Chicago Board of Trade Market News

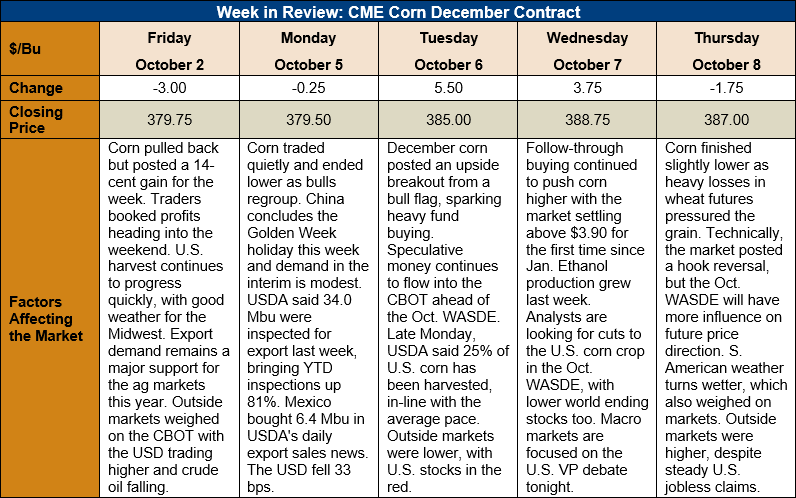

Outlook: December corn futures are 7.25 cents (1.9 percent) higher this week as demand remains supportive and speculative money continues to flow into agricultural futures markets. Last week’s Grain Stocks report was bullish corn, and funds have continued to trade the tighter-supply outlook. Friday’s WASDE will likely be important for determining the CBOT’s direction as harvest continues to advance across the U.S.

Strong export demand continues to support the CBOT and U.S. cash market rallies. Exporters booked 1.225 MMT of net sales last week and increased the export pace 25 percent above the prior week. Shipments totaled 934,000 MT for the week ending October 1, bringing YTD exports to 3.67 MMT – up 77 percent. YTD bookings now total 25.8 MMT, up 159 percent from this time last year. The aggressive pace of this year’s sales and shipments has many in the trade expecting USDA to increase its estimate of the 2020/21 U.S. export program in the October WASDE.

Typically, the October WASDE reflects a continuation of the supply increase/decrease adjustments USDA made from the August to the September reports. In this case, since the September WASDE and Grain Stocks reports showed tightening supplies, most in the trade are looking for smaller U.S. production and ending stocks in the October report.

Analysts surveyed by Dow Jones expect, on average, the U.S. 2020 corn yield to reach 11.16 MT/ha (177.7 bushels/acre), which would be below the September WASDE but above year-ago levels. Production is expected to be near 376.143 MMT (14.808 billion bushels) and 2020/21 ending stocks are forecast at 53.673 MMT (2.113 billion bushels). The ending stocks figure, if realized, would be 15% lower than USDA’s September forecast. Internationally, analysts are looking for 300.1 MMT of 2020/21 ending stocks, down 6.7 MMT from USDA’s current estimate.

Cash corn prices continue to firm around the U.S. with basis remaining steady despite the advancing harvest. Grain elevators are increasing bids to keep the grain pipeline full to meet export commitments and farm sales have been somewhat light as producers focus on harvest activities. U.S. cash prices are 2 percent higher this week at $142.75/MT ($3.63/bushel).

From a technical standpoint, December corn futures are continuing their trend higher but posted a hook reversal Thursday afternoon as wheat futures broke lower. The reversal may signal that traders are positioning for the October WASDE or may be looking for further demand confirmation before carrying the market to new highs. December corn is exhibiting many of the hallmarks of a bull market including rising open interest, strong technical indicators, and heavy trading volume, among others. The October WASDE will be the biggest factor in determining the market’s future direction, but the current technical picture leans bullish.