Supply/Demand Basics

- India exported 3.3 MMT of corn in 2022/2023.

- Corn supplies, which were expected to hit a shortfall by 2026 due to the ethanol blending program will likely be realized in 2024, as more corn is diverted to ethanol to ensure stable sugar prices.

- Poultry feed demand has been growing by 7 to 8% over the past few years, and 20 MMT of corn went to poultry feed in 2023.

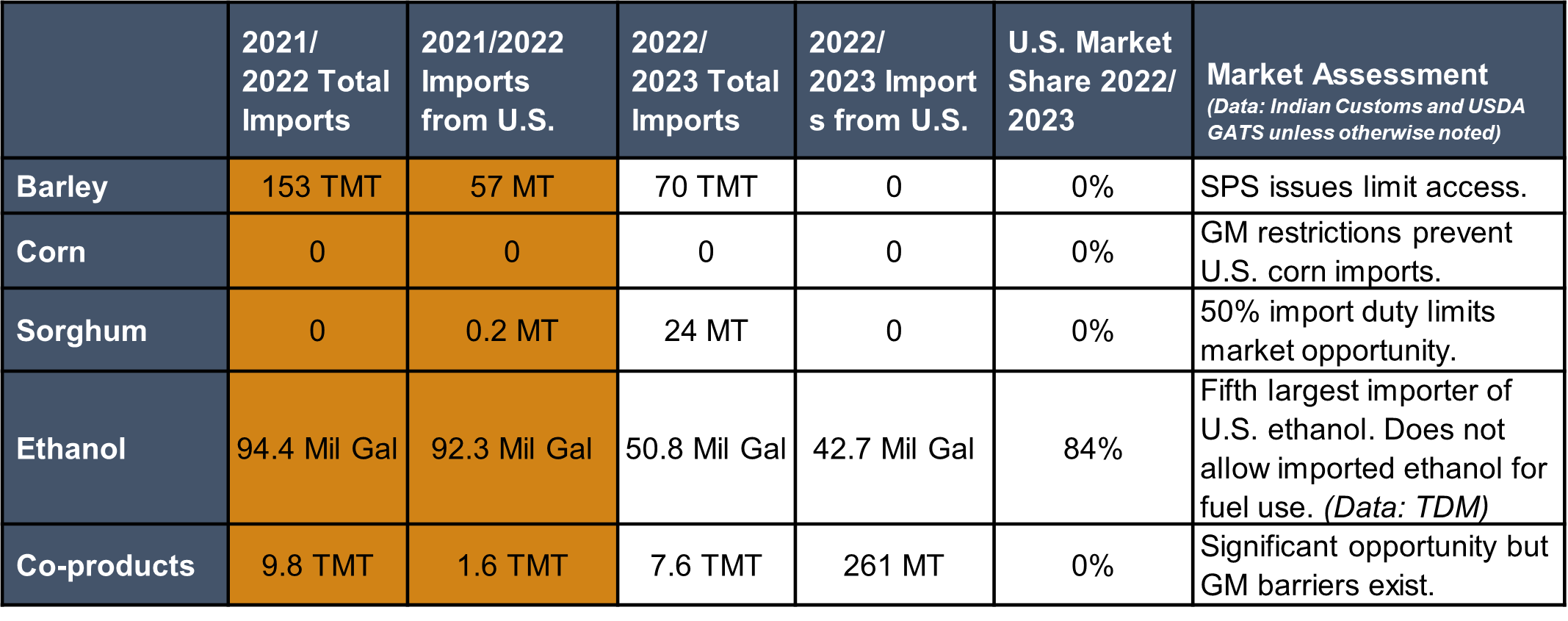

- 153 TMT imports of barley in 2023/2024 for malt to fulfill the demand for malt beverages and beer.

- Industrial chemical sector is expected to grow by 10% per year and move to green chemicals in near future, pending feedstock availability.

Country Overview

- US-India trade policy remains unsettled without the restoration of GSP. This will be a focus for India in 2024 after the April/May 2024 national elections.

- Focus on biofuels remains and investments focus on making biofuels from grains, 131 new projects are coming online, which would need 9 MMT of grains, which India does not have.

- India founded the Global Biofuels Alliance with the U.S., Brazil, and seven other nations.

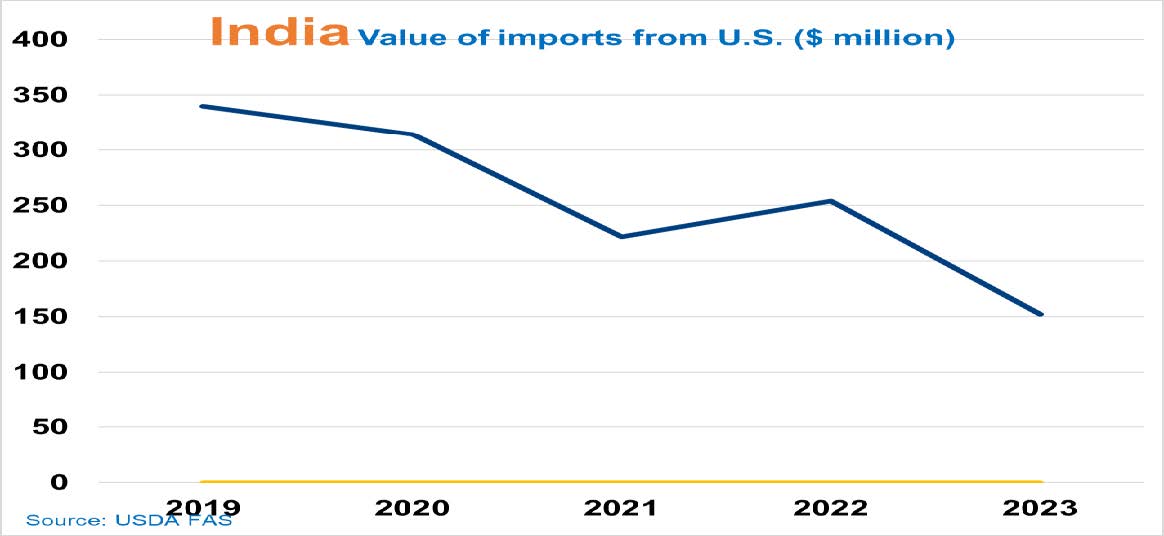

Trade and Market Share Overview

- Usually a top five ethanol market, India remains an importer of U.S. ethanol.

- In 2023, the national average blend rate was 11.72%, against the GOI target of 12%.

- GOI is has advanced the E20 blend mandate to 2025/2026, despite being unable to import fuel ethanol and a lack of feedstocks to achieve their goal. Without action, blending rates are expected to fall to under 10% in 2024.

- The government’s announcement to use grains for ethanol production is pushing the starch and feed industries to look for imported corn.

- Sustainable aviation fuel mandates are at 1% by 2027 and will move up to 20-30% in the future.

Policy Overview

- India does not allow the use of GM seeds in any crop, except cotton. Due to looming feedstock shortages, the feed, starch, and ethanol industries have been asking for a ban on exports of corn, lowering corn tariffs, and GM corn market access for both sowing and import.

- GM Mustard for planting has been allowed by GEAC and is pending a final nod from the court. GOI is keen that Mustard and other GM crops should see the light of day. CRISPR technology is not part of the GM law.