from the United Sorghum Checkoff Program (USCP), is exploring how much demand this popular Chinese alcoholic beverage could generate for U.S. sorghum farmers.

Two vessels of U.S. sorghum have already been sold to China in 2019 for use in the baijiu industry. These sales are even more significant as the buyers were willing to pay an additional 25 percent import duty if trade negotiations with the United States are still ongoing when the vessels arrive in China.

“Baijiu is China’s traditional and, by far, the world’s largest distilled spirit,” said Reece Cannady, USGC manager of global trade. “Up to now, sorghum imports have been driven by demand for sorghum in livestock feed, but key traders have started selling U.S. sorghum to the distilled spirits industry.”

Sorghum can account for up to 50 percent of the grain used in production of baijiu, though exact inclusion rates vary among individual producers. To explore potential for the market, Cannady traveled to China in March with China-based USGC staff and a Sorghum Checkoff delegation.

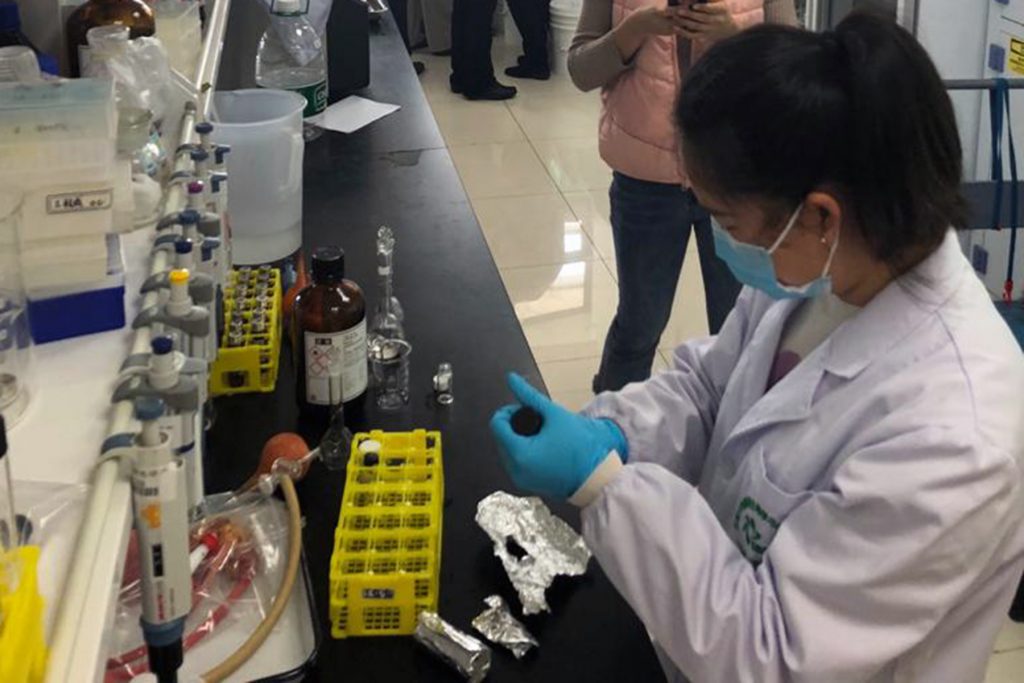

The group visited baijiu production facilities as well Jiangnan University in Wuxi, where the Council and the Sorghum Checkoff are funding research into what types of sorghum are preferred for use in baijiu and what recipes can draw out the favorable flavor compounds in these varieties.

The delegation visited the university lab where samples of U.S. sorghum finally arrived two months ago after a year and a half of delays due to the ongoing trade conflict between China and the United States. There, the group was pleasantly surprised with progress made on the research into what varieties or types of sorghum work best for baijiu in the short time the lab has had access to the samples.

“The people at the university have incredible insights and their connections are deep within the baijiu industry,” Cannady said. “There is quite a bit to learn and there is quite a bit of nuance to the market.”

Cannady explained the baijiu market is complex, with a mix of producers focused on either quality or quantity. The higher-end baijiu producers are looking for a consistent, high-value product, while other producers churn out higher volumes, but want to save on costs wherever possible.

“The idea is to figure out how to penetrate the market effectively with U.S. sorghum from a premium standpoint,” Cannady said. “What is the best way for us to trade at a premium while trading significant volumes?”

The baijiu industry is booming for both domestic production and exports. The delegation determined market demand for baijiu production is substantially higher than original estimates, which were about 3 million tons (118 million bushels).

Chinese baijiu producers have few alternatives for this main ingredient this year, providing continued opportunities for U.S. sorghum farmers. A drought has driven up prices for Australian sorghum, and blending ethanol into the product has mixed results. The Council continues to monitor the findings from the baijiu research project as well as the progress of trade negotiations with China to seize this toast-worthy opportunity.

“We continue to work with the Sorghum Checkoff to embrace all opportunities for U.S. sorghum and continually engage the industry in China,” Cannady said. “Baijiu is one component of overall efforts to develop sorghum-specific and higher-value uses for U.S. sorghum.”

About The U.S. Grains Council

The U.S. Grains Council develops export markets for U.S. barley, corn, sorghum and related products including distiller’s dried grains with solubles (DDGS) and ethanol. With full-time presence in 28 locations, the Council operates programs in more than 50 countries and the European Union. The Council believes exports are vital to global economic development and to U.S. agriculture’s profitability. Detailed information about the Council and its programs is online at www.grains.org.