Chicago Board of Trade Market News

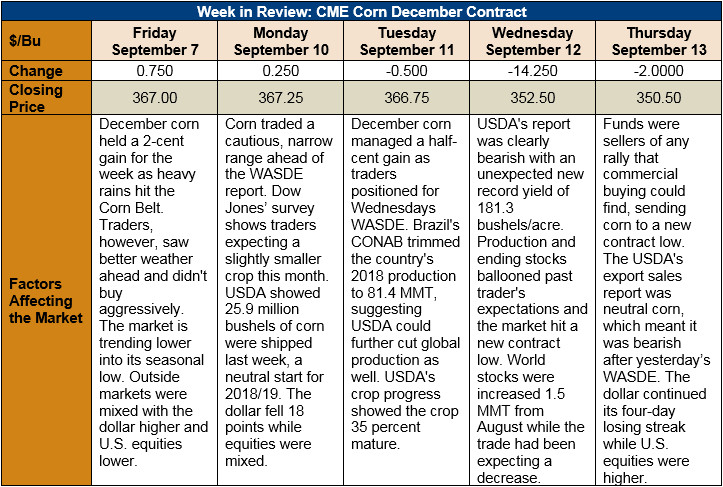

Outlook: December corn futures fell 4.3 percent (15 ¾ cents) this week as USDA surprised the market with a bearish WASDE. The WASDE contained large increased in U.S. corn supplies and a modest increase in word ending stocks, whereas the market had been expecting decreases for both.

Perhaps the biggest surprise in USDA’s report was the record-breaking 11.386 MT/hectare (181.3 bushels/acre) U.S. corn yield. The market had been expecting yields in the high 170’s, but very few analysts foresaw yields above the 180 mark. Based on the estimated yield and acreage, USDA’s 2018/19 U.S. corn production figure grew to 376.62 MMT (14.827 billion bushels), up 1.7 percent from last month and up 2 percent from 2017/18.

On the demand side of the U.S. corn balance sheet, USDA increased feed and residual use by 50 million bushels (1.27 MMT) and ethanol use of corn by 25 million bushels (635,000 MT). The agency also increased its corn export forecast 50 million bushels (1.27 MMT) to 2.40 billion bushels (60.963 MMT).

Largely because of the huge U.S. crop, USDA increased world 2018/19 corn production 0.7 percent from last month to 1,069 MMT. The production figure is 3 percent larger than 2017/18. USDA increased world corn use by an equal amount, pegging 2018/19 global consumption at 1,260 MMT, up 4 percent from last year. World ending stocks grew 1 percent from the agency’s August estimate to 157 MMT, down 19 percent from 2017/18.

USDA made few changes to the 2018/19 U.S. sorghum outlook, boosting beginning stocks 0.127 MMT (5 million bushels), increasing yield 0.2 bushels/acre and production by a consequent 0.025 MMT (1 million bushels). With no changed to the demand side of the balance sheet, USDA added 0.152 MMT (6 million bushels) to ending stocks and lowered the expected price range by 10 cents/bushel.

The biggest change to USDA’s 2018/19 barley forecast was a 0.109 MMT (5 million bushels) reduction in feed and residual use, which drove imports lower by an equal amount. USDA left its ending stocks forecast unchanged but increased its expected price range 10 cents/bushel.

The U.S. corn crop is in amazing shape and the current weather looks to continue that trend. With warm but moderate temperatures and lower-than-average rainfall expected for much of the Corn Belt, the weather will aid in crop maturation and harvest. USDA said Monday that 35 percent of the U.S. crop is mature while 5 percent had been harvested. Both figures are above their respective five-year averages.

From a technical standpoint, December futures are trending lower but could find support at their new contract lows. The market has priced in large supplies and now it will look for demand to work off what are quickly becoming large stocks. Corn export sales are up 44 percent YTD, an excellent pace and bright spot for demand; now actual shipments must catch up. Corn futures are heading into their seasonal lows right now, and good demand could help the market rebound.