U.S. exports of grain in all forms (GIAF) are on track to set a new record in 2017/2018, with two months of sales left to report, according to data from the U.S. Department of Agriculture (USDA) and analysis by the U.S. Grains Council (USGC).

During the first 10 months of the marketing year (September 2017 to June 2018), the United States exported 98.3 million metric tons (3.87 billion bushels) of grain in all forms, up 2 percent year-over-year from last year’s record-setting pace.

The feed grains in all forms calculation helps capture how much of U.S. coarse grain production is actually used in the world market by including the corn equivalent of co-products like ethanol and distiller’s dried grains with solubles (DDGS) as well as beef, pork and poultry meat exports.

“GIAF exports is a fully-loaded accounting of the importance of exports to the livelihoods of U.S. coarse grain farmers and agribusinesses, particularly in a year of increased volatility and concern over retaliatory tariffs on U.S. agricultural products in multiple markets,” said Mike Dwyer, USGC chief economist. “U.S. GIAF exports could exceed 116 MMT (4.57 billion bushels) at the end of 2017/2018, up from last marketing year’s 114 MMT (4.49 billion bushels) and the second year in a row setting a new record high.”

That achievement would come despite a tumultuous trade environment, serving as a reminder of the resiliency of U.S. exports and of the quality and price competitiveness of U.S. coarse grains and co-products.

Trade with North American Free Trade Agreement (NAFTA) countries and neighbors, Mexico and Canada, has increased GIAF purchases by 3.7 percent and 12.6 percent year-over-year, respectively. In Mexico, corn sales are up 8.9 percent at nearly 12.4 MMT (488 million bushels), and DDGS sales are up 4.2 percent at 1.76 MMT. In Canada, corn imports have nearly doubled to 1.25 MMT (49.2 million bushels), and ethanol purchases are up slightly at nearly 270 million gallons year-to-date.

“GIAF exports to NAFTA partners could exceed 31 MMT (1.22 billion bushels) this marketing year – another record high that would account for 27 percent of worldwide GIAF sales,” Dwyer said. “Those sales signal the continued importance of the well-established supply chains and strong relationships the U.S. agricultural sector shares with both countries.”

Notably, GIAF exports to the European Union have also risen nearly 84 percent year-over-year to 3.78 MMT (149 million bushels) thus far in 2017/2018.

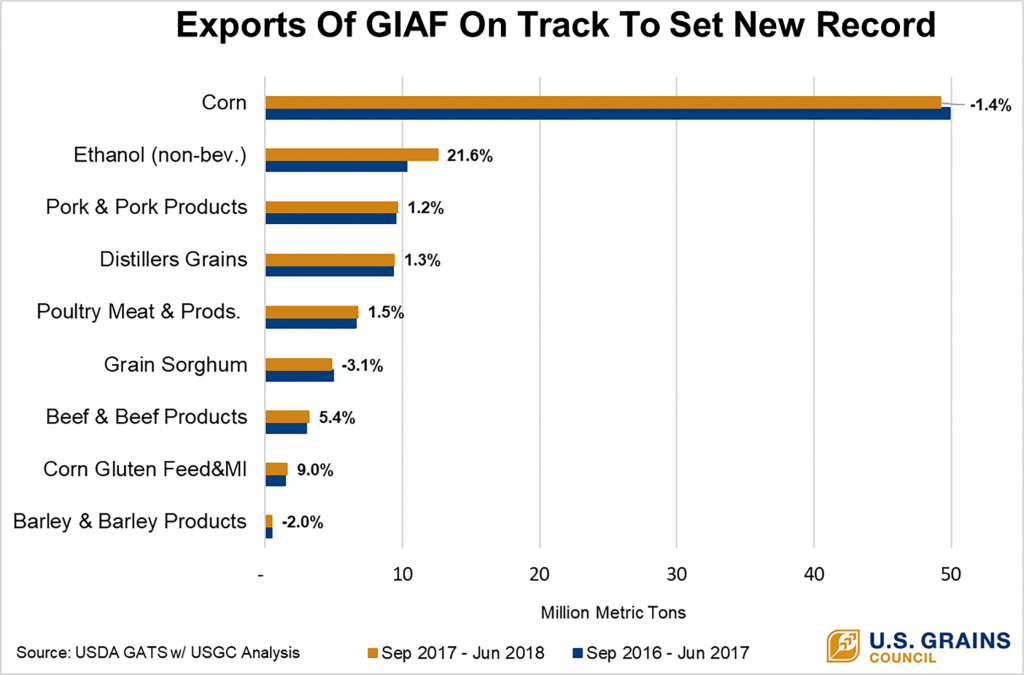

By sector, U.S. ethanol exports accounted for the lion’s share of the overall increase of GIAF exports in June, pushing exports up nearly 22 percent year-over-year to 1.36 billion gallons (12.2 MMT or 480 million bushels in grain equivalent), continuing a surprisingly strong pace of exports. As a result, the Council now believes ethanol exports could reach 1.6 billion gallons (14.4 MMT or 568 million bushels in grain equivalent), setting another new record.

Large customers including Brazil and India have continued to increase ethanol purchases, but other important trading partners including South Korea and Colombia have also realized large increases – up 41 percent and 194 percent year-over-year, respectively.

“The overall growth in ethanol exports showcases the increased focus of ethanol within the Council’s programming and the importance of exports of value-added products,” Dwyer said.

Overall corn, barley and sorghum exports remain down slightly year-over-year. But while corn exports are 1.4 percent lower than last marketing year at this time, USDA’s forecast of increased corn exports for the 2017/2018 marketing year signals the potential for a strong final two months of sales.

Key trading partners including Mexico and Colombia have also purchased larger volumes of U.S. corn compared to this time last marketing year, with both markets growing around 9 percent year-over-year. This export growth reaffirms that U.S. agriculture continues to benefit immensely from access to markets provided by free trade agreements.

“The release of the June numbers has provided some reassurance to producers roiled by tariffs and low prices throughout much of the marketing year,” Dwyer said. “The Council has continued to cultivate relationships with overseas buyers in decades-old markets and aggressively build new worldwide demand for corn, barley and sorghum farmers and the value-added industries they supply.”

Learn more about the feed grains in all forms calculation and dive into numbers by export market here.

About The U.S. Grains Council

The U.S. Grains Council develops export markets for U.S. barley, corn, sorghum and related products including distiller’s dried grains with solubles (DDGS) and ethanol. With full-time presence in 28 locations, the Council operates programs in more than 50 countries and the European Union. The Council believes exports are vital to global economic development and to U.S. agriculture’s profitability. Detailed information about the Council and its programs is online at www.grains.org.