Chicago Board of Trade Market News

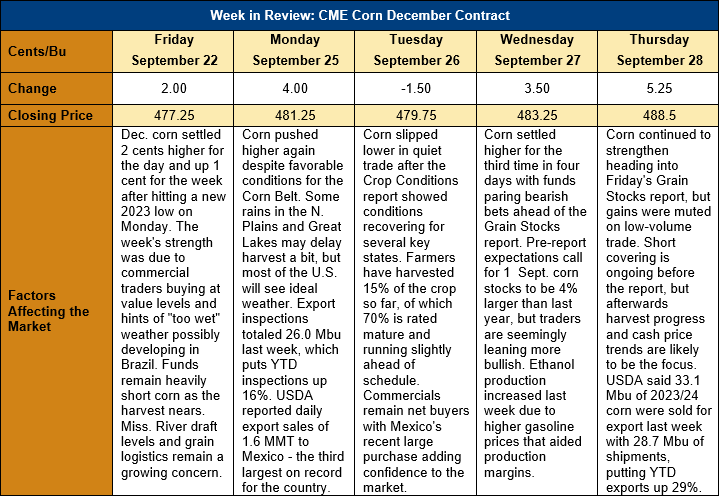

Outlook: Corn futures are 11 ¼ cents (2.4 percent) higher this week as the market has steadily strengthened on a stream of positive news. The week started off with the daily export sales announcement of 1.66 MMT of corn sold to Mexico – the third largest sale to Mexico in recorded history – and ended with a strong Export Sales report. Note that the daily sale to Mexico included 1.049 MMT of corn for 2023/24 delivery and the balance (0.611 MMT) for 2024/25 delivery. Support has also come from the fact that commercial traders now net long corn futures and options after weeks of value buying. The week’s rally is interesting, however, as the quarterly Grain Stocks report (to be issued Friday during the U.S. trading day) is expected to show larger U.S. corn stocks compared to last year.

The coming Grain Stocks report, which will estimate grain on-hand as of 1 September 2023, is expected to show U.S. corn stocks up 4 percent from 2022. Pre-report estimates average 36.4 MMT (1.433 billion bushels) and range from a low of 33.53 MMT (1.32 billion bushels) to a high of 37.77 MMT (1.487 billion bushels). The report will effectively set the USDA’s estimate for 2022/23 ending stocks and 2023/24 carry-in for the October WASDE report.

U.S. corn exports are starting to pick up four weeks into the 2023/24 marketing year. In addition to the large daily sale to Mexico reported on Monday, USDA’s Thursday Export Sales report found 0.926 MMT of gross export sales for the week and a 48 percent weekly increase in net sales. Exports were up 21 percent from the prior week at 0.73 MMT and put YTD shipments up 29 percent. YTD bookings (exports plus unshipped sales) total 12.568 MMT so far and are down 3 percent.

The U.S. corn crop continues to head into the final stages of development and USDA said 70 percent of the crop was mature in its Sunday report. U.S. farmers have harvested 15 percent of the crop so far, which is slightly ahead of the five-year average. Except for a few showers in the Northern Plains and northeastern Corn Belt, the weather outlook remains favorable for the final stages of maturation and harvest. Corn conditions ratings improved 2 percentage points last week to 53 percent good/excellent, with significant improvement noted in several key producing states including Illinois and Iowa.

The weekly Commitments of Traders data from the Commodity Futures Trading Commission showed two interesting trends in last Friday’s release. The first is that funds are heavily short corn and hold their largest short position for late-September in at least the past five years. The second, and the near opposite of funds’ position, is that commercial traders have dramatically pared back short futures bets and now hold a net long combined futures and options position. The latter fact points to commercials becoming more aggressive buyers with corn near its 2023 lows and “value buying” has become a frequent discussion point in market chatter. With commercials turning into more aggressive buyers, one has to wonder if the corn market lows set on 19 September might be the seasonal lows. If correct, that would imply a steady/higher outlook for corn heading into 2024.