Chicago Board of Trade Market News

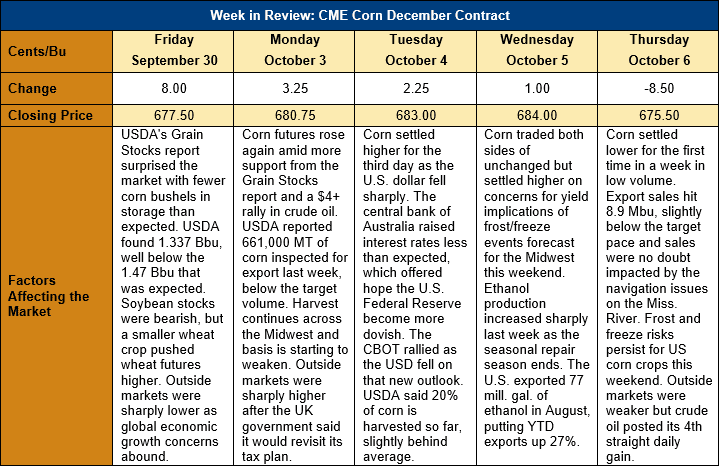

Outlook: December corn futures are 2 cents (0.3 percent) lower than last week after a bullish Grain Stocks report failed to see much follow-through buying. The market has drifted sideways/lower since then with traders’ attention on the implications of the Grain Stocks report, the U.S. harvest, and navigation issues on the Mississippi River. Traders are also squaring positions and adjusting risk profiles ahead of next week’s October WASDE report, which will feature what is practically considered USDA’s final yield estimate.

The quarterly Grain Stocks report offered plenty of surprises last Friday and smaller-than-expected corn supplies created a bullish reaction in CBOT futures. Before the report, analysts expected 37.975 MMT (1.495 billion bushels) of corn in storage as of 1 September, which would have been up 21 percent from last year. USDA’s report, however, found 34.98 MMT (1.377 billion bushels), which was a 12 percent increase from 2021. Off-farm corn stocks were up just 3 percent from 2021, which is a partial explanation for the atypically strong Midwest basis levels observed this year. The smaller 1 September corn stocks served to tighten 2022/23 carry-in supplies and, consequently, the overall supply outlook for the year.

The U.S. corn harvest continues to pick up speed as the crop’s maturity enters the final stages. On Monday, USDA reported that three-quarters of the crop was mature – a figure in-line with the five-year average – and 20 percent was harvested. The harvest progress is just 2 percent behind normal and is not a significant concern. The market will be watching the Northern Plains and parts of the Upper Midwest over the weekend to judge possible frost/freeze events and any impacts on crop yields. The region is slated for sub-freezing temperatures from Thursday through Sunday and with some of the crop still not yet mature, some yield losses could occur. The precise yield impact will depend greatly on how low temperatures fall and how long the cold lasts. Beyond this weekend, however, the weather is favorable for the final stages of development and harvest across the Midwest.

One growing issue for U.S. grain markets are low water levels in the Mississippi River that are affecting barge navigation. Shippers have been loading as much as one-quarter less grain in barges to help compensate for the low draft levels and barge freight rates pushed to all-time highs this week. FOB Gulf basis levels are higher this week but offers are increasingly difficult to obtain. Traders and exporters are hoping the weather forecast will shift to include more rains that could help the situation.

From a technical standpoint, December corn continues to find resistance at the downtrend line that has been in place since mid-May. The market was unable to break above that plane following the Grain Stocks report and has drifted sideways/lower since then in low trading volume. Support lies near the 100-day moving average ($6.60/bushel) and the market seems to be content to stay within this range heading into next Wednesday’s October WASDE report.