Ocean Freight Markets and Spreads

Ocean Freight Comments

Hurricane Francine made landfall in U.S. between New Orleans and Lake Charles on September 11 as a moderately strong Category 2 hurricane. There were no reports of significant damage to export grain elevators or the inland river system. Power was lost at some locations but was restored within a few days.

Water levels are low in various navigable river systems around the globe including Parana River in Argentina, Maderia River in Brazil, Rhine River in Germany and portions of the Mississippi River. The Parana and Maderia Rivers are being impacted by an historical drought in central and western Brazil. Vessels are being light loaded leading to higher transport costs. The Mississippi River has areas upriver from Baton Rouge, Louisiana where tow restrictions of limited draft and hours of operation are in place.

There continues to be no reports of contract negotiations between the United States Maritime Alliance and International Longshore Union. The contract covers ports along the U.S. East Coast and Gulf Coast and expires at midnight on September 30. The ILA is prepared to strike on October 1 if their demands are not met. President Biden could intervene by urging the two sides to negotiate, put a federal mediator in place or invoke the Taft-Hartley Act that imposes an 80-day cooling off period. Grain export elevators will not be directly impacted since they have their own labor, but container activity will be greatly impacted if there is a strike.

There were no new reported attacks by the Houthi terrorist organization in the Red Sea this past week. The U.S. armed forces and military alliance in the region continues to destroy Houthi drones and missile systems. Ship owners and operators persist in diverting vessels from transiting the Red Sea and Suez Canal to avoid the conflict, opting for longer and more costly routes.

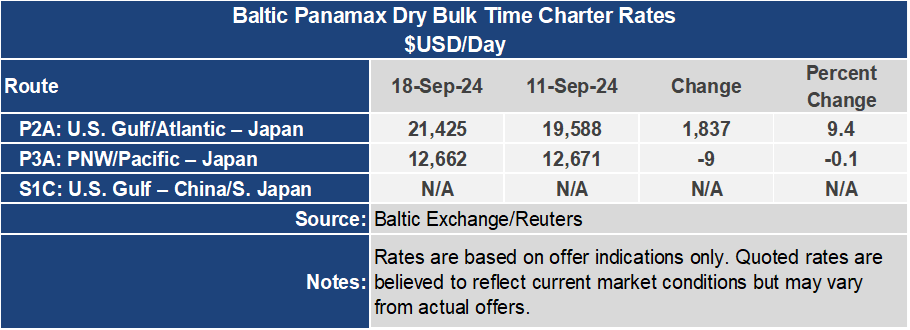

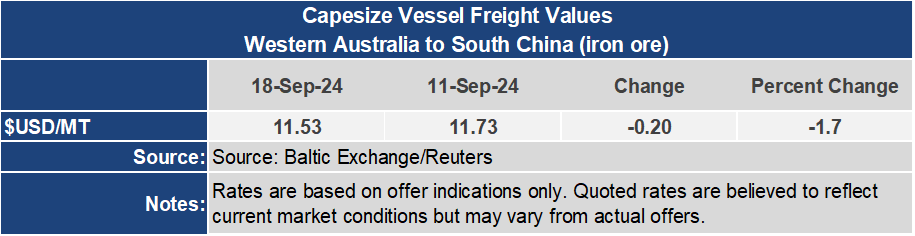

The Baltic Dry Index cooled off this week, dropping 73 points or 3.7% to an index of 1,890. The Baltic Capesize Index ended the week 351 points or 10.4% lower at an index of 3,024. The smaller vessel classes were moved higher for the week. The Baltic Panamax Index was up 10.8% to an index of 1,502. The Baltic Supramax Index was up 0.9% to 1,270.

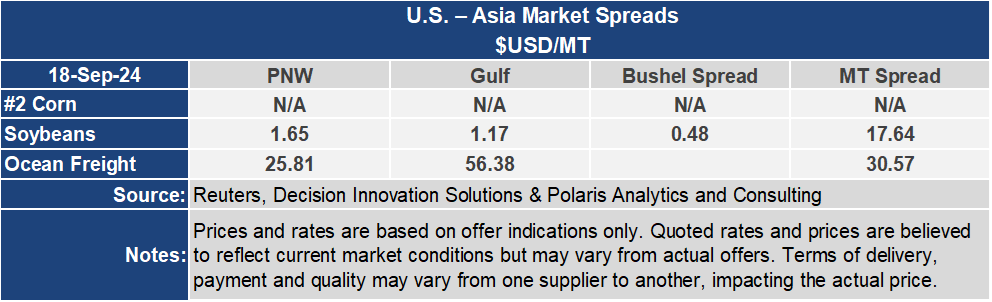

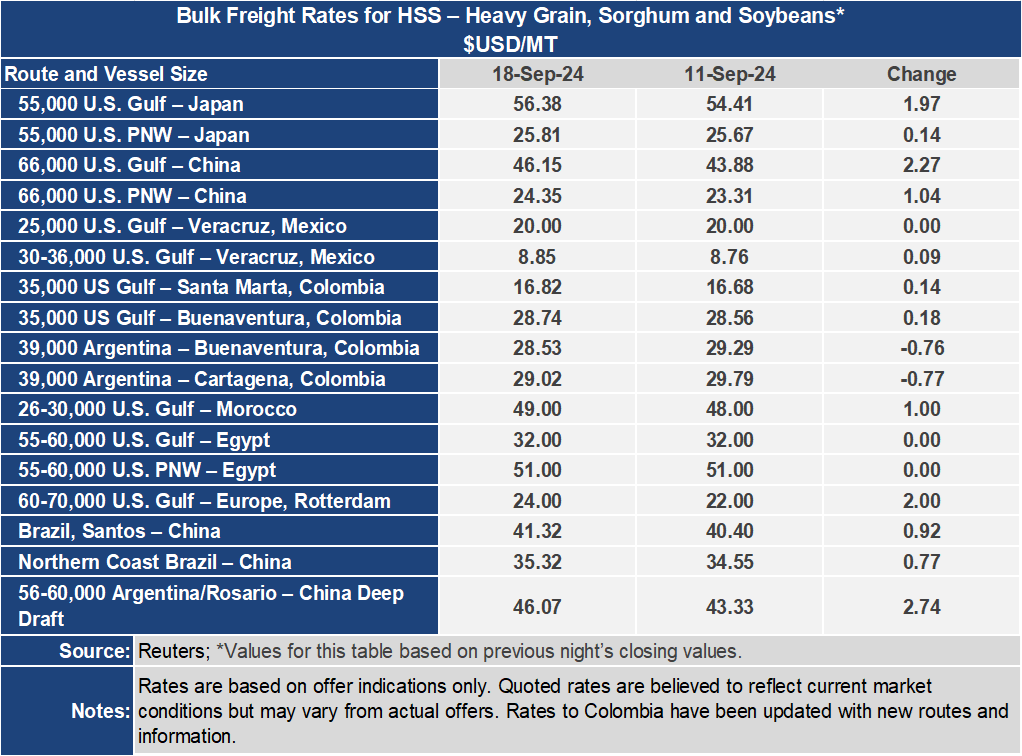

Because of the strength in the Panamax and Supramax sectors, voyage grain rates were stronger for the week across most routes. The U.S. Gulf to Japan freight rate was up $1.97 per metric ton or 3.6% for the week to $56.38 per metric ton. From the Pacific Northwest the rate was up 0.5% or $0.14 per metric ton at $25.81 per metric ton. The spread between these highly monitored grain routes narrowed 6.4% or $1.83 per metric ton to $30.57 per metric ton. Both routes are quoted using vessels loaded with 55,000 metric tons.

To China the rate from the U.S. Gulf was $46.15 per metric ton for the week, up $2.27 per metric ton or 5.2%. From the PNW, the rate was down $1.04 per metric ton or 4.5% to $24.35 per metric ton this week. The spread on this route narrowed by 6.0% or $1.23 per metric ton to $21.80 per metric ton. Both routes to China are quoted using vessels loaded with 66,000 metric tons.