Chicago Board of Trade Market News

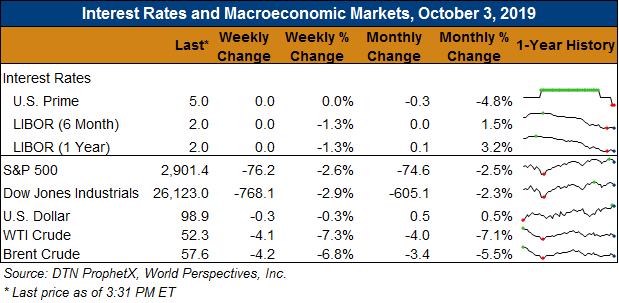

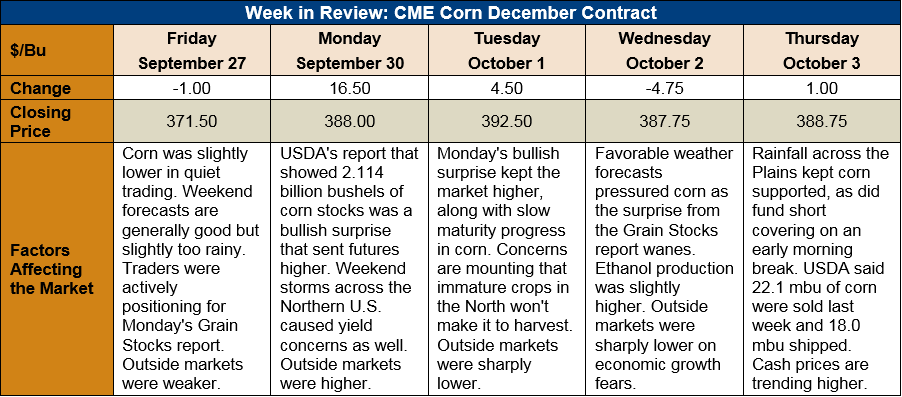

Outlook: December corn futures are 17 ¼ cents (4.6 percent) higher this week after USDA surprised the market with a bullish Grain Stocks figure. Moreover, the U.S. weather continues to be risk factor for corn yields, keeping the market is somewhat of a “risk on” mode.

The September USDA Grain Stocks report caught the market by surprise and sent corn futures sharply higher. USDA estimated corn stocks as of 1 September 2019 (making the estimate effectively the 2018/19 ending stocks figure) at 53.698 MMT (2.114 billion bushels), far less than the 58.4 MMT (2.3 billion bushels) the market was expecting. Notably, on-farm storage was up 22 percent from the prior year, reflecting the widespread trend of farmers expanding storage capacity as a marketing/risk management tool.

Other highlights from the Grain Stocks report were the 4.18 MMT (195 million bushels) of barley stocks and 1.612 MMT (63.7 million bushels) of sorghum stocks. Notably, the sorghum stocks figure implies a June-August usage rate that is 76 percent higher than the prior year.

USDA’s latest Export Sales report recorded 562,600 MT of net sales and 458,300 MT of exports. The export figure was up 64 percent from the prior week. While still very early in the marketing year, YTD bookings (exports plus unshipped sales) are down 51 percent. Other Export Sales highlights include 10,600 MT of sorghum exports and 1,900 MT of barley exports. YTD bookings for sorghum and barley are up 53 and 3 percent, respectively.

Cash prices are higher this week with the average price across the U.S. reaching $145.50/MT. Barge CIF NOLA values are 5 percent higher while FOB NOLA prices are firmer at $171.75/MT for October delivery. Technically, the trends are steady/higher for interior cash prices and export-oriented prices as the market adjusts to lower 2019/20 beginning stocks.

From a technical standpoint, December corn has entered a new sideways trading range between the 50-day moving average ($3.82) and $4.00. Funds are still net short corn but have been paring back that position on breaks, which will keep the market supported. The seasonal lows have likely been set and now the market will trade weather forecasts and expectations of just how much a frost/freeze event will impact yields.