Supply/Demand Basics

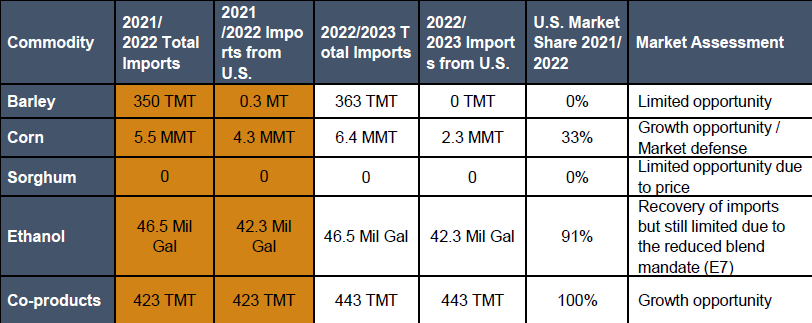

-#4 export market for U.S. corn in MY 2022/2023.

-#9 export market for DDGS. 100 percent U.S. market share. 2023 was a record year for DDGS.

-#8 export market for U.S. ethanol in MY2022/2023. In 2023, Colombia’s six sugar mills produced 320 million liters of ethanol annually, marking a 9% reduction compared to 2022.

Country Overview

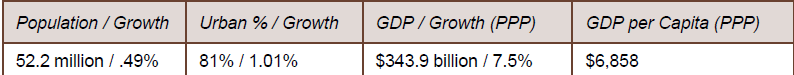

Colombia’s economy has recovered remarkably well from the COVID-19 crisis, and strong fiscal and monetary policy support have averted a stronger contraction of incomes. Solid macroeconomic policy frameworks are laying the grounds for a continuous recovery of domestic demand, although the sustainability of fiscal accounts will require further action. In a longer view, however, both growth and social inclusion are trapped by weak structural policy settings that preclude more than half of income earners from formal jobs and social protection, while preventing firms from growing and becoming more productive. Solving this vicious circle through ambitious reforms would allow a significant leap forward for material well-being in Colombia.

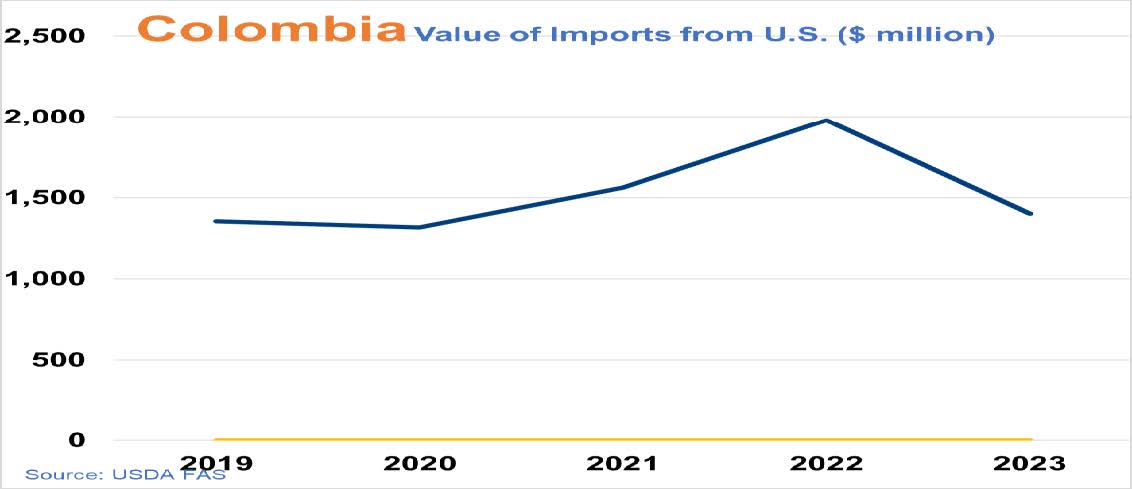

Trade and Market Share Overview

-U.S.-Colombia FTA. U.S. corn and sorghum TRQs phased out on January 1, 2023.

-The Colombia 2040 study updated in 2021 estimates the country will demand 8.7 MMT of corn in 2030, of which around 7.2 MMT will be imported corn, and 9.4 MMT in 2040, of which around 7.8 MMT will be imported.In 2023, South America was more competitive in the second half of the year, with Brazil taking the largest share.

-During 2023, the Colombian Ministry of Mines and Energy continued adjusting the monthly ethanol blend rate due to the local industry’s inability to supply E10. The rate fluctuated between 3% and 7%. It is anticipated to increase to E10 in February 2024.

Policy Overview

-Colombia’s domestic corn industry continues to pose policy threats against US corn. Colombia’s President Petro’s campaign promise included helping domestic corn farmers by blocking corn imports.

-Despite the Colombian Government’s decision in March 2023 to extend the countervailing duty (CVD) on U.S. ethanol for an additional five years (with a review period in 2025/26), U.S. ethanol exports to Colombia saw significant growth, exceeding 42 million gallons in MY 2022/2023.