Chicago Board of Trade Market News

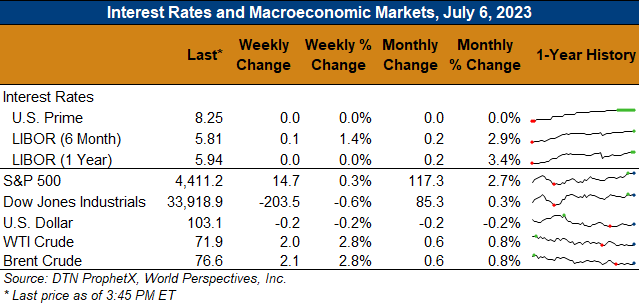

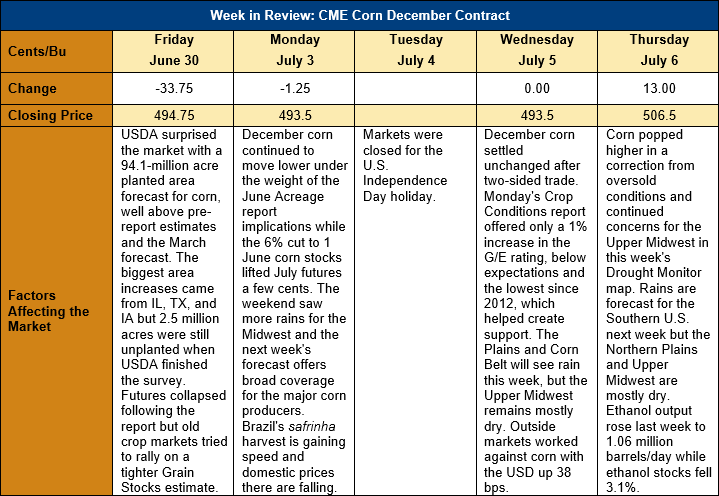

Outlook: Corn futures have been nothing if not volatile in the past month with early-June drought worries giving way to improved Midwest forecasts and major surprises in two fundamental USDA reports. Last Friday, USDA published the annual June Acreage and quarterly Grain Stocks reports, both of which surprised markets. The markets primarily focused on the acreage figures and the reaction was swift and bearish and December futures fell 33 cents on the day the reports were released. Since then, however, the market has found support near the $5.00 mark and December futures are up 11 ¾ cents (2.4 percent) from Friday’s close.

The headline number from the Acreage report was corn planted area of 38.082 Mha (94.1 million acres), which would be up 6 percent from 2022. The acreage estimate was well above pre-report estimates of 37.151 Mha (91.8 million acres) with most analysts predicting that a wet planting season in the Northern Plains would reduce corn acres from the March Prospective Plantings report. The 850,000-hectare (2.1-million-acre) increase from USDA’s March report was among the biggest in the past decade. Of note is the fact that the six states to see the largest corn area increase from March to June – Illinois, Texas, Iowa, South Dakota, Missouri, and North Dakota, respectively – are all battling persistent drought. USDA did note that through the report’s survey period, 2.5 million corn acres were not yet planted, which indicates potential for downward revisions in future reports.

The Grain Stocks report was somewhat overshadowed by the surprise of the Acreage report but its data held some supportive implications for old crop markets. U.S. corn stocks as of 1 June totaled 104.3 MMT (4.106 billion bushels), which was down 6 percent from 2022 and the lowest for the quarter in the past nine years. The data implied better than expected U.S. feed and residual demand and created the potential for USDA to cut its forecast of 2022/23 carry-out in coming WASDE reports. One interesting note from the report is the fact that on-farm corn stocks were up 5 percent from the prior year, suggesting producers have been slower than usual marketing last year’s crop.

Rains continue to fall across the U.S. Midwest but the Crop Conditions is seemingly slow to reflect this, with the good/excellent rating for corn stuck at multi-decade lows. This week’s report pegged 51 percent of the corn crop as good/excellent condition, up 1 percentage point from the prior week and the lowest rating for early July since 2012. Conditions are particularly concerning in Illinois (29 percent below average), Missouri (32 percent below average) and Nebraska (27 percent below aveage). USDA reported that 8 percent of the crop is silking, in-line with the five-year average.