Chicago Board of Trade Market News

Outlook

USDA’s Chief Economist, Seth Meyers’ presentation at the USDA Outlook Forum focused on the 2024 agricultural economic and foreign trade outlook but also provided USDA’s first “guess” at U.S. planted acreage for the four principal crops. The U.S. corn outlook for 2024/25 is for lower production, greater domestic use, increased exports, and higher ending stocks. The corn crop is projected at 15.040 billion bushels, down about 2 percent from the prior year’s record. Corn planted area is forecast at 91.0 million acres, down 3.6 million from a year ago. The yield projection of 181.0 bushels per acre is based on a weather-adjusted trend assuming normal planting progress and summer growing season weather. Total corn supplies are forecast at a record 17.237 billion bushels. Total U.S. corn use for 2024/25 is forecast higher relative to last year on growth in domestic use and exports. Food, seed, and industrial (FSI) use is slightly higher at 6.805 billion bushels with use for ethanol forecast at 5.4 billion bushels. Feed and residual use is up about 1 percent to 5.75 billion, reflecting corn supplies that are higher than a year ago and lower expected prices during the year. Exports are up 50 million bushels to 2.15 billion on expectations of modest global trade growth. Ending stocks are projected at 2.532 billion bushels, up 360 million from a year ago and resulting in stocks relative to use at 17.2 percent, which if realized would be the highest since 2005/06. The season-average corn price received by producers is forecast down 40 cents to $4.40 per bushel.

The 2024/25 U.S. soybean outlook includes higher supplies, use, and ending stocks, and lower prices compared to the prior year. Soybean supplies are projected at 4.8 billion bushels, 8 percent above 2023/24 with increased beginning stocks and production. Soybean production is projected at 4.5 billion bushels, 8 percent above a year earlier, and assumes a weather-adjusted trend yield of 52.0 bushels per acre and a 4.2-million-acre increase to harvested area from 2023/24. As soybean crush capacity continues to expand in the United States, crush is projected to rise to a record 2.4 billion bushels in 2024/25. Domestic and global soybean meal demand is expected to increase as greater availability of soybean meal, both in the United States and South America, leads to lower prices. Reduced soybean meal prices will likely make soybean meal a more competitive feed ingredient and may prompt stronger demand in the global livestock and poultry sectors after several years of high prices.

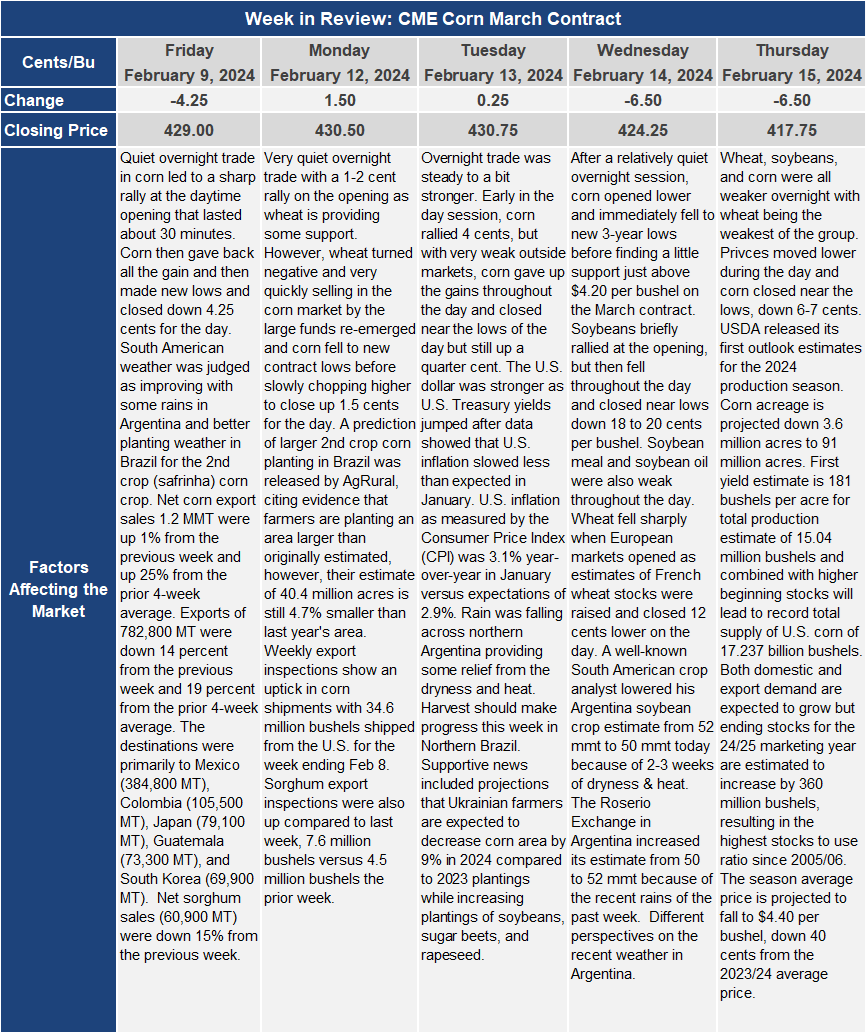

New contract lows were seen for corn this week as corn fell to the lowest levels since December 2020. The market continues to be very oversold technically but that may not prevent the market from moving lower in the near-term until a catalyst emerges to spark short-covering by the managed funds and reverse the negative sentiments dominating the current market. A meaningful jump in physical U.S. export shipments lies just ahead according to some market analysts. These same analysts expect weekly corn export sales to stay elevated. It is expected that Brazilian offers will not be significant prior to July.

The U.S. Census of Agriculture which is published every 5 years was released this week. It shows that the number of farms in the U.S. continues to decline (down 6.9% from 2017), land in farms decreased by roughly 20 million acres (down 2.2% from 2017), and the average size of U.S. farms increased by 22 acres to 463 acres, a 5% increase compared to 2017. Farm production expenses increased by $97.8 billion which is an increase of 29.9%, from 2017 to 2022. The value of ag production increased from $388 billion to $543 billion, a 40% increase from 2017 to 2022, and the number of young producers increased by 3.9% nationally with all of the Midwestern corn producing states showing strong increases in the number of young farmers.