Chicago Board of Trade Market News

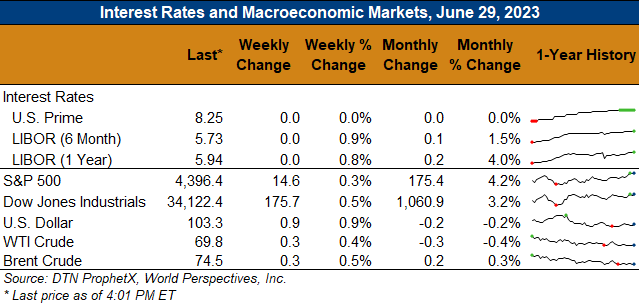

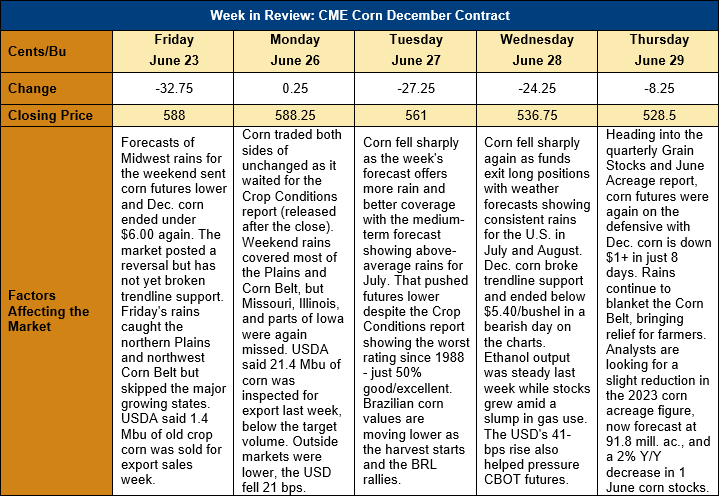

Outlook: Just as quickly as drought added a huge premium to corn futures, Midwest rains and forecasts for above-average July precipitation took away that premium. December corn futures are 49 ¾ cents (7.9 percent) lower this week after last weekend brought beneficial rains to many parts of the Midwest. The weekend precipitation was followed by more this week with showers reaching parts of Illinois and Missouri that previous storms skipped. Even more comforting for producers (but bearish prices) was the consistency in medium- and long-range weather forecasts that now show above-average precipitation for the major corn-growing states through August. Between realized and predicted showers, futures traders saw little reason to maintain their long positions and quickly exited those trades, which sent futures sharply lower.

Despite last weekend’s moisture, USDA’s weekly Crop Conditions report showed another week of deterioration in U.S. summer crops. The share of U.S. corn rated good/excellent hit its lowest late-June number since 1988 at just 50 percent, a decline of 5 percentage points from the prior week and down 17 percentage points from the five-year average. USDA’s report said the 4 percent of the crop is silking currently, with the bulk of that occurring in the South, where rains have been more plentiful this year. As the crop moves closer to the key yield-defining month of July, the addition of rain to the forecast is more than welcome.

International buyers were active in booking U.S. corn last week with USDA reporting an increase in gross and net old crop sales. Exporters sold 232 KMT of old crop corn last week along with 124 KMT of new crop sales. The new crop sales figure was up 162 percent from the prior week. Corn exports through the week of 22 June dipped slightly to 605 KMT, which put YTD exports at 34,251 MMT, down 33 percent. On Wednesday this week, USDA reported the sale of 170,706 MT of corn for delivery to Mexico, split between the 2022/23 and 2023/24 marketing years.

Grain markets will receive some key fundamental data on Friday, 30 June when UDSA releases the quarterly Grain Stocks report and its June Acreage report, with the latter often considered the year’s final acreage estimate. Heading into the reports, analysts are expecting 91.8 million acres to have been planted to corn this year, down slightly from USDA’s March estimate of 92.0 million acres. The lower planted area is likely to come from wet planting conditions in the Northern Plains earlier this spring that push acres into the “prevent plant” category or other crops. For the Grain Stocks report, analysts predict there will be 108.235 MMT (4.261 billion bushels) of corn in storage as of 1 June, which would be down 2 percent from June 2022.