Chicago Board of Trade Market News

Outlook

USDA reported sales of 215 TMT of corn to Mexico of which 165 TMT was for 23/24 and 50 TMT for 24/25. Spain was also in for US corn this week. Argentine corn exports to China are expected to start in July with the approval of two varieties of GMO corn. EU corn exports are 16.7 MMT, down from 25 MMT a year ago. US corn exports were 42.4 million bushels last week. China took 87 TMT of corn last week, leaving 107 TMT in unshipped purchases. Cumulative inspections are up 26.4% from last year at 1.429 billion bushels. USDA projects corn exports up 29.4% from a year ago.

Brazilian corn exports are seen at 520 TMT in May. Brazil’s corn crop is seen at 118.4 MMT by AgRural with USDA’s most recent estimate at 122 MMT. The Safrina corn crop is 2% harvested. Argentina’s corn crop is 28% harvested with the current estimate from the Rosario Exchange at 47.5 MMT, whereas USDA’s latest estimate is at 53 MMT. A cold snap may reduce the leafhopper outbreak and slow the damage to the Argentinian corn crop.

US sorghum exports were 1.9 million bushels last week with cumulative exports now at 192.6 million bushels versus 65.7 million bushels last year.

Soil moisture conditions have significantly changed in the US Midwest since early April. Two months ago, much of Iowa and a large portion of the Midwest US were in the grips of a severe drought and very low soil moisture conditions. This week’s drought monitor map shows that drought conditions have been fully eliminated in Iowa and Nebraska and more rain is forecast for Texas, Oklahoma, the Delta areas of Arkansas and Louisiana as well as for much of the Central Plains area. The change in soil moisture conditions should set the stage for relatively good crop condition reports for corn and soybeans that start next week. Warmer temperatures are expected in the cornbelt over the next 6 to 10 days, but extreme heat stays absent until at least into mid-June. This should further crop development since good moisture combined with a rapid accumulation of growing degree days will lead to good early development of the corn and soybean crops.

In comparison, the soil moisture conditions in the Black Sea area are in fast retreat. Major forecasting models confine precipitation to the far south of Russia through June 10th, while subsoil moisture will be at very low levels and insufficient nearly everywhere else in the region by mid-June. While the wheat market will be less interested in Black Sea weather as wheat harvest in that area begins soon, that area is the major corn producing area of Russia and the corn growing areas in Ukraine are also seeing soil moisture depletion. Traders will still be watching this area’s weather to determine how the corn crop will be affected.

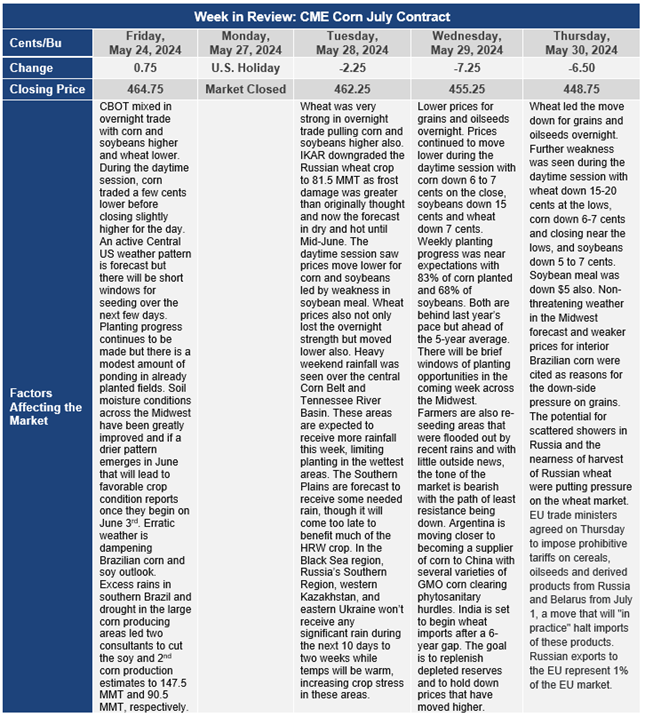

After following wheat prices higher in recent weeks, the global corn market is showing some weakness on favorable early-season growing weather for the corn that has been planted and as weakness in the Brazilian real weighs on Brazilian corn prices. The EU corn market is concerned that elevated wheat prices and Ukrainian dryness are putting upward local pressure on prices there while US and Brazilian corn markets need a new spark to either supply or demand to sustain the market rally. In the absence of that spark, corn prices could drop back toward the $4.40 to $4.50 level basis July futures and test the uptrend line that has been in place since the March lows.