Supply/Demand Basics

-Domestic corn production expected to decline to 8.2 MMT due to typhoons and fall armyworm.

-Region’s 2nd largest producer of corn, with 60% yellow and 40% white.

-Feed mill production capacity of 18.5 MMT, with utilization of around 90%.

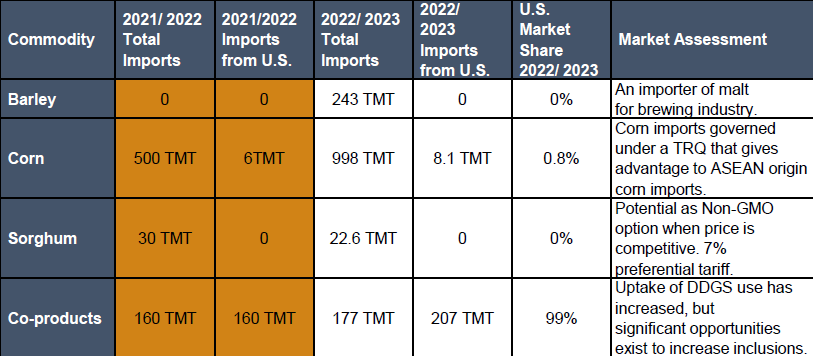

-DDGS imports increased 33% in MY 2022/23 vs previous MY; wheat imports down 18%.

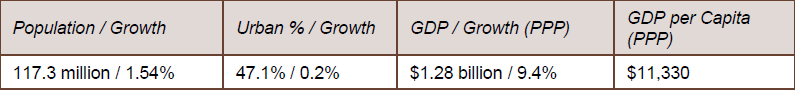

Country Overview

-A complex archipelago with over 7,000 islands.

-One of the fastest-growing populations in Southeast Asia.

-GDP growth forecasted at 6.2% for 2024.

-Sticky inflation of 6.1% in Q4 2023 pressured the government to rein in price increases.

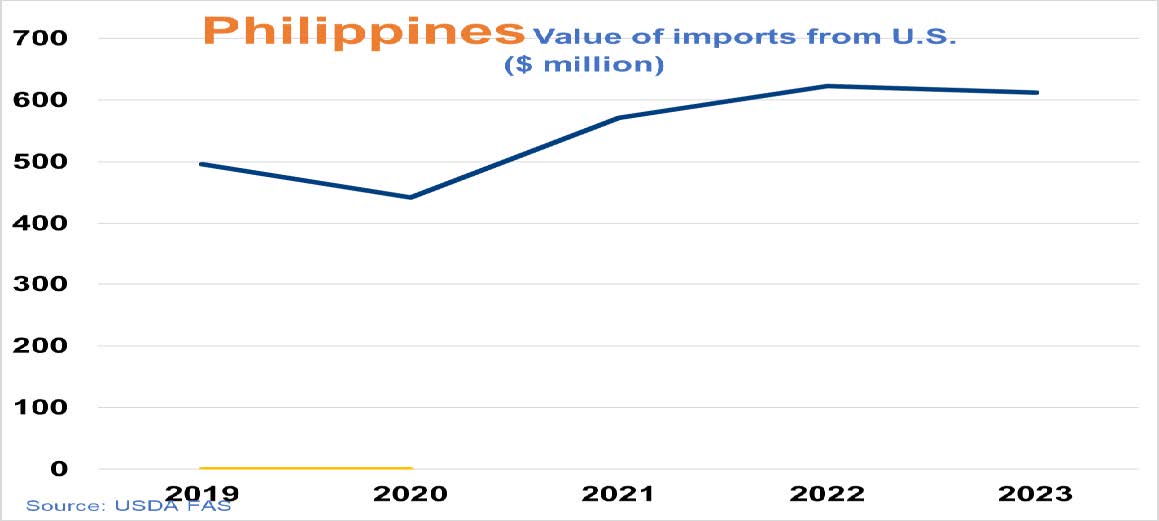

Trade and Market Share Overview

-Corn gained an advantage over feed wheat in MY 2022/2023 due to lower prices coupled with the Philippines feed industry’s strong preference for corn.

-Corn import is expected to increase to 1MMT in 2023/24 due to favorable pricing and low local supply.

-Major U.S. ethanol importer (9th largest market in 2022).

-End users preferimported corn due to lower mycotoxin content.

-4th largest U.S. DDGS importer in Southeast Asia; alternative to higher-priced local corn and SBM.

Policy Overview

- -All imports with GMO events must have a biosafety certificate.

-Effective and strong ethanol blending mandate at 10%; discretionary E20 policy being drafted.

-Non-ASEAN corn import tariff cut to 5-15% from 35-55% (IN MAV-OUT MAV) through 2023 and extended until the end of 2024.

-Asian Economic Community (AEC) countries will have a 5% corn import duty.