Chicago Board of Trade Market News

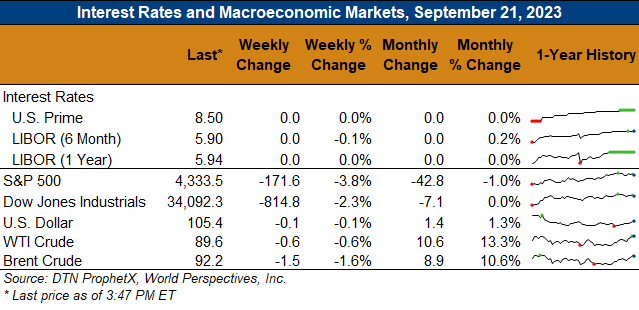

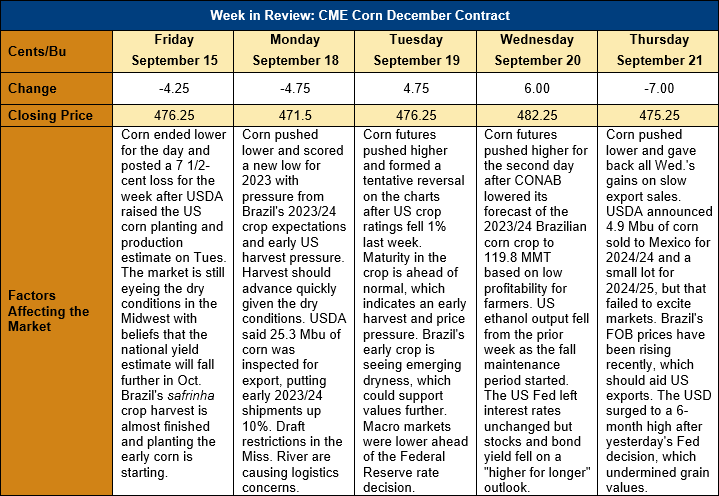

Outlook: Corn futures are 1 cent lower (0.2 percent) than last Friday’s close and just 3 cents (0.6 percent) below the last Market Perspectives report from 31 August. To state the obvious, the market has been range-bound over the last three weeks with even the mildly bearish WASDE unable to exert much influence. While the WASDE’s surprise increase in U.S. acreage was bearish corn, the market remained concerned about yield variability and further possible cuts to the national estimate, which supported values. Typically, harvest pressure influences corn prices this time of year, but until combines start rolling and a better yield picture emerges, it looks like futures will struggle to move lower.

Perhaps the biggest surprise in last week’s September WASDE report was the upward revision of U.S. planted acres. USDA revised the planting estimate higher by 320,00 hectares (0.8 million acres) based on new data from the Farm Service Agency. That put total 2023 corn plantings at 38.42 Mha (94.9 million acres), which when combined with a 1.3 percent reduction in yields (from 10.99 MT/ha to 10.91, or from 175.1 BPA to 173.8), pushed 2023 production 0.15 percent higher to 384.42 MMT (15.134 billion bushels). The market had anticipated the yield reduction but did not expect the larger acreage, giving the report a bearish implication for prices.

On the demand side USDA left the 2023/24 U.S. balance sheet unchanged, which meant that carry out stocks for the year rose 483,000 MT (19 million bushels). Despite the fractionally larger ending stocks, USDA did not adjust its season-average farm price, which still stands at $192.90/MT ($4.90/bushel).

For the world corn balance sheet, USDA raised the 2032/24 production forecast fractionally from the August report to 1.214 billion MT, which is up 5 percent from the prior year. USDA left non-U.S. corn production essentially unchanged with a larger crop estimate for Ukraine (28 MMT) offsetting reductions for the EU crop (now projected to total 59.4 MMT). Global trade for 2023/24 was essentially unchanged while feed and residual consumption fell 590 KMT. That left 313.9 KMT of ending stocks for the coming year, a figure up nearly 1 percent from the August estimate and up 4.9 percent from 2022/23.

U.S. corn conditions ratings continue to slowly erode, as is typical for the late season. On Monday, USDA said that 51 percent of the U.S. corn crop is in good/excellent condition, down 1 percent from the prior week and down 8 percent from the five-year average. Ratings are now in line with the drought year of 2011. The crop is slightly above average in its maturity, however, with 90 percent of the crop dented (versus 87 percent on aveage) and 54 percent is mature (up from 44 percent for the five-year average). The harvest has just started in the southern states and 9 percent of the national crop has been collected, up from the five-year average of 7 percent.

After remaining historically strong for much of the past two marketing years, the large 2023 corn crop is starting to cause basis levels to weaken. The average Midwest basis was -17Z (17 cents under December futures) last week, unchanged from the prior week but below the 9Z reported this time last year. Additionally, spot physical corn prices are near $180.90/MT ($4.60/bushel) right now, down from the $270.10/MT ($6.86/bushel) reported in late September 2022.

The 2023/24 corn marketing year started at the beginning of the month and export sales and shipments are showing improvement. Last week featured 739 KMT of gross sales and exports of 602.5 KMT (both down from the prior week) but YTD exports are up 29 percent through the first two weeks of the marketing year. YTD new crop bookings (exports plus unshipped sales) are down just 6 percent at 11.73 MMT and already account for 28 percent of USDA’s 2023/24 export forecast. Even more impressive has been the demand for new crop sorghum, where YTD bookings are up 733 percent at 1.996 MMT.