Supply/Demand Basics

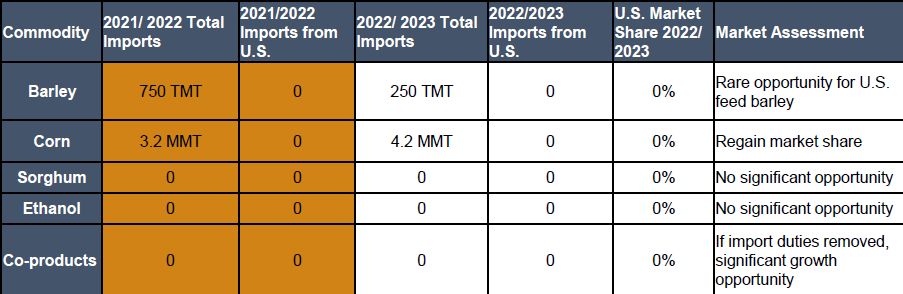

Corn imports raise by 20% to 4.2 when compared to previous year but still down from 5 MMT imported before Covid-19, as poultry industry did not recover yet.

Barley imports fluctuate depending on local production and rainfall; in MY 2022/23 Algeria imported 250 TMT down from the 750 TMT imported the previous year.

No imports of corn co-products, primarily due to import duties.

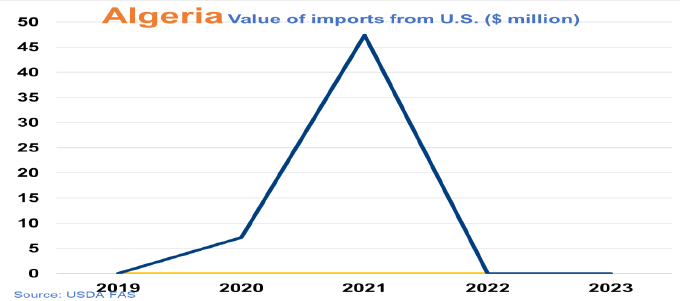

U.S. corn import remain zero compared to 181 TMT imported in MY 2020/21 due to competition from South America.

Country Overview

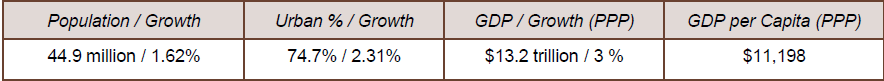

State-dominated economy with restrictions on imports and foreign investment.

Hydrocarbon production and export revenues remain central in the country’s economy, generating about 70% of total budget receipts.

Algeria aspires to diversify its economy to vary the country’s sources of revenues and improve employment prospects, particularly for young people.

Trade and Market Share Overview

Corn used by the Algerian feed industry was imported from South America: Argentinian corn had a 58% market share while Brazil had 41% followed by Romania with 1%.

Most of the corn is used for on-farm feed mixing.

April 5, 2023, grain importers must obtain an import permit from the Ministry of Agriculture, to purchase abroad corn and soybean meal.

Few import permits were delivered to private importers leading to the import of Brazilian frozen chickens, to stabilize local chicken prices that reached $4.5 per kilo., Brazil had 41%.

Policy Overview

On April 1st, 2021, the Algerian government removed the VAT on all feed ingredients to reduce feed prices.

After setting up a grain permit license earlier in 2023, the government of Algeria decided on November 2023 to step back from its previous decision.

The duties on DDGS and corn gluten feed (CGF) are set at 30% and 19% respectively with no VAT, while the duties on corn and soybean meal are only 5%, making corn co-products less competitive with soybean meal and other feed ingredients.