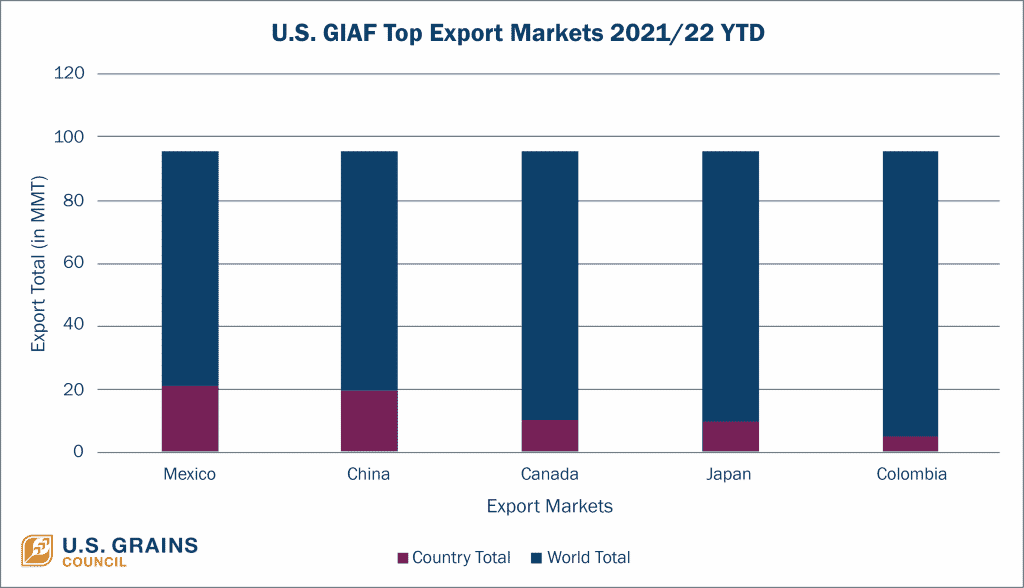

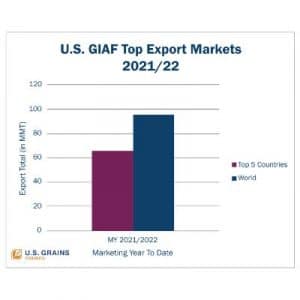

U.S. grain in all forms (GIAF) exports for the first nine months of the current marketing year (MY 2021/2022) totaled 96 million metric tons (MMT) (3,779,328,000 bushels in corn equivalent) to 145 countries, landing just under the total from the previous year (MY 2020/2021). Increased exports to Mexico, Canada and Colombia have helped offset year-to-date (YTD) losses in China and Japan, the five markets that account for nearly 70 percent of all GIAF commodity exports.

U.S. GIAF numbers are derived from the U.S. Department of Agriculture’s Foreign Agricultural Service (USDA/FAS) GATS database. There is a three-month lag in data reporting, so currently monthly reporting is from September 2021 to May 2022.

U.S. GIAF numbers are derived from the U.S. Department of Agriculture’s Foreign Agricultural Service (USDA/FAS) GATS database. There is a three-month lag in data reporting, so currently monthly reporting is from September 2021 to May 2022.

“These five markets are important to overall grain-in-all-forms exports – Canada, with strong exports of U.S. corn and distiller’s dried grains with solubles (DDGS) and continued strong ethanol exports is not only an important market for us to the north, but now the third largest after Mexico and China,” said USGC Vice President Cary Sifferath.

Important notes in the current marketing year information include:

Mexico has surpassed China month-over-month to become the top market for U.S. GIAF exports, totaling 21 MMT (826,728,000 bushels in corn equivalent) in the first nine months of the current marketing year, up 2 MMT (78,736,000 bushels in corn equivalent) from last. Corn and DDGS exports are up more than 1 MMT (39,368,000 bushels) and 280,000 MT (11,023,040 bushels in corn equivalent) in the first nine months of the marketing year, respectively. A trend to note is the sharp uptick in ethanol (up over 300,000 gallons) and sorghum (up from nearly zero, reaching 190,000 MT, or 7,479,920 bushels) exports that remained consistent over the nine months.

China is the second largest U.S. GIAF export market, with exports totaling 20 MMT (787,360,000 bushels in corn equivalent) in the first nine months of the current marketing year, down 7 MMT (275,576,000 bushels in corn equivalent) from last. Corn, sorghum, pork and pork products have experienced declines, buoyed by gains in poultry and poultry products (up 25,000 MT, or 984,200 bushels in corn equivalent), beef and beef products (up 214,000 MT, or 8,424,752 bushels in corn equivalent) and DDGS (up 70,000 MT, or 2,755,760 bushels in corn equivalent).

Canada has eclipsed Japan as the third largest GIAF market for the United States, with exports reaching more than 10 MMT (393,680,000 bushels in corn equivalent) in the first nine months of the marketing year, nearly double from last. Ethanol and corn exports continue to boom, totaling 331 million gallons and 5 MMT (196,840,000 bushels) in the first nine months of this marketing year. Gains in Canada have helped offset losses in China.

Ethanol, corn and DDGS exports to Canada continue to set records this marketing year, with ethanol exports averaging 37 million gallons each month. This flow commodities is an outcome of strong trade policies and partnerships between producers and users who benefit from grain sales.

Japan is the U.S. fourth largest GIAF market, with exports slightly behind Canada, totaling 10 MMT (393,680,000 bushels in corn equivalent) in the first nine months of the marketing year, nearly equal to last. Decreased export momentum is due to an overall decline in reported GIAF categories, largely visible in exports of corn (down 1 MT) from last. While not included in USDA GATS reporting, based on USGC data, there have been 84 million gallons of U.S. ethanol exported to Japan in the first nine months of this marketing year.

Colombia rounds out the top five GIAF markets with exports totaling 5 MMT (196,840,000 bushels in corn equivalent) in the first nine months of the marketing year, nearly equal to last. An influx of exports of corn and pork and pork products have helped offset losses from ethanol, down 300,000 million gallons from last year due to fluctuating policy changes at the national level.

“The benefits of the Council’s grain-in-all-forms data are that it not only gives us insights on direct corn, sorghum and barley exports, but also allows us to track the feed grain equivalents of grain exports of ethanol, DDGS and other grain co-products as well as feed grain equivalents of pork, beef and poultry exports. This shows the importance of these markets to the U.S. corn, sorghum and barley sectors,” Sifferath said.

About The U.S. Grains Council

The U.S. Grains Council develops export markets for U.S. barley, corn, sorghum and related products including distiller’s dried grains with solubles (DDGS) and ethanol. With full-time presence in 28 locations, the Council operates programs in more than 50 countries and the European Union. The Council believes exports are vital to global economic development and to U.S. agriculture’s profitability. Detailed information about the Council and its programs is online at www.grains.org.