Chicago Board of Trade Market News

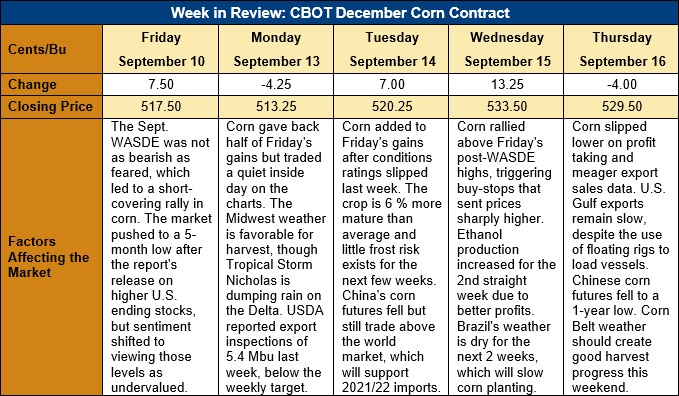

Outlook: December corn futures are 12 cents (2.3 percent) higher this week after selling off steadily heading into the September WASDE and rallying since then. The September WASDE wasn’t especially bullish, but the lack of a bearish surprise led to short-covering and a stronger market this week. After the USDA numbers were released and digested by the trade, there was a sense the market was oversold and needed a correction and that prices were perhaps undervalued. Early U.S. yield results have also supported futures this week, with initial reports coming in below market expectations.

The September WASDE saw USDA issue an outlook for greater corn supplies for 2021/22 but also larger consumption. USDA raised beginning stocks for the new marketing year after lower estimates of 2020/21 exports and ethanol use and raising ending stocks accordingly. USDA increased 2021/22 corn acreage 0.243 million hectares (0.6 million acres) based on fresh data from the USDA Farm Service Agency. In its first survey-based yield estimate, USDA raised the U.S. 2021 corn yield to by 0.107 MT/ha (1.7 bushels/acre) to 11.09 MT/ha (176.6 BPA), which is near the all-time high. In total, USDA increased supplies 1.9 percent from the August WASDE.

On the demand side, USDA increased feed and residual use 1.905 MMT (75 million bushels) due to the larger crop and lower price expectations. USDA also increased the 2021/22 corn export by an equal amount, but the combined effect of larger production and these use increases was to add 4.22 MMT (166 million bushels) to 2021/22 ending stocks. The ending stocks-to-use ratio increased to 10.3 percent (up from 9.5 percent in the August WASDE) and USDA lowered its price forecast by $11.81/MT (30 cents/bushel) to $214.56 ($5.45/bushel).

Also in the WASDE, USDA increased 2021 sorghum planted and harvested acres but cut sorghum yields 0.028 MT/ha (1.1 bushels/acre). USDA increased feed and residual use but left the export forecast unchanged from the previous report. Ending stocks expanded slightly and the ending stocks-to-use ratio rose from 4.4 percent to 7.3 percent. USDA also lowered the 2021/22 sorghum farm price forecast by $11.81/MT (30 cents/bushel) to $230.30/MT ($5.85/bushel).

Outside the U.S., USDA increased world 2021/22 corn production by 11.6 MMT due to larger crops in China and Argentina that offset reductions in the Russian crop. Despite larger corn production, China’s imports were left unchanged due to the large premium Chinese corn prices, particularly in the South, hold to the world market. USDA increased total world trade for the coming year but increased global ending stocks 12.9 MMT, resulting in a 21.6 percent ending stocks-to-use ratio.

Since the USDA issued the September WASDE, early yield results from the Midwest, particularly the Eastern Corn Belt, have been below expectations. This has rekindled discussion of lower yields for the 2021 crop, which is supporting futures. Notably, however, only 4 percent of the crop was harvested as of Monday’s Crop Progress report, which is 1 percent behind the 5-year average pace. Consequently, it is too soon to accurately judge the crop’s potential. Harvest progress should be strong this weekend with warm, dry weather expected for most of the Midwest.

U.S. cash markets and basis levels remain strong, which is further supporting futures. The average basis across the Midwest his week was 0Z (0 cents over December futures, or at parity with the contract), down from 8Z last week but above the -30Z that occurred this time last year. Despite this week’s futures rally, farmers have been reluctant sellers, waiting to see how early-year new crop export will fare and waiting for additional harvest progress/yield results before making sales.

From a technical standpoint, December corn futures likely formed a near-term, if not seasonal, bottom the day the September WASDE was released. The contract traded to a new 5-month low before rallying sharply, triggering buy-stops, and ending 7 ½ cents higher. The contract has maintained and extended those gains since then, though Thursday saw some additional selling pressure when the market neared the $5.40 level. This week’s rally, combined with early yield data, paused managed money fund selling and it is unclear whether funds will return to selling next week. For now, December corn looks to be carving out a range from support at $4.97 ½ to $5.58.