Supply/Demand Basics

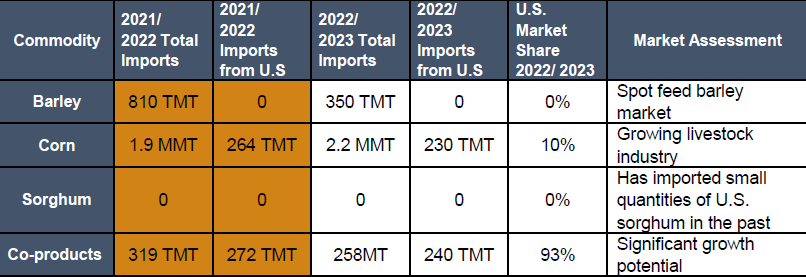

-Corn import in Morocco returned to a normal level of 2.2 MMT in MY 2022/2023 compared to 1.9 MMT the previous year, thanks to the recovery of the poultry industry.

-Barley imports fluctuate from year to year depending on rainfall.

-Poultry farming activity rebounded in Morocco, as corn import prices decreased by 30%.

Country Overview

-The Moroccan economy recovered in 2023 from negative shocks in 2022 that have halted the rapid rebound after the pandemic. The growth in 2023 is supported by the rebound of the tourism sector, and the positive contribution of net exports.

-Drought in Morocco severely impacted agricultural production and employment, causing a significant 80% decrease in production.

-Political stability and no security issues compared to neighboring countries in the east and the south. Potential to be a conduit for trade to West African countries.

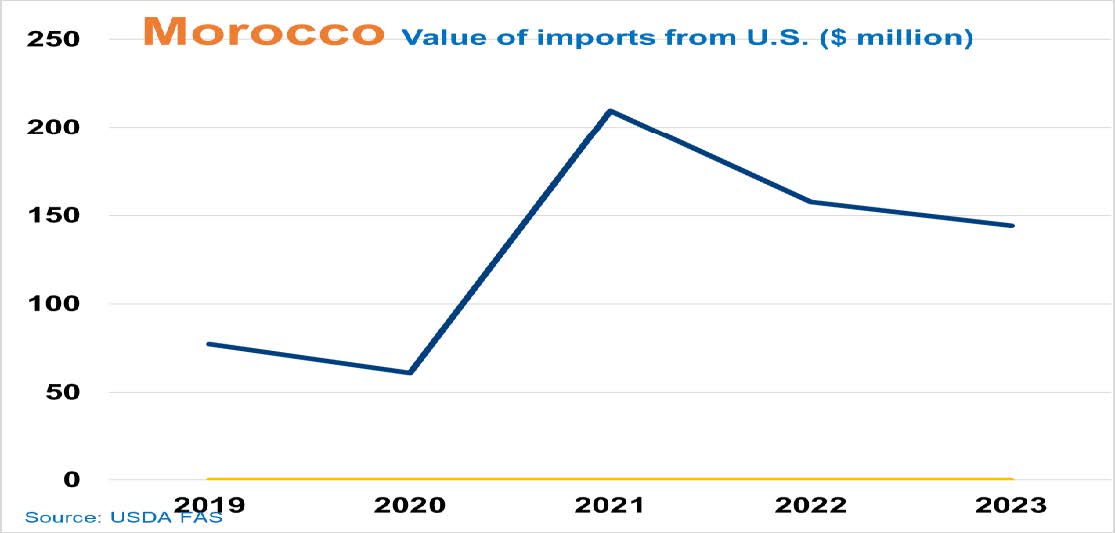

Trade and Market Share Overview

-Brazilian corn import to Morocco was ranked first in 2023 with 1.1 MMT followed by Argentina corn with 730 TMT, while the U.S. comes third with a 10% market share.

-The EU was the only exporter of barley to Morocco in MY 2022/2023.

-The U.S. is the leading supplier of corn co-products to Morocco with a 93% market share, followed by Argentina with 7%.

-Poultry and dairy sectors are the main consumers of imported corn.

Policy Overview

-The U.S.-Morocco FTA provides the advantage of no tariff on corn and other feed products, compared to a 2.5% tariff applied to other export origins.