Supply/Demand Basics

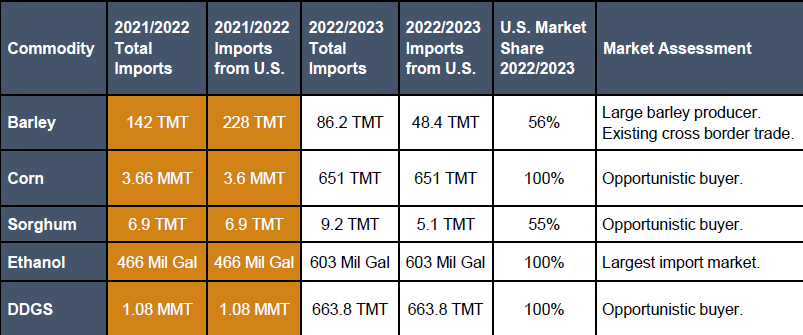

-#8 export market destination for U.S. corn, importing over 651 TMT in MY 2022/2023.

-#5 export destination market for U.S. DDGS, importing 663 TMT in MY 2022/2023.

-#1 export destination import market for U.S. ethanol, importing 603 million gallons in MY 2022/2023.

Country Overview

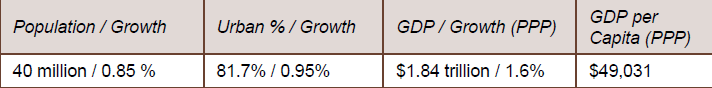

-Canada resembles the U.S. in its market-oriented economic system, pattern of production, and high living standards.

-The livestock sector in Canada is large and well-developed. Around 2.26 MMT of pork were produced in Canada in 2022 and approximately 1.36 MMT of pork were exported that year.

-In 2022, Canada produced around 1.38 MMT of beef and exported almost 597 TMT that year. The United States accounted for 77.5% of Canadian beef exports.

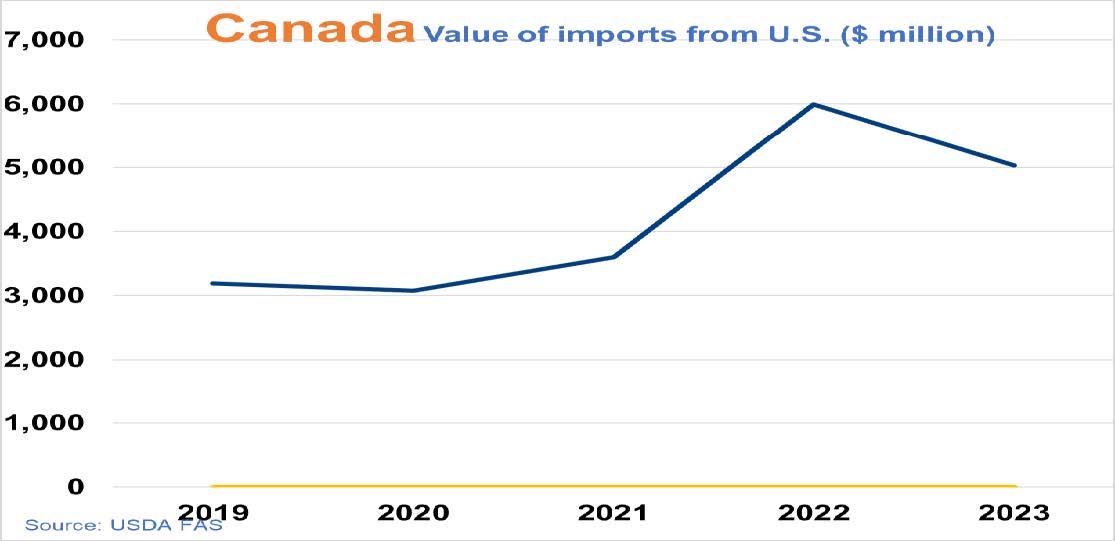

Trade and Market Share Overview

-In 2022, Canada remained a top export market for U.S. agricultural exports, totaling $28.3 billion, accounting for nearly 15% of total U.S. agricultural exports.

-In 2022, the United States imported just over $37 billion worth of agricultural products from Canada.

-Canada is a top market for U.S. ethanol. It is the #4 export market for U.S. feed grains in all forms with a value of $6.3 billion.

Policy Overview

-The first dispute settlement panel under the USMCA was brought against Canada, which was found guilty of violating the agreement by reserving most of its dairy tariff-rate quota for the exclusive use of Canadian processors. This decision sets the stage for regulation of the trade agreement.