U.S. grains in all forms (GIAF) exports for marketing year (MY) 2021/2022 totaled more than 122 million metric tons (MMT), the second highest year on record following 129 MMT in MY 2020/2021, according to data from the U.S. Department of Agriculture (USDA) and analysis by the U.S. Grains Council (USGC).

Near-record exports of ethanol helped offset losses from corn and barley and barley products.

As the new 2022/23 marketing year takes off, the Council is continuing to work around the world to promote the quality, reliability and value of U.S. grain products and ethanol. To track GIAF exports, the Council reviews exports across 10 product sectors, including U.S. corn, barley and sorghum and value-added products including ethanol, distiller’s dried grains with solubles (DDGS) and other co-products, as well as the corn equivalent of exported meat products.

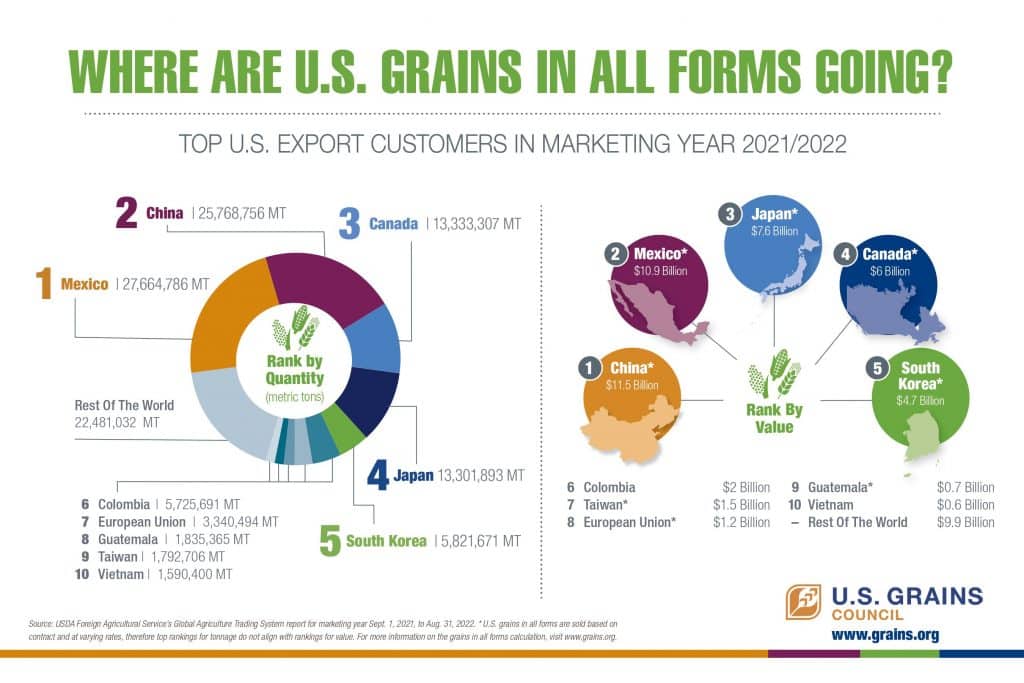

Top Three GIAF Countries

Mexico – Record exports of ethanol, corn, DDGS and pork and pork products, combined with a reduction in GIAF from China, made Mexico the largest GIAF market in 2021/22. The country imported more than 27 MMT (equal to 1 billion bushels) worth $11 billion, accounting for more than 22% of the total MY 2021/2022 export market. Mexico was the top market for U.S. corn, barley and barley products, coarse grain products, DDGS, pork and pork products, poultry and poultry products and the second-largest market for U.S. sorghum. Exports of corn and DDGS to Mexico increased substantially, totaling nearly 17 MMT of corn and 2.3 MMT of DDGS in MY 2021/2022. U.S. sorghum exports to Mexico also more than quadrupled from last year, totaling 361,000 MT.

China – China was the second-largest market for U.S. GIAF in the 2021/2022 marketing year, with exports totaling 26 MMT worth over $11 billion, accounting for 21% of the total MY 2021/2022 export market. China was the top market for U.S. sorghum, with exports totaling 6.45 MMT in MY 2021/22 (equal to 260 million bushels), worth over $2 billion. China was also the second-largest market for U.S. corn, pork and pork products and poultry and poultry products. The decline in exports to China is attributed to lower corn exports and decreased ethanol exports. MY 2021/2022 corn exports to China totaled nearly 15 million MT, down 7 MMT from the last marketing year and ethanol exports to China totaled less than 500,000 gallons, dropping it from the top 10 markets.

Canada – Canada was the third-largest U.S. GIAF market in the in the 2021/22 marketing year, with exports totaling more than 13 MMT (equal to 252 million bushels) worth $6 billion, accounting for 11% of the total MY 2021/2022 export market. Canada is a top five market for seven out of the 10 GIAF commodities including ethanol, barley and barley products and coarse grain products. Canada remains the top year-over-year market for U.S. ethanol in 2021/22, setting records both monthly and yearly, with exports totaling 466 Mgal (165 million bushels), worth $1.4 billion, up over 30% from 2020/21. Due to a short wheat and barley crop in Western Canada, the country increased its imports of U.S. corn and DDGS in 2021/2022, and had strong ethanol import numbers.

Top Three Commodities

Corn – U.S. corn exports totaled 63 million metric tons (2.5 billion bushels) in MY 2021/22 (worth $19 billion), down 7 MMT, from MY 2020/21, making up for more than 5% of total MY 2021/2022 commodity exports. Nearly all top 10 countries remain unchanged from 2020/21, with movements in rank primarily due to Canada’s record corn purchases. While exports to China decreased from more than 21 MMT in 2020/21 to 14.7 MMT in 2021/22, exports to Canada more than tripled, totaling a record 6 MMT (240 bushels), worth nearly $2 billion, placing it as the fourth-largest market. More than 60 countries purchased U.S. corn in MY 2021/22.

Ethanol – U.S. ethanol exports saw their third-largest marketing year on record, totaling 1.45 billion gallons (515 million bushels) in 2021/22, worth $4 billion, up 230 million gallons from 2020/21, making up over 11% of total MY 2021/2022 commodity exports. Ethanol remained a robust and diversified market with 79 countries purchasing in 2021/22. Total marketing year exports were up in eight of the top 10 markets, with Canada, the EU, Nigeria, Singapore and the UK all hitting new records for ethanol exports.

“Building upon the momentum for MY2021/2022, we look next to assist countries in creating their own clean fuel standard or discretionary blend levels that would incentivize ethanol consumption, and we will continue to discuss how U.S. ethanol can easily be implemented within existing world infrastructure as a right here-right now solution to carbon mitigation strategies,” said USGC Vice President Cary Sifferath.

DDGS – U.S. DDGS exports totaled 11.6 MMT (455 million bushels), worth $3 billion in 2021/22, nearly equal to 2020/21. Mexico, Vietnam and South Korea remain the top three markets from last, making up for 9% of total MY 2021/2022 commodity exports. More than 50 countries purchased U.S. DDGS in 2021/22.

“As the world continues to recover from effects of the global pandemic, along with logistical issues and grain trade flow changes due to the conflict in the Black Sea region, it is very impressive to see our GIAF number for the 2021/2022 marketing year come in at over 122 MMT. While down a bit from last year’s all time historical record high of 129 MMT, to see U.S. GIAF, especially our ethanol export numbers perform so well, is a great tribute to USGC’s members and their dedication to the development of GIAF exports to all markets globally,” Sifferath said.

About The U.S. Grains Council

The U.S. Grains Council develops export markets for U.S. barley, corn, sorghum and related products including distiller’s dried grains with solubles (DDGS) and ethanol. With full-time presence in 28 locations, the Council operates programs in more than 50 countries and the European Union. The Council believes exports are vital to global economic development and to U.S. agriculture’s profitability. Detailed information about the Council and its programs is online at www.grains.org.