Supply/Demand Basics

- Local corn production is estimated at 10.5 MMT with 7.7 MMT going to the poultry sector.

- Poultry is the country’s second largest industry, and the local crop anchored increased corn consumption for the poultry sector in 2023. Nearly 95% of the chicken is sold in the wet market. Per capita consumption of chicken is 7.5 kg and eggs at 3.6 kg per year.

- Imports of raw materials (corn/DDGS and SBM) face high duties and a GM ban.

- Livestock feed is primarily used in the informal sector and is highly inefficient. Estimates put the informal feed market at almost 95% of the total demand.

Country Overview

- Pakistan is facing significant economic challenges due to its weak, unbalanced economy. The country has received a bailout package from the International Monetary Fund.

- Pakistan’s currency was the fourth-worst performing currency in 2023, devaluing 58.7% against the USD.

- Almost 36% of the population is below the poverty line, and unemployment is rapidly rising.

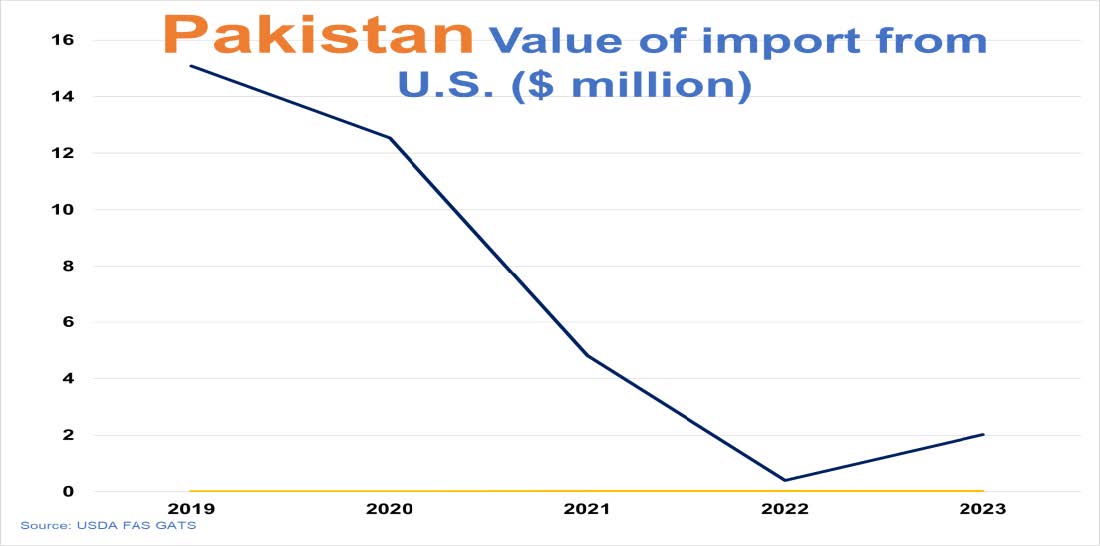

Trade and Market Share Overview

- Pakistan exports about 90 percent of their molasses-based ethanol to the European market for potable use at a premium. No incentive to produce fuel grade ethanol yet.

- Pakistan is a major importer of energy, with petroleum imports valued at $17.5 million.

- Pakistan exports corn to Sri Lanka, Southeast Asia, and the Middle East. On the high end, this total can reach as high as 800 TMT.

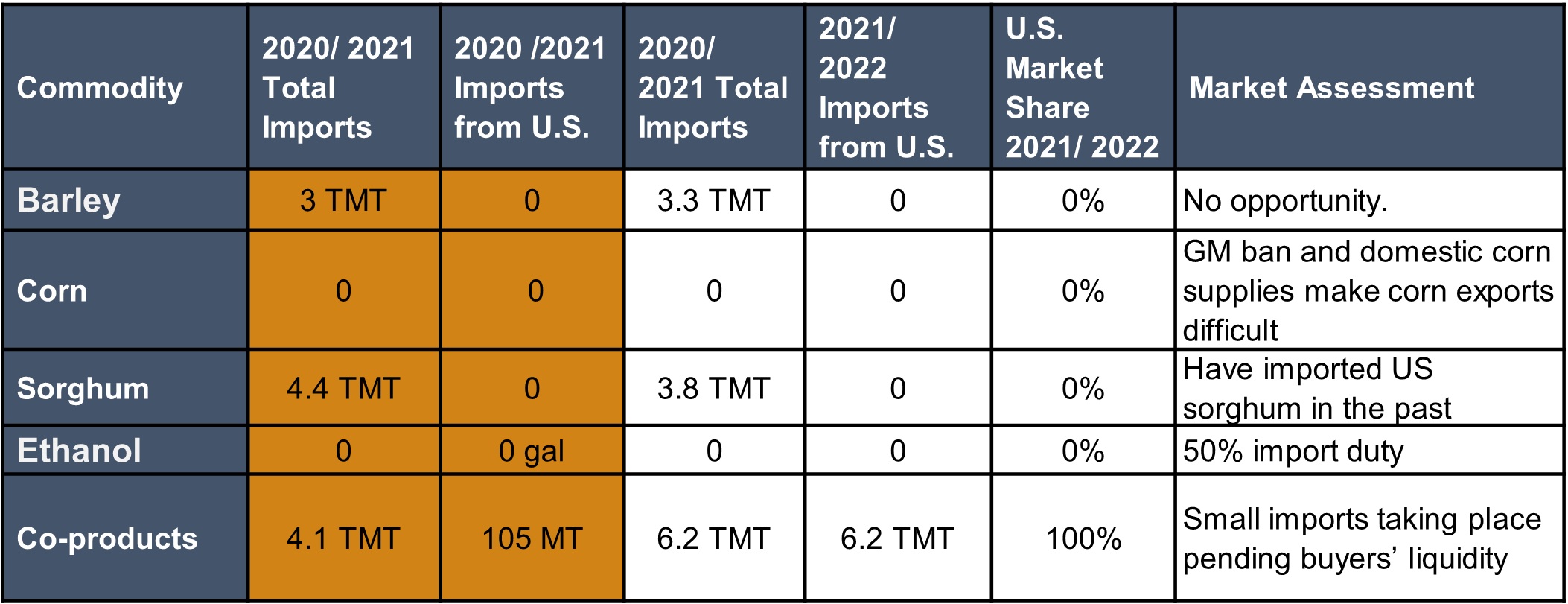

- Barley, sorghum and U.S. DDGS, are imported when required and feasibility permits. This is not anticipated in the coming years; although, droughts caused by El Niño could change that.

Policy Overview

- Pakistan has a ban on GM corn.

- Pakistan’s business environment is difficult – but ranks well above others at 108 on the World Bank’s Ease of Doing Business Index.