Supply/Demand Basics

- World’s fifth largest market in fish production and 3rd largest freshwater fish producer, growing at 8%. Feed use is not widely adopted, and the industry will need coaching to continue growth.

- Total feed production is estimated at 7 MMT, with the poultry sector leading the way at 4.5 MMT. Egg consumption is scheduled to double over a 20-year period, from 104 in 2020 to 208 in 2041. The aqua sector uses an estimated 1.6 MMT of feed, with room to grow.

- Demand for feed ingredients continues to increase. Bangladesh is a major importer in South Asia.

Country Overview

- Bangladesh is the most densely populated country in the world and is also one of the most vulnerable to climate change.

- Despite significant devastation during COVID-19, Bangladesh’s economic recovery is good. Some red flags are raised as the supply chain is affected and food inflation is high, increased forex outflow due to high energy prices.

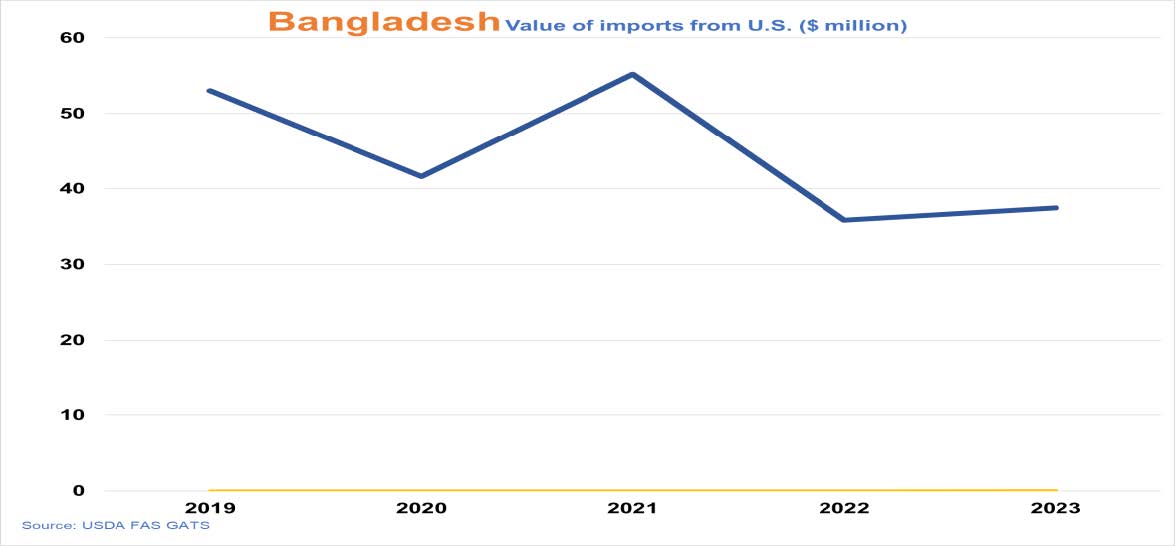

Trade and Market Share Overview

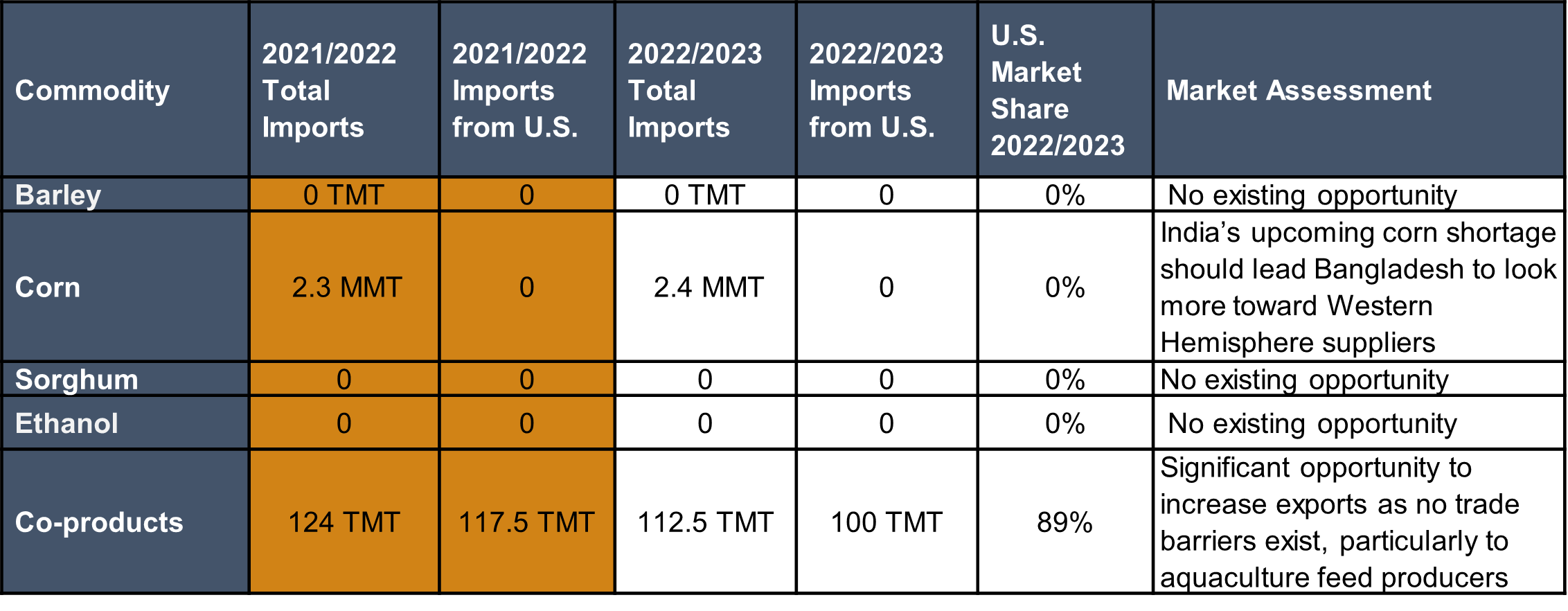

- Financing has historically been an issue, but the situation has improved during 2023, and buyers have recently been more active in purchasing U.S. DDGS.

- Government does not impose import tariffs on any feed ingredients.

- Total corn imports in 2023 were 2.4 MMT, of which 1.8 MMT was from India. Bangladesh has also been buying Brazilian corn, which is their preference.

- Port and storage infrastructure is insufficient and in poor condition. New projects have been announced.

Policy Overview

- The only country in the region with no tariffs on feed ingredient imports.

- Industry continues to push suppliers for bulk shipments into Chittagong. New ports are being setup in special economic zones, and Bangladesh is seeking foreign investment.

- Foreign investment from China has largely been shunned by the Bangladeshi government.

- The country is trying to lower its trade deficit by focusing on high-value agricultural exports, particularly fish.