Supply/Demand Basics

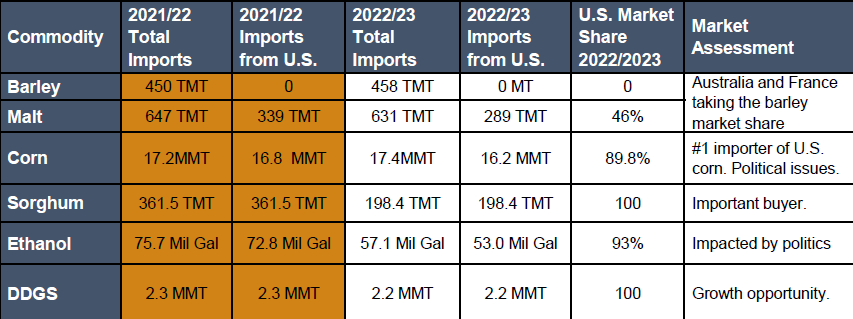

-Feed industry growth is the main demand driver for grains and co-products.

-#1 importer of U.S. corn (white and yellow 16.2 MMT).

-#1 DDGS market with imports of 2.2 MMT. #1 importer of U.S. barley and barley malt with imports of 253 TMT.

-U.S. sorghum imports decreased, from 361.5 TMT to 198.4 TMT.

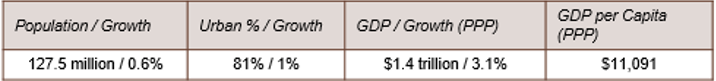

Country Overview

-U.S. Mexico & Canada committed to a more collaborative and competitive North America in their trilateral January 2023 meeting. Together the three nations generate 1/3 of the global GDP.

-Immigration remains a critical sticking point throughout 2023, culminating in an unprecedented closure of 2 railways at Eagle Pass and El Paso, points that account for 45% of bilateral trade.

-As of 2022, The U.S. requested dispute settlement consultations under USMCA due to the undoing of 2013 energy liberation reforms and allowed State monopolies: Pemex and CFE to regain control.

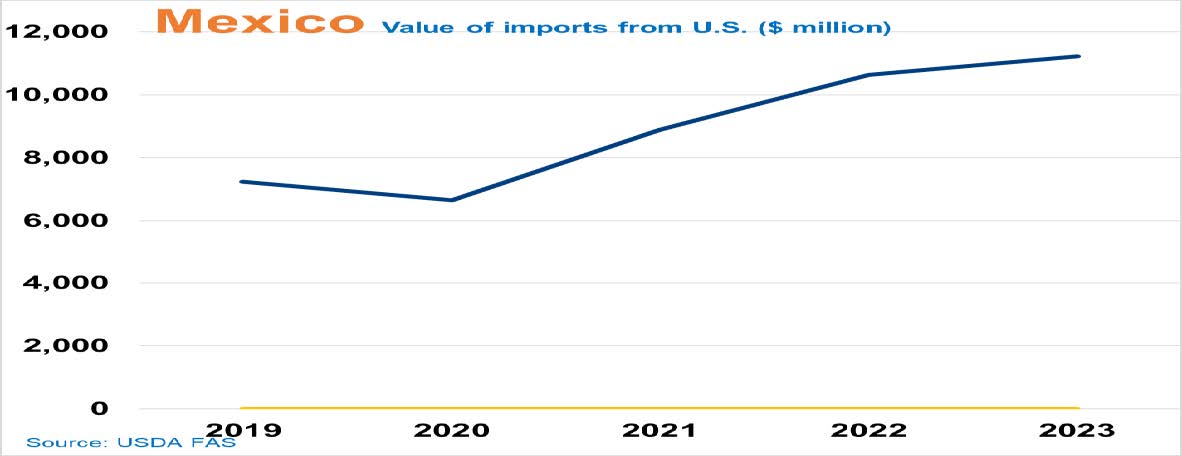

Trade and Market Share Overview

-U.S. market share for corn is 89.8%

-Due to the imposition of a 50% tariff for exports in January 2023, Mexico only exported 74 TMT of white corn, mainly to the United States (22 TMT), Honduras (14 TMT), El Salvador (14 TMT) and Guatemala (9 TMT).

-The world’s 5th largest compound feed industry running at 88.8% percent capacity and expanding at 3.6% annually.

Policy Overview

-US – Mexico – Canada (USMCA) ratified and into action on July 1, 2020.

-The dispute settlement consultations are ongoing 17 months later. The U.S. so far has decided against requesting the establishment of a dispute settlement panel to deal with the matter

-The Energy Commission (CRE) delays the opportunity for ethanol imports due to a court ruling prohibiting blending outside 3 major cities. The rest of the country is capped at 5.8%.

-On December 31, 2020, Lopez Obrador signed a decree eliminating the use of glyphosate and GE corn for human consumption by 2024.

-On February 13, 2023, Mexico published a modified decree abrogating the 2020 decree and narrowing its focus on biotech corn use in tortilla production destined for human consumption

-On August17, 2023 USTR requested a dispute settlement panel challenging the measures concerning biotech corn