U.S. corn exports to Colombia have set a new record every year since the U.S.-Colombia Trade Promotion Agreement (TPA) entered into force into 2012, showing the effectiveness of strong trade policy and subsequent market development work to increasing sales of U.S. agricultural products.

“Colombian livestock and feed producers have benefitted from the cost advantages provided by the trade agreement with the United States for their grain needs,” said Marri Tejada, U.S. Grains Council (USGC) regional director for the Western Hemisphere. “Larger imports of U.S. grains and co-products depend on industry growth, higher inclusion rates and further educational activities for end-users.”

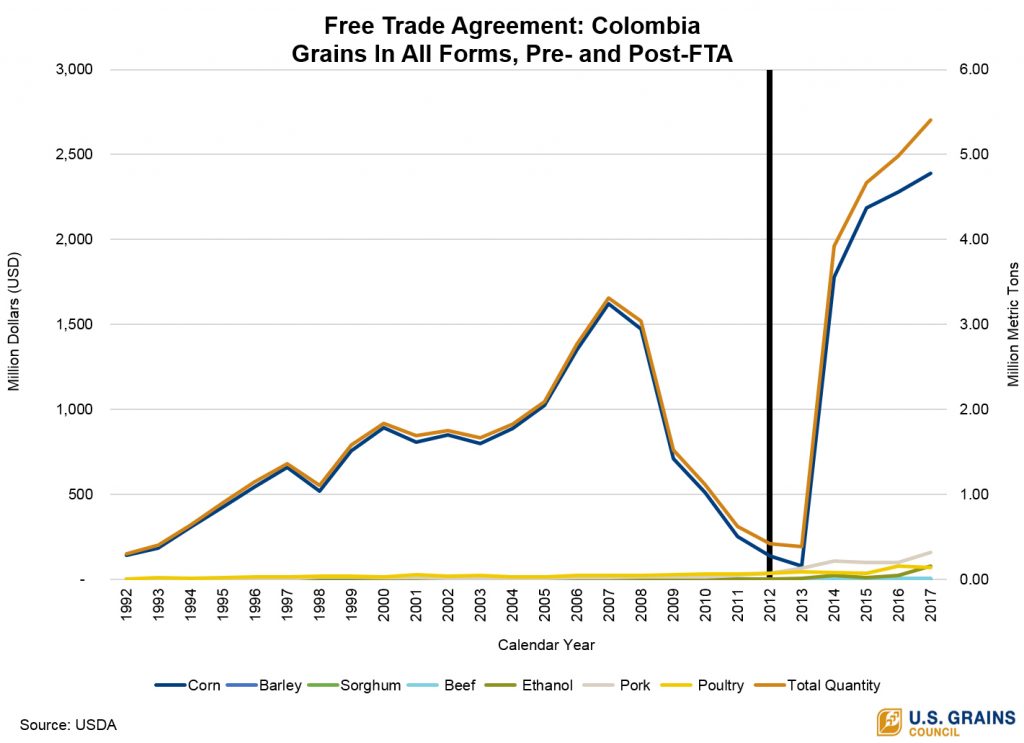

The free trade agreement between Colombia and the United States was signed in 2006, but not put into effect for six more years. During that time, U.S. grain exports decreased due to more favorable duties for competitors.

The Council helped make the case for the agreement’s ratification, which included duty-free access for the first 2.1 million metric tons (82.7 million bushels) of corn imports in addition to a tariff rate quota for U.S. sorghum. Once these preferential terms were in place, the Council worked with buyers who wanted to take advantage of the favorable policy, fueling dramatic growth.

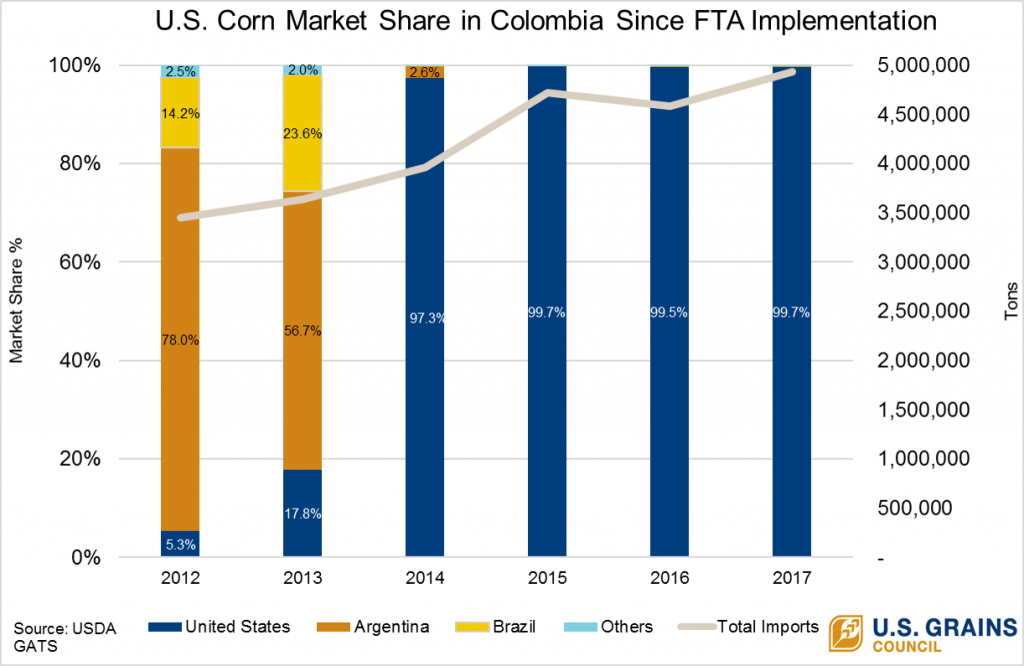

U.S. market share in the Colombian corn market has increased from 5.3 percent in 2012, the year the trade agreement was implemented, to 97.3 percent in 2014 and 99.7 percent in 2017. Colombia imported 4.73 million tons (186 million bushels) of U.S. corn in 2016/2017, ranking as the fourth largest buyer. Eight months into the 2017/2018 marketing year (September 2017-April 2018), Colombia had already imported 4.17 million tons (164 million bushels) of U.S. corn, up eight percent from the same time the prior year and jumping to the third largest buyer for the current marketing year.

USGC’s Outlook Colombia 2030 report projected Colombia corn imports will reach 5.5 million tons (216.5 million bushels) by 2020 and 7.8 million tons (307 million bushels) by 2030, with the majority of that demand met by U.S. producers.

“Even though the market is still price-driven, the competitive conditions favoring the United States and the Council’s marketing programs in the country add value to the industry,” Tejada said. “Working closely with the industry associations and the largest feed and livestock producers in Colombia enhances the Council’s ability to service this market.”

Strong educational programming is a critical component of the Council’s work in Colombia. As part of these efforts, the Council conducted a South American trade school in three Colombian cities in late May to provide information to Latin American livestock and feed producers. Seventy-three participants from 32 companies in Colombia, Peru and Ecuador attended the sessions on risk management, contracts, international freight markets and quality.

“Trade schools offer reliable, transparent and independent information in addition to contributing to the Council’s position as an ally and supporter of the improvement of Colombia’s livestock and feed industries,” Tejada said. “Programs like trade schools help emphasize the U.S. competitive advantage in the country and provide the opportunity for USGC representatives to answer questions and address concerns to facilitate trade with the United States.”

Colombia also represents a burgeoning market for U.S. ethanol, with the Colombian government increasing the national blend mandate to E10 in March 2018.

Colombia has a growing domestic ethanol industry, producing sugar-based ethanol. U.S. ethanol enters Colombia duty free per the terms of the U.S.–Colombia trade agreement, but the government’s current low-carbon fuel standard discriminates against corn-based ethanol. Still, some U.S. refineries can meet the greenhouse gas (GHG) emissions reductions required in the standard.

Despite these challenges, Colombia set a new record for U.S. ethanol imports in 2016/2017, purchasing 13.7 million gallons. Imports in the current marketing year have nearly tripled year-over-year to 28.7 million gallons.

Strong sales of U.S. coarse grains and co-products to Colombia are a testament to the importance of this market and its growth in coming decades. Yet, none of these successes would have been achieved without the preferential access provided by the trade agreement between the United States and Colombia.

“The Colombian industry has established a strong trading relationship with the United States and they want to continue to build on that relationship,” Tejada said. “The trade agreement between the two countries ensures the United States remains a long-term supplier to this highly competitive and growing market.”

Learn more about the Council’s work in Colombia here.

About The U.S. Grains Council

The U.S. Grains Council develops export markets for U.S. barley, corn, sorghum and related products including distiller’s dried grains with solubles (DDGS) and ethanol. With full-time presence in 28 locations, the Council operates programs in more than 50 countries and the European Union. The Council believes exports are vital to global economic development and to U.S. agriculture’s profitability. Detailed information about the Council and its programs is online at www.grains.org.