Chicago Board of Trade Market News

Outlook

USDA’s Crop Progress report showed corn crop ratings up 1% to 65% G/E. By state, MN was the largest improvement, up 9, with IL up 8 points, NE 3 points higher and MO improving 2 points. Ratings in OH continue to deteriorate, down 21 points, with KS losing 12, SD down 11, IN slipping 7, ND losing 6 points, and IA down 2. For mid-September, a 65 G/E rating is well above the 58% G/E average rating since 2010. There have been 5 years since 2010 with higher ratings in Mid-September than this year’s rating. Early yield reports have been mixed with some of the early-harvested corn being corn that was stressed by localized or regional moisture and heat stress. Reports from the heart of the Cornbelt will begin to come in over the next 10 days.

Weekly EIA data shows 1.049 million barrels per day of ethanol production during the week that ended on September 13. That was down 31,000 bpd from the week prior, assuming a drop in corn use. Ethanol stocks saw a build of 71,000 barrels to 23.785 million barrels. Refiner inputs of ethanol rose 16,000 bpd to 908,000 bpd, with ethanol exports down 26,000 bpd to 151,000 bpd.

CONAB outlined their initial outlook numbers this week in a presentation that showed corn output rising by 3.6% vs last year. Brazil’s 2024/25 corn crop is estimated at 119.8 MMT according to CONAB’s initial estimate. That is below the 127 MMT projection from the USDA. Corn exports from Brazil are expected to drop 5.6% to 34 million metric tons, while domestic consumption is seen rising by 3.3%. The weather conversation right now is mostly around its impact on soybeans, but as the calendar turns over to October corn will start to be a part of the conversation. Brazil’s corn exports for September are expected to total 6.63 MMT, a slightly increase from the 6.47 MMT projection last week from ANEC. Last year, Brazil exported 6.42 MMT in September.

La Nina was confirmed this week as the 30-day net change threshold was -.67 degrees Celsius in the Nino-3-4 region. The models have shown a strengthening of La Nina for most of September and the confirmations that a La Nina now has developed will be watched by grain and commodity markets. La Nina should allow rains to return to Northern Brazil during October, while producing dryness across Argentina and southern Brazil in Q1 of 2025. Australian wheat typically benefits from increased rainfall during a La Nina and whether a Central US drought develops in the summer of 2025 will be something that will be watched. La Nina typically adds additional weather risk to world crops versus El Nino and commodity traders will be highlighting La Nina developments into 2025.

Rains are expected to develop in the Central US starting this weekend and will be welcomed following a month of extreme dryness that has produced a flash drought. Unfortunately, this rain will be of limited benefit to the current corn and soybean crops that have been pushed to maturity by the flash drought. The most benefit will be seen in winter wheat where seeding is underway, and germination will be aided by the rainfall. In addition, farmers that are planting cover crops following corn and soybeans in the Midwest will welcome the rain. It may cause a small delay in early harvesting, but field conditions will absorb the rain quickly.

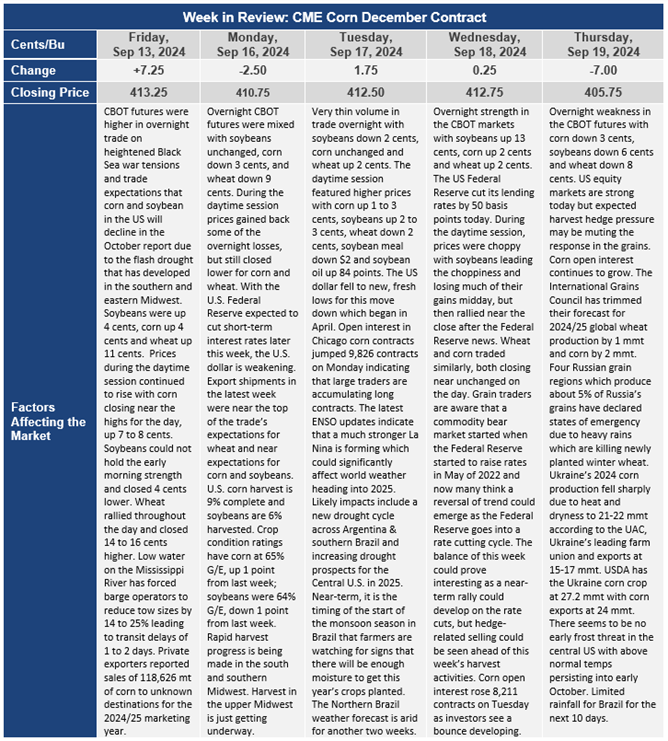

Historically the market makes an attempt at a harvest low between now and the first week of October. Given the changes in US macro-monetary policy, the weakening US dollar, and the apparent building of long positions by traders, the seasonal low for corn may already have been made.