Supply/Demand Basics

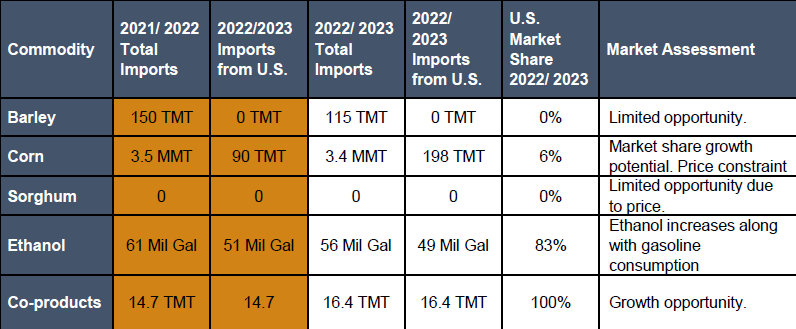

-Peru used to be a top 10 export destination for U.S. corn. However, MY 2022/2023 only captured a 6% market share. The U.S. lost its market share against Argentinian-origin corn.

-The Council has resumed discussions around increasing ethanol rates above 7.8% with refineries.

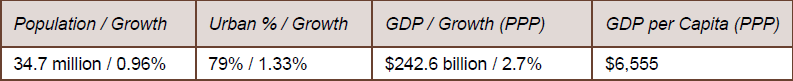

Country Overview

In 2023, GDP contracted by 0.5 percent due to political uncertainty and social unrest. Tighter financial conditions also contributed to depressed private spending and the country showed a slower-than-expected recovery, especially in key sectors such as agriculture, fisheries, and tourism. The country continues to face significant threats to achieving greater development and prosperity: the impact of climate change, persistent inequalities, and its economic structure dependent on its natural resources. Unaddressed structural constraints limit formal job creation, economic diversification, and the pace of poverty and inequality reduction.

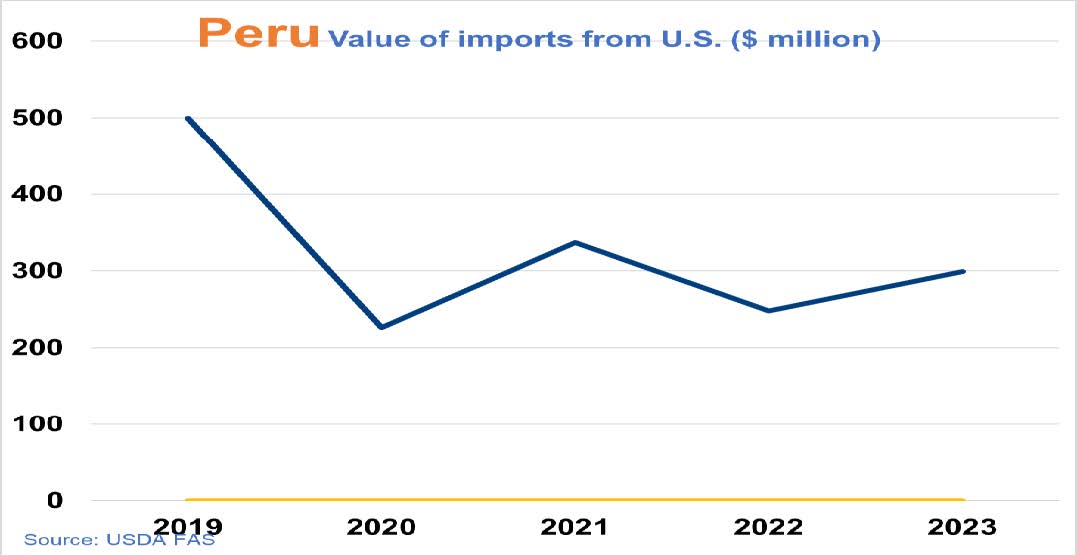

Trade and Market Share Overview

-All corn coming in from the U.S. is tariff-free. Since 2020, Argentinian corn has been priced more competitively than that of U.S. origin. This situation limited logistics in bulk vessels from the U.S., affecting DDGS imports.

-Fuel ethanol imports are mainly from the U.S. because domestic industry diverted most of its sales to the E.U. market. Imports increased 10% in 2023 (51 million gallons Jan/Nov) due to increased light vehicle ownership

Policy Overview

-There are no pressing issues related to feed grains or co-products trade.

-Unstable political situation has affected the discussion around the ethanol rate increase.