Distiller’s Dried Grains with Solubles (DDGS)

DDGS Comments: DDGS values $3-5/MT lower this week as ethanol plants return from the seasonal maintenance season and increase production rates. The larger production is allowing sellers to become more aggressive on offers. Traders note that historically low water levels in the Mississippi River system have stopped barge movement and allowed ethanol plants near the river to procure corn at a discount. The DDGS/Kansas City soymeal ratio rose to 0.59 this week, above the three-year average of 0.49, while the DDGS/cash corn ratio increased to 1.06 this week, below the three-year average of 1.06.

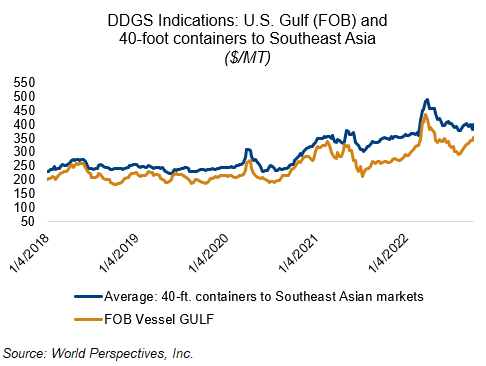

On the export market, Barge CIF NOLA prices are sharply higher for October and November positions, with the average offer rising $17/MT to $353. FOB Gulf offers are similarly higher, rising $13/MT for spot positions, while deferred offers are up just $1-5/MT. U.S. rail rates are $15/MT lower as the threat of a railroad worker strike seems to be mitigated for now. Finally, containerized DDGS markets are mixed this week with spot offers up $2/MT while deferred positions are steady/$2 lower. Offers for 40-foot containers to Southeast Asia are averaging $404/MT this week.