Chicago Board of Trade Market News

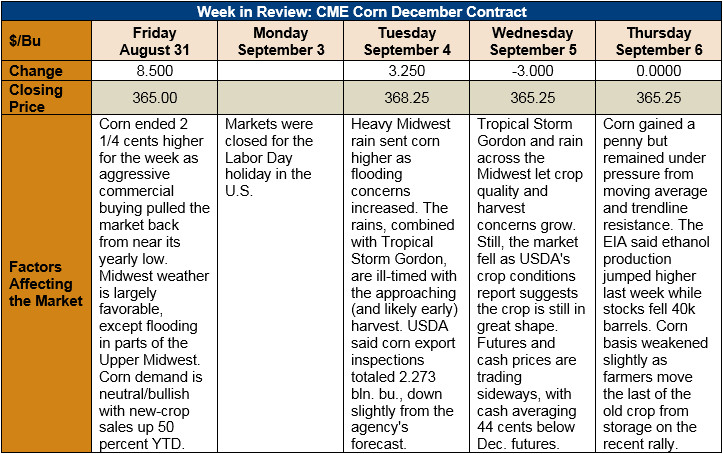

Outlook: December corn futures rose 2.7 percent (9 ¾ cents) this week as active commercial buying pulled the contract back from near its yearly low. The contract remains under fundamental and technical pressure, however, despite this week’s gains.

The bullish side of the corn market is largely depicted in the 50 percent YTD increase in new-crop sales. Sales, which total 6.9 MMT, have been brisk with the U.S.’ position as the low-cost feed grain supplier in the world. Old-crop exports totaled 1.344 MMT as of last Thursday’s report (the next Export Sales report will be issued Friday, September 7, 2018) while unshipped sales (which will be rolled forward into the 2018/19 marketing year) totaled 4.5 MMT, a 4 percent increase from this time last year. In all, the new-crop export prospects suggest 2018/19 exports will meet or exceed USDA’s present projections.

On the bearish side, the 2018 U.S. corn crop looks to be record-large with USDA’s yield estimate at 178.4 BPA, with recent private forecasts confirming large, above-trendline yields. USDA pegged the crop at 67 percent good/excellent this week, up from the five-year average of 66 percent, while 22 percent of the crop was rated “mature”, up from 11 percent for the five-year average. The crop’s conditions and yield forecasts suggest the U.S. will have no shortage of corn this year, and robust demand will be required to support prices at their current level.

Technically, December corn is trapped between its life-of-contract low at $3.50/bushel and moving average/trendline resistance at various points between $3.68-3.76. Commercial firms have been aggressive buyers on the market’s recent dip, which suggests a measure of ongoing support. Additionally, livestock feeders, many of which face negative margins, are aggressively locking in corn purchases at these prices. With robust demand at low prices, the remaining factors are the final size of the U.S. crop and how funds will react to the September WASDE report. Should the WASDE prove bullish, the market could rally to near $3.90, where the 200-day moving average presently lies.