Supply/Demand Basics

-Feed mill production capacity of 20 MMT, with a utilization of around 90%.

-Poultry and swine feed are the major segments in the Thailand compound feed market, accounting for around 80% of the market in 2019.

-Demand for aquafeed is expected to remain high due to increased modernization in aquaculture and growing demand for seafood.

-3rd largest producer of corn in Southeast Asia; 2023/24 corn production to increase to 5.4 MMT, reflecting an expansion in planting and high farm-gate prices.

Country Overview

-Thailand has one of the lowest official unemployment rates in the world – reported as 0.98% as of August 2023 with headline inflation at 2.5%.

-Second largest economy in Southeast Asia, after Indonesia.

-Heavy export-dependent economy, with exports of goods and services accounting for 66% of GDP.

-2024 GDP growth outlook is raised from 3.8% to 4.4% by the Bank of Thailand.

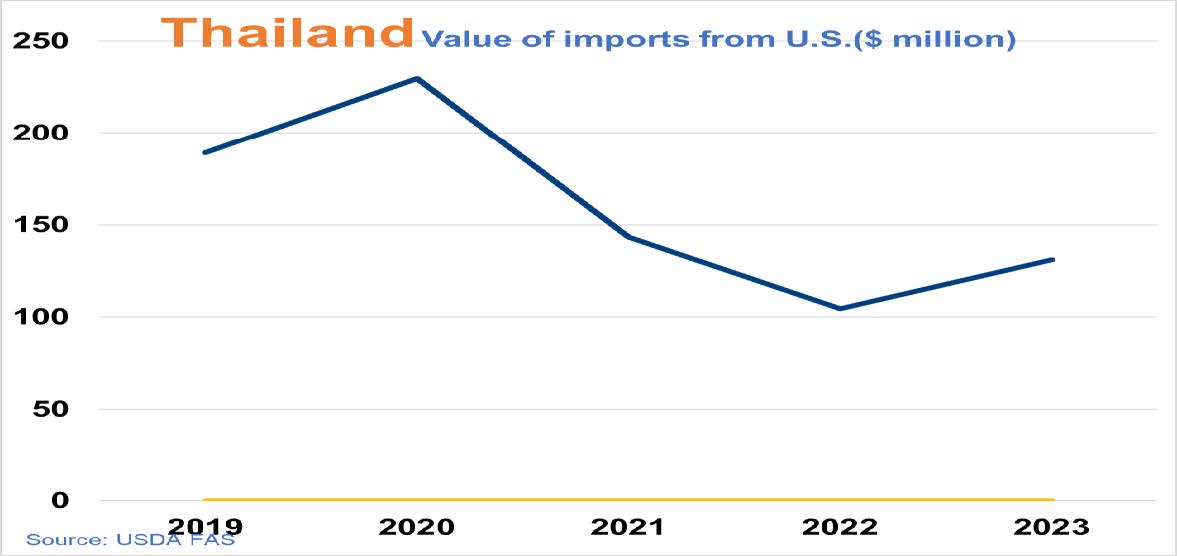

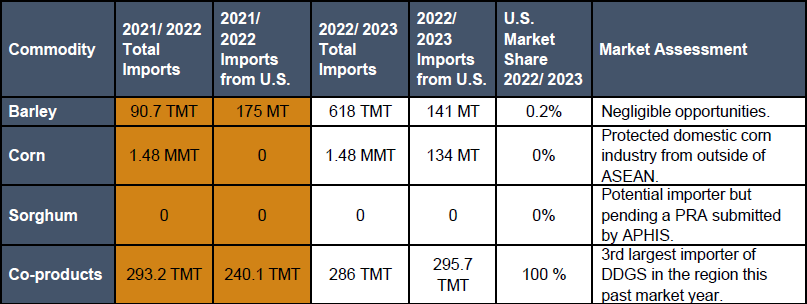

Trade and Market Share Overview

-DDGS imports rebounded 30% to 264 TMT in 2022/23, 3rd largest market in Southeast Asia.

-Fumigation issue has impacted DDGS demand, but fewer red flags encouraged more imports.

-High domestic corn prices are driving an increase in import demand.

-Reliance on EU poultry exports gives buyers concerns over antibiotic residue.

-Feed industry is dominated by large, sophisticated buyers.

-Home to one of the world’s leading feed producers, Charoen Pokphand (CP Group).

-2022/23 feed wheat imports totaled 1.4MMT, up 96% from 2021/22 due to competitive pricing in H1 2023.

Policy Overview

-Trade distorting import tariff differential between DDGS (9%) and SBM (2%).

-54,700 MT corn TRQ with 20% in-quota tariff and 73% out-of-quota tariff.

-Feed mills must buy domestic corn with a ratio of 3-1 for a quota to import wheat.

-Phosphine was accepted by Thailand regulators in April 2021 as an approved fumigation treatment for U.S. DDGS but is being closely monitored.