Chicago Board of Trade Market News

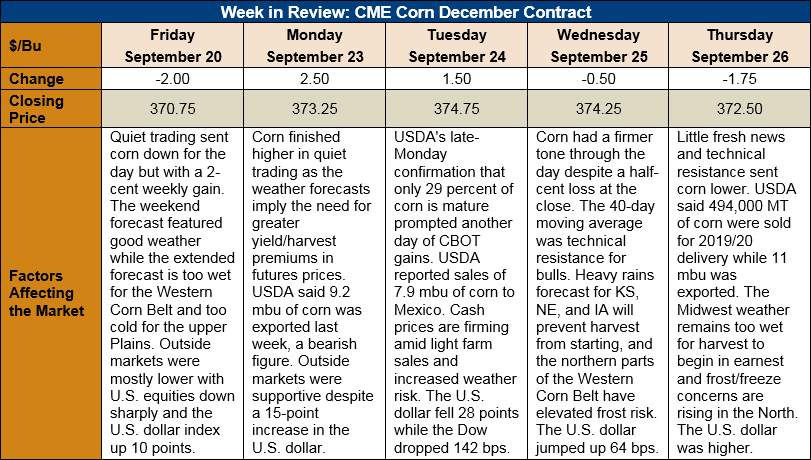

Outlook: December corn futures are 1 ¾ cents (0.5 percent) higher this week after down days on Wednesday and Thursday erased some of the early week gains. There is simply little fresh news for the corn market except continual weather forecast updates and the weekly export statistics. With harvest still not begun in earnest, the futures market is keeping a small risk premium in corn prices, but the USDA’s latest ending stocks/use estimate for 2019/20 is keeping upside potential in check. The major trend for corn futures seems to be sideways until further notice.

USDA’s latest Export Sales report recorded 494,000 MT of net sales and 278,900 MT of exports. While still very early in the marketing year, YTD bookings are down 50 percent. Other Export Sales highlights include 66,000 MT of sorghum net sales, 400 MT of sorghum exports, and 700 MT of barley shipments. YTD bookings for sorghum and barley are up 106 and 7 percent, respectively.

Cash prices are higher this week with the average price across the U.S. reaching $141.25/MT. Barge CIF NOLA values are 2 percent lower while FOB NOLA prices are slightly lower at $163.50/MT for October delivery. Technically, the trends are steady/firmer for interior cash prices and lower for export-oriented prices as exporters work to remain competitive on the world market.

From a technical standpoint, December corn posted a solid 20-cent move higher during September, and the present contract low is likely the seasonal low for the year as well. The weather continues to command additional yield/harvest premium in futures prices, but bulls are finding it difficult to overcome technical resistance at the 40-day moving average without solidly bullish news. Managed money funds are still heavily net short corn, which will keep the market under some pressure.