Relevant and fresh market intelligence is a crucial component of working in China – both for U.S. farmers and agribusinesses and for Chinese grain traders, importers and end-users. A collaborative conference held twice each year by JCI, a prominent agricultural intelligence and consulting organization based in China, the U.S. Grains Council (USGC) and the U.S. Soybean Export Council (USSEC) enables these groups to ask questions and provide unique insights related to the grain and oilseed trade.

This spring’s conference was postponed from March to May and moved from an in-person meeting to an online format. Still, it allowed for the flow of information needed to facilitate future business.

“The virtual JCI conference was a well-attended, well-planned webinar that was also very timely,” said Reece Cannady, USGC manager of global trade, who presented during the event. “This year, China is poised to be one of our largest U.S. corn buyers – so talking about the supply, quality and planting prospects for the crop is exciting.”

The Council is an original sponsor of the JCI conferences, which first started in the mid-2000s. Now, the events are the largest feed industry conferences in China. Through these events, the Council continues sharing market and quality information for U.S. corn, sorghum and dried distiller’s grains with solubles (DDGS) with top importers and interacting with key customers about U.S. feed grain supply and quality issues.

“The JCI conferences are a really successful means for the Council to engage with a wide swath of the industry – end-users, traders, feed companies, livestock companies, risk management brokers, foreign exporters and, of course, Chinese importers,” said Bryan Lohmar, USGC director in China.

This year’s virtual conference split the sessions over three mornings to better accommodate international speakers and participants in different time zones. Lohmar estimated that about 120 participants attended each of this year’s sessions.

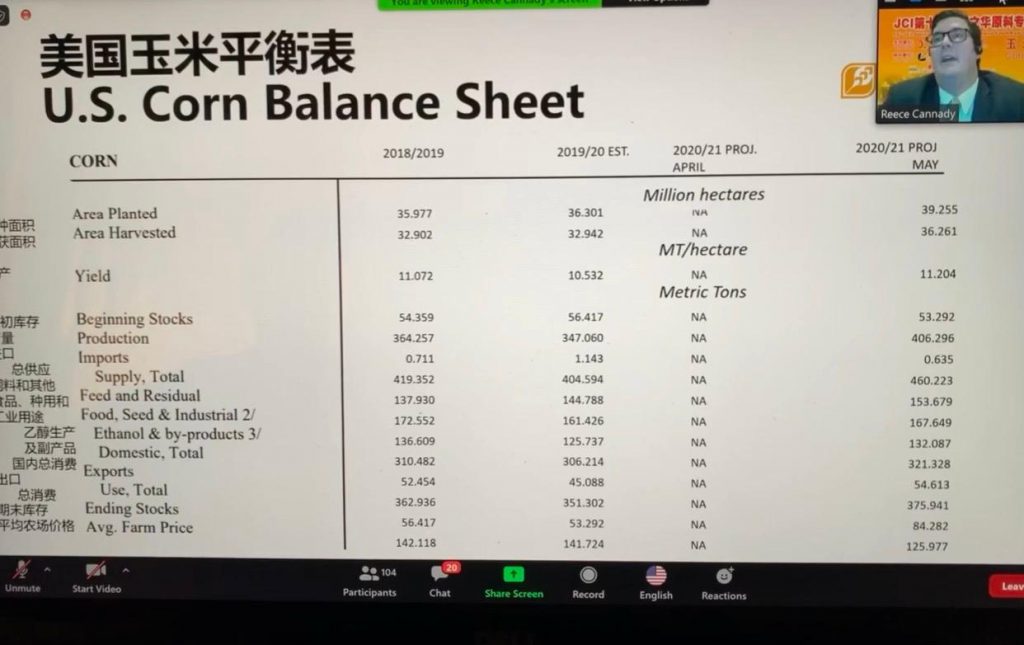

This year’s corn session featured Cannady presenting on U.S. corn production, supply and demand. He and Lohmar also participated in a question-and-answer panel. Questions during both sessions focused on expectations for U.S. corn acreage and how the drop in oil prices and stall in livestock processing would affect what farmers are planting this spring.

The conference also offered Council participants the chance to ask their own questions of Chinese end-users, importers and grain traders regarding feed demand following African Swine Fever (ASF) virus and COVID-19-related shifts in consumer eating patterns, factors that could affect purchases of U.S. corn and sorghum.

In his comments, Lohmar reported Chinese hog prices, while still high, are trending downward, indicating restored inventories after ASF decimated operations in 2019 and providing support for slowly growing demand for feed. The poultry market, which expanded significantly when consumers switched from eating pork to chicken, is vacillating due to the COVID-19 shutdown of the schools, workplace cafeterias and restaurants where chicken is more commonly served instead of being cooked at home. Despite these tumultuous events, demand for feed corn has remained relatively steady, and demand for meat by Chinese consumers is also slowly returning as parts of the country are reopening with restrictions.

“The fact that demand for corn has remained fairly strong this whole time suggests to me that the larger proportion of Chinese producers are using corn and soybean meal feed rations,” Lohmar said. “They are not using substitutes for corn because those alternatives are cheaper; they are using corn because they can trust it as a feed ingredient.”

In light of COVID-19, the Council will continue holding virtual conferences like the JCI conference with Chinese stakeholders and others in the region. Later in May, the Council will assist with a supply and demand seminar for customers in North Asia – a joint initiative involving the Council’s offices in China, Japan, South Korea and Taiwan.

About The U.S. Grains Council

The U.S. Grains Council develops export markets for U.S. barley, corn, sorghum and related products including distiller’s dried grains with solubles (DDGS) and ethanol. With full-time presence in 28 locations, the Council operates programs in more than 50 countries and the European Union. The Council believes exports are vital to global economic development and to U.S. agriculture’s profitability. Detailed information about the Council and its programs is online at www.grains.org.