Ocean Freight Comments

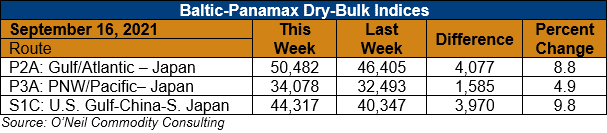

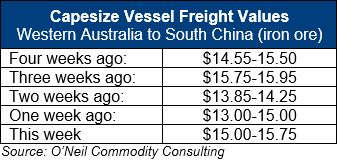

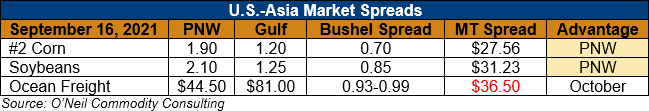

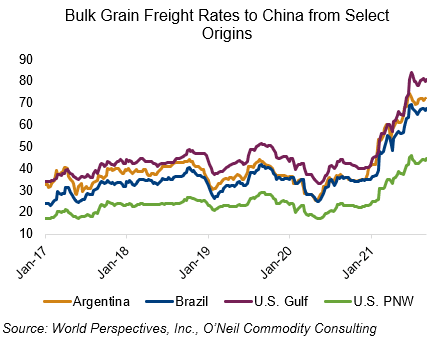

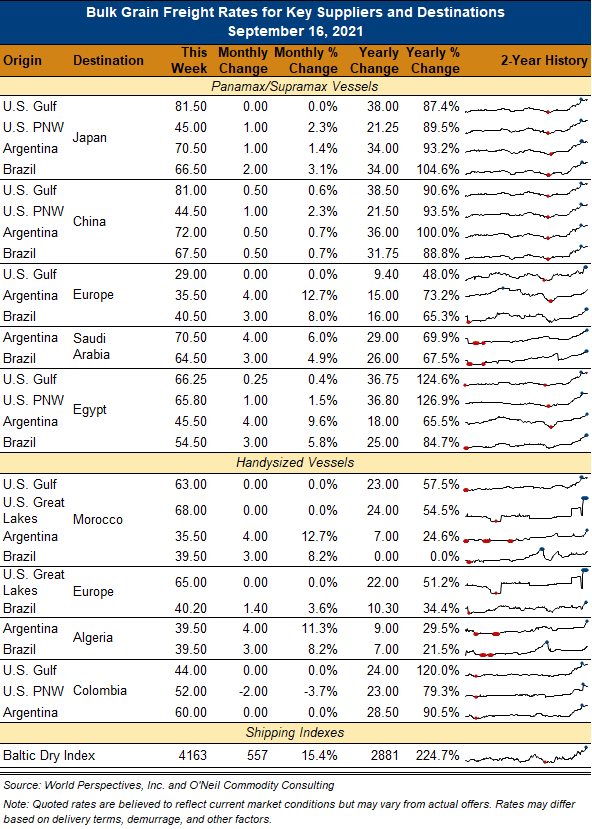

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: Dry-Bulk markets tried their best to claw back last week’s losses. Though daily hire rates did recover most of the previous week’s drop, there is concern over what will follow now that Capesize congestion in China is easing. The October Panamax FFA paper market traded up to $36,500/day and Q4 at $35,250/day. Supramax hire rates continue to be higher than Panamax at $39,000/day for October and $37,750 for Q4. There is nothing new to report in container freight markets.

Things are slowly improving for New Orleans export grain facilities. Four facilities are now open and loading (LDC Baton Rouge, Bunge Destrehan, Zen-Noh, and ADM Destrehan via floating rig). CHS Myrtle Grove now has power and is conducting repairs with hopes for restating late next week. Current estimates suggest there are 67 grain vessels currently in NOLA; of which 5 are loading at grain facilities and 7 are being loaded via floating rig. FOB vessel export grain values remain uncertain.