Supply/Demand Basics

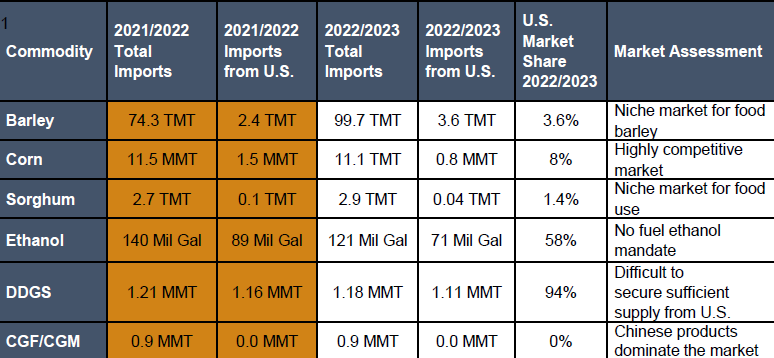

-Coarse grains demand of 14 MMT/ year – 98% imported: 78% for feed, 16% corn milling, 6% alcohol and others

-#6 import market of U.S. corn in MY 2022/2023

-#2 import market of U.S. DDGS in MY 22022/2023.

-#4 import market of U.S. ethanol in MY 2022/2023.

-The livestock industry and compound feed market growing marginally.

Country Overview

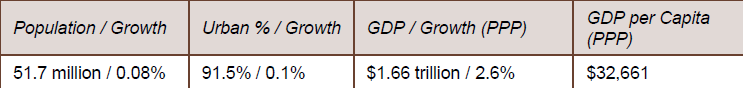

-Asia’s 4th and world’s 13th largest economy.

-Facing sluggish domestic demand, low youth unemployment, falling birth rates, and an aging population.

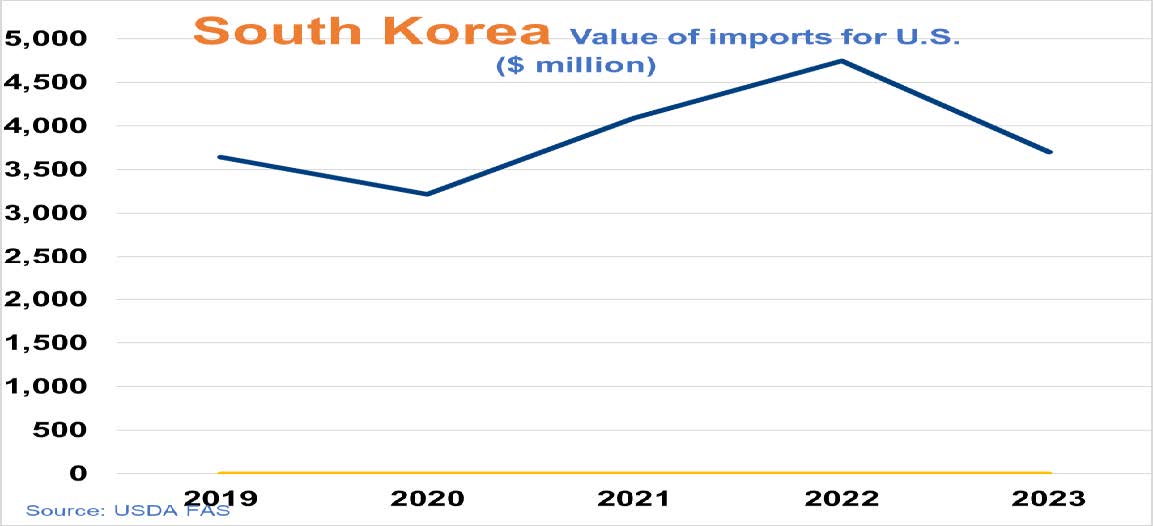

Trade and Market Share Overview

-U.S. corn market share has fallen to its lowestsince 2013 due to weaker price competitiveness.

-The feed industry prefers South American corn even at a $2-3 premium due to BCFM issues.

-Market share of US DDGS declines slightly due to increased imports from Brazil and Australia.

-Due to weakening price competitiveness and decreased consumption of U.S. ethanol, imports decreased significantly.

-U.S. barley Imports increased due to the promotion of U.S. barley’s functionality and health claims.

Policy Overview

-MOTIE promoted the SAF demonstrationproject in 2023, but no progress in the ethanol pilot supply project.

– SAF: Introduce in 2026 through a demonstration project (2023-24)

– Fuel ethanol: Pilot distribution for public vehicles and pilot gas stations (2024-25)

-Through the efforts of the council, the MFDS raised the IT of malathion to 2.0 ppm in 2023, resolving obstacles of U.S. food grade cornexports.

-MOTIE is in the process of revising the LMO Act to exempt low-risk NBT from safety review through the prior review system.