Ocean Freight Comments

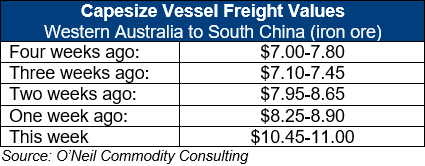

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: Even with China on Golden Week Holiday, dry-bulk markets experienced some rough seas this week. The week started with a strong Capesize market due to an imbalance between Pacific and Atlantic vessel positions/logistics. Daily hire rates for Capesize vessels reached $30,000/day before trading down to $26,400 for October. Dry-bulk markets remain severely inverted with Q2 2021 Capesize vessels trading at $11,800/day.

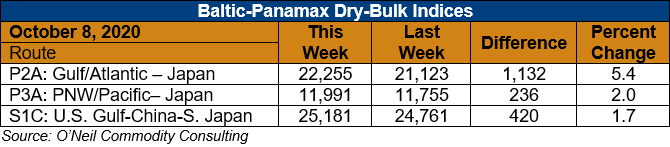

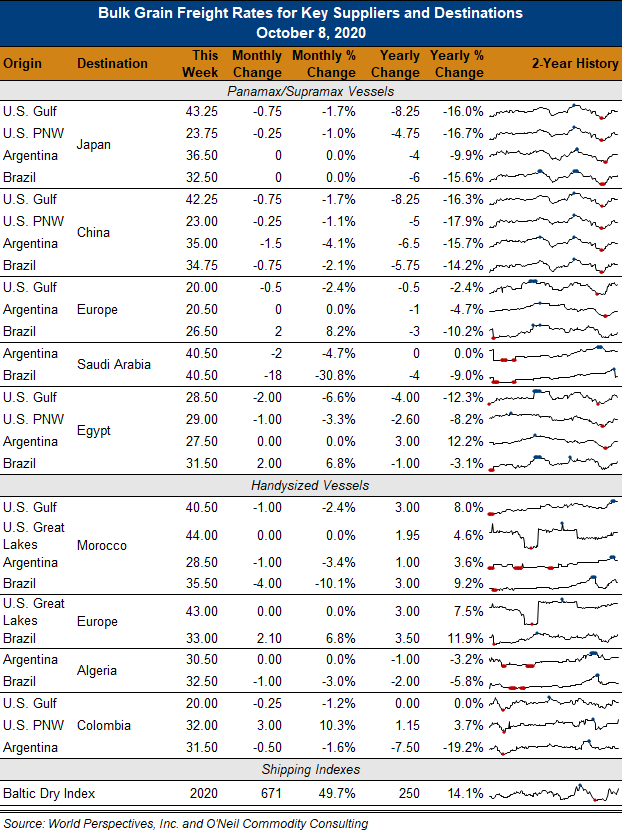

As is common, Panamax markets took their lead from the Capesize sector and traded higher early in the week but, once again, sold off at week’s end. Daily Panamax hire rates are now around $12,000 for Q-4 2020 and $10,250 for Q1 2021. The result is that not much changed from last week’s values.

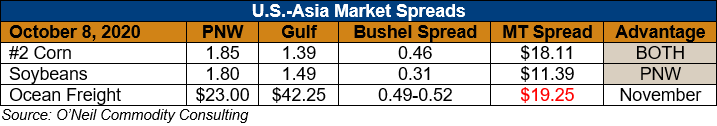

It is both interesting and encouraging to see U.S. containerized grain shipments grow back to a trend of 80,000 – 90,000 MT per week. Earlier this year, containerized volumes were averaging 55,000 – 65,000 MT/week. FOB Gulf fobbing margins are very profitable currently, and U.S. grain trading firms should see finances improve.